The “Melt-Up” Scenario for 2014

Market mavens have increasingly turned their talk to a possible “melt-up” scenario in the stock market. The big fear entering 2014 is that another runaway freight train-type stock market, like the one preceding the 2008 crash, is gathering momentum. The latest comment by incoming Fed president Janet Yellen only added to that speculation.

Yellen stated last week that, based on current valuations, stocks aren’t “in territory that suggest bubble-like conditions.” Her lack of concern is one reason for thinking that the equities could be on the verge of a melt-up. Economist Ed Yardeni has made the case for this potential scenario playing out, especially if Yellen turns out to be more dovish than Bernanke as he expects.

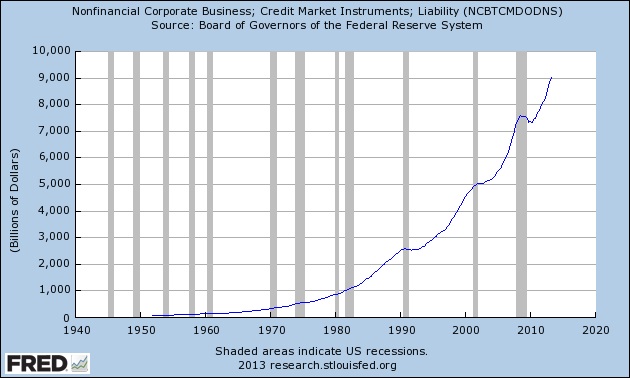

There are two principle drivers behind the melt-up scenario: the first is the so-called “reach for yield” among investors that Yellen herself alluded to in her latest remarks and which has resulted in a veritable bubble for corporate and emerging market debt issuance. The second is the unprecedented monetary policy of the Fed in its frenzied efforts to beat deflation and lower unemployment.

Emerging market debt suffered a temporary setback in the wake of the “tapering” talk and debt ceiling limit debate earlier this summer. Since then, however, emerging market bonds have rebounded and there is a growing conviction among savvy investors that this sector is precariously close to being over-inflated. It’s not there yet, but it appears to be headed in that direction and that’s one of the potential catalysts to an early 2014 melt-up scenario.

Corporate bond issues have risen to a record $6.1 trillion as of the second quarter of 2013, according to Federal Reserve statistics. This translates to an increase of $625 billion year over year. Moreover, as Yardeni points out, corporations are likely using some of their bond sale proceeds to repurchase shares of their companies, which artificially inflates earnings per share. “That’s a bubble-like development if stock prices are getting a significant lift from debt-financed share buybacks rather than actual earnings growth,” Yardeni wrote.

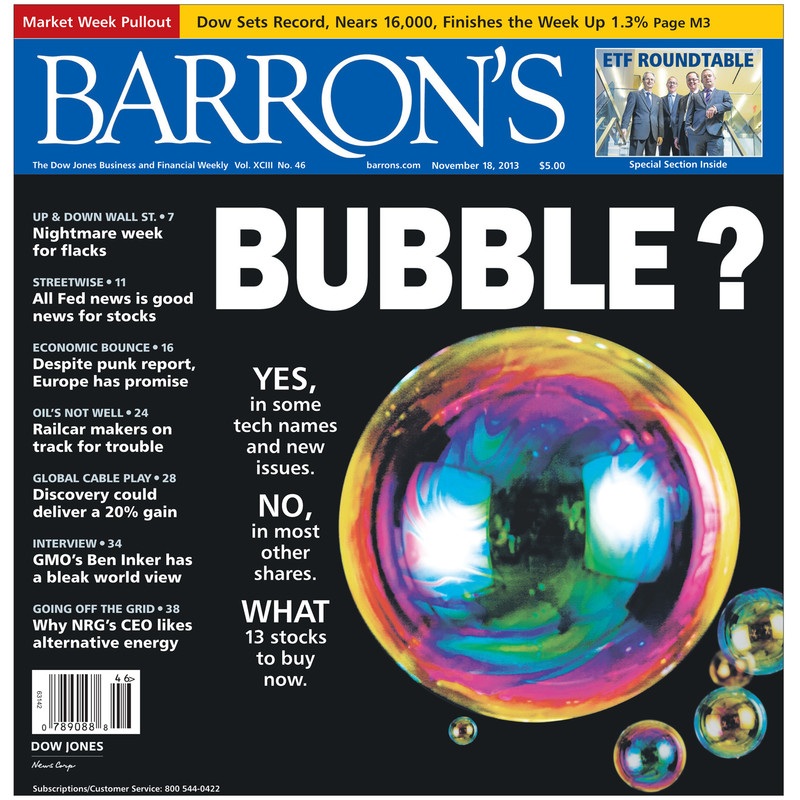

But short sellers beware: we’re not there yet. The bubble vigilantes are out in full force which suggests a full-fledged financial market bubble hasn’t fully developed. On the front cover of the latest issue of Barron’s, the editors ask the question of whether or not equities are in a bubble. Their answer: “Yes, in some tech names and new issues” and “No, in most other shares.” The Barron’s cover very much underscores the heightened sensitivity to developing bubbles, which in turn keeps investor sentiment from becoming too ebullient before the final melt-up stage of the bull market.

Assuming the market does start melting up in the coming weeks and months, the final outcome is easy enough to predict: a market crash. The fact that the 120-year cycle is in its final “hard down” phase next year would only add impetus to the crash following a breath-taking rally to new highs.

********

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets? Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you’re buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the “smart money” pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you’ll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.