Dressed to the Nines with Gold

While paper gold is getting the cold shoulder in the West, the Love Trade buyers in the East are wrapping their arms around all the physical gold they can get their hands on.

In the third quarter, gold jewelry demand was at the highest level since 2010. Buying out of love in the East was significantly higher during the first nine months of the year compared to demand the same time last year, according to the World Gold Council (WGC). As the chart shows, buyers in Hong Kong and China went on a shopping spree for gold jewelry, as demand rose 40 percent and 35 percent, respectively, on a year-to-date basis in 2013 compared to the same period last year.

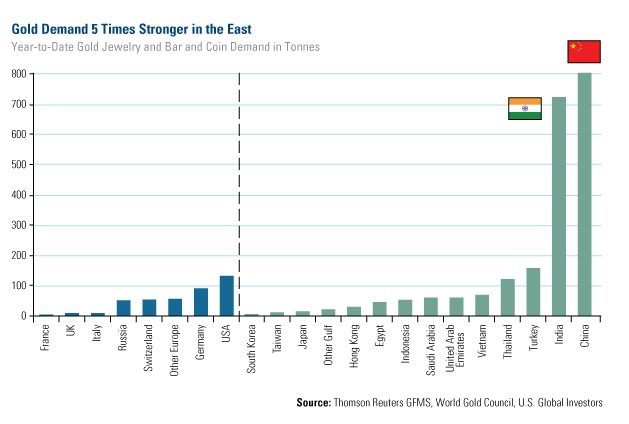

Another way to look at the strong demand coming from the East is to compare it to Western demand. As you can see below, so far in 2013, the East purchased 5 times more gold bars, coins and jewelry than the West. Together, Chindia purchased a whopping 1,500 tonnes in physical gold in nine months.

It's important to note that despite the government's efforts to stop Indians from buying gold, jewelry demand in India was still about 12 percent higher in the first nine months of 2013 compared to same time frame last year. The buying continued despite the fact that premiums were above the international price of gold.

Indian gold demand did weaken in the third quarter, as consumers were discouraged from loading up on the yellow metal through official channels. Residents faced a depreciation of the rupee, the tight restrictions, and confusing regulation, as gold bullion imports were tied to a fixed level of exports, says the WGC.

An emphasis should be placed on gold demand recorded by “official channels," as “gold entering the country unofficially through India's porous borders helped to meet pent-up demand," according to the WGC.

While traveling in India, I'm anticipating that I'll gain tacit knowledge on this topic. I'm eager to learn how locals think the government will contain its current account deficit that has weighed on the economy. It seems the slowdown in GDP per capita has created a short-term setback for gold, but when the economy picks up, there should be ready buyers lined up outside the gold shops.

Dressed to the Nines in Gold

What's interesting about gold demand today is that more and more investors around the world are buying higher-end, more expensive gold. Specifically in China, 24-karat gold jewelry and ‘four nines' gold gained market share in the third quarter, says the WGC.

‘Four nines' is named for the almost pure gold content of 99.99 percent; in comparison, 24-carat jewelry has a purity of 99.95 percent. According to the WGC, ‘four nines' gold is “unique to China and has proved to be most popular with consumers in lower tier markets and rural areas, again reflecting the investment qualities offered by such jewelry," says the WGC.

I point this out because investors should take note of the emerging trend for luxury goods as a result of growing incomes in emerging markets around the world.

Take the buying of high-end products such as Chanel and Louis Vuitton bags, Rolex watches, and Chow Tai Fook jewelry in China, for example. From 2009 to 2012, the luxury-goods sector grew by 41 percent, due primarily to “lavish spending by rich Chinese and aggressive gift giving," according to research from CLSA. Looking over the next five years from 2013 though 2018, the middle class in China will increasingly be participating in this boom, as “income levels pass critical inflection points for spending on luxury items," says CLSA.

Jewelry is only one of many luxury items that has been seeing significant growth year after year. CLSA finds that from 2009 to 2012, jewelry sales increased 115 percent in Hong Kong and 172 percent in China.

So even as hearts beat fast for gold in the East, the yellow metal continued to lose its luster in the West. According to Bloomberg's precious metal mining team, gold ETF holdings have fallen nearly 30 percent since the all-time peak earlier this year. It's no surprise that the selling has been a big contributor to the decline in gold prices in 2013.

The good news is that gold ETF redemptions are no longer the main driver of gold prices. You can see below how the selling out of gold ETFs holdings has been slowing, but the metal has not followed the same path. Instead, gold has moved sideways over the past few months, with the price “supported at about $1,200 to $1,300 an ounce," says Bloomberg. We believe this shift provides an opportune time to buy, especially with the tremendous physical demand continuing to emanate from the East.

Earlier this week, The Wall Street Journal asked several “gold enthusiasts" and me about our case for gold investing. Reporter Lindsay Gellman highlighted many of gold's important attributes, including inflation protection and diversification, and discussed one of the most important points I often make about gold: Make sure you allocate only 5 to 10 percent of your portfolio to gold and gold stocks, and have the discipline to take profits.

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the links above, you may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. Diversification does not protect an investor from market risks and does not assure a profit. None of U.S. Global Investors Funds held any of the securities mentioned as of 9/30/2013.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of