Gold At All-Time Highs: Should I Buy?

Gold just crossed $3,300 per ounce; a new all-time high. It won’t be the last one this year, if our views in the 2025 Gold Outlook Report continue to prove accurate.

But this moment has left many investors wondering whether to sell their gold and lock in their gains or to buy more, hoping this is just the beginning or a further bull run.

Although we are bullish on gold prices, we think there’s a better way to think about gold ownership that breaks the buy/sell stalemate entirely.

But first, let’s explain where we see gold prices going in 2025 and why our outlook has predicted gold’s major rally so far.

Gold didn’t go up, the dollar went down

There’s no such thing as a gold bull market without a dollar bear market. One is just the inverse of the other.

As we wrote in the 2025 Gold Outlook Report:

“We are in a gold bull market today for a very different reason than in 2009–2011. It’s not about the fear of rising consumer prices. It’s about the fear of being a creditor to an increasingly obvious Ponzi scheme.”

That’s the driver. Not CPI. Not ETF flows. Not even central bank buying (though we’re watching that too). This is about trust—or the lack of it—in irredeemable paper currencies.

Here’s a graph of the price of the dollar measured in gold since 1996. From over 120 mg of gold per dollar, down to below 10 mg. Where is the limit?

Dollar price in gold since 1996

Tariffs, tensions, and tightening

Let’s not forget what else is going on: Trump’s volatile tariff policy is a constant threat for equity markets, which have wobbled under that pressure.

Here’s roughly how $100,000 would have performed from January 1st to March 31st this year:

Gold (with a 4% annual yield): $119,630

Dow Jones $98,700

S&P 500: $95,770

With major indicators pointing towards further room to fall for stocks, many investors have added to their gold holdings in anticipation of a bear market for equities.

Meanwhile, the carry trade in gold has surged. The gold basis hit 6.8% in mid-January, then fell back to 4.5%, even as prices rose.

That’s not speculators betting on price.

That’s market makers bidding up metal, not futures. That’s a bullish signal if there ever was one.

The top for gold is not in

Ask yourself: does this feel like a top for gold?

We’ve had no media gold rush. No euphoria. No retail mania. Just a quiet, relentless bid under the metal.

The “top” crowd would have to argue that gold is somehow becoming less relevant in a world where the dollar is being debased faster than GDP can grow, and the U.S. debt trajectory continues to grow exponentially, with no signs of slowing.

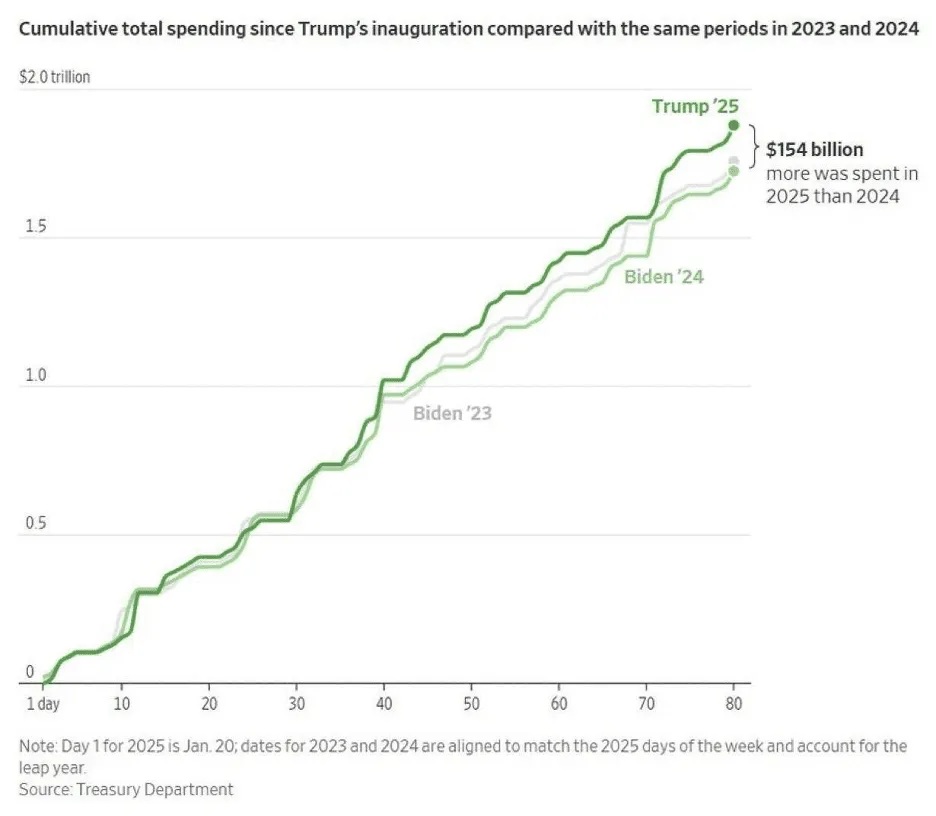

Cumulative total spending since Trump’s inauguration compared with same periods in 2023 and 2024

Buy more gold or sell?

Now let’s address the gold investor’s paradox. Gold prices are high, and you want exposure. But you’re nervous to add more at current prices and hesitant to sell in case the gold bull market continues.

This is the part where most financial advisors shrug and say, “just hold it.”

But that ignores the most interesting development in gold investing in decades. You can earn a return on gold, paid in physical gold, without giving up ownership.

It’s the solution to the “do I buy or sell?” question:

- You own your gold.

- You earn a yield.

- Your gold compounds over time.

No dollars necessary.

Why this matters now

Rates on dollars are potentially coming down hard. Inflation continues to eat away at returns. All the while, gold is showing the one thing every investor wants but few ever find: a reliable signal amid the chaotic investing noise.

We don’t think this rally is over. If anything, we’re just getting started.

Our 2025 Gold Outlook Report predicted a path for gold prices to reach $3,700 or higher this year, especially if the dollar continues to weaken and gold remains tariff-free. Whether you think gold is heading to $4,000 or due for a pullback, the core problem remains that your gold capital needs to be productive.

Idle gold might preserve wealth but earning gold on gold builds it.

********

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the