2014 Commodities Halftime Report

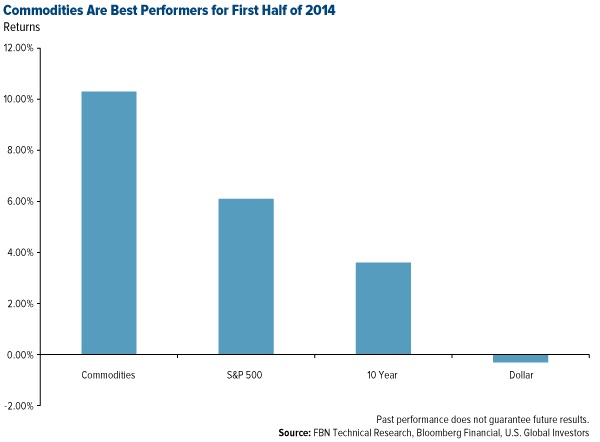

What a difference six months can make. After a disappointing 2013, the commodities market came roaring back full throttle, outperforming the S&P 500 Index by more than 4 percentage points and 10-year Treasury bonds by more than 6.

Leading the rally was nickel, delivering a 37.14 percent return, followed by palladium (17.70 percent) and gold (10.90 percent). Nickel also saw the largest gain from last year, climbing more than 55 points to settle close to $19,000 per metric tonne. Gold jumped 38 percentage points to $1,327 an ounce, and palladium rose 16 points to $843 an ounce.

At the back of the herd lagged lead, copper and wheat, which was the best performer only two short years ago.

Below you can see the 2014 halftime edition of our periodic table of commodity returns, which has proven to be a perennial favorite among our investors.

That commodity prices often fluctuate so wildly supports the need to have your investments in the resources space diversified and actively managed by an experienced team of professional investors. Simply put, there are far too many worldly factors—some of them political, others acts of God, all tugging and pulling at the market in tandem—for any one person to reasonably keep track of. It’s important to have a limber group of managers and analysts with the expertise and diligence to monitor and anticipate the most pressing global trends.

What we know is that now many investors have become bullish on resources. At a conference in New York at the end of last month, Credit Suisse polled 350 investors and found that 42 percent of them were planning to be overweight in commodities in the coming months. For some perspective, when the same question was asked of them the previous year, only 19 percent had a rosy attitude toward commodities.

As I said, what a difference six months—or, in this case, a year—can make. With money flowing back into commodities, the market is finally trying to reverse the downtrend that we’ve been up against since 2011.

Nickel

As usual, government policy is often a precursor to change. Nowhere did we see this adage in action more transparently this year than in Indonesia, whose government shocked the market in January by enacting an outright ban on nickel ore exports. Because the Southeast Asian country is the world’s second-largest producer of nickel ore, accounting for about a fifth of global supply, any alteration to its export policy was bound to send far-reaching ripples throughout the market.

China, one of the leading importers of not just Indonesian nickel but other global raw materials as well, reacted by stockpiling the silvery-white metal, 75 percent of which is used worldwide in stainless steel production. This in turn encouraged investors to drive prices even higher out of fear of a supply shortage.

China, one of the leading importers of not just Indonesian nickel but other global raw materials as well, reacted by stockpiling the silvery-white metal, 75 percent of which is used worldwide in stainless steel production. This in turn encouraged investors to drive prices even higher out of fear of a supply shortage.

A repeal on the export ban is unlikely to happen in the near-term, as both Indonesian presidential contenders, Joko Widodo and Prabowo Subianto, who are both claiming victory in the recent election, favor its continuation. We will keep our eyes on nickel, as a correction might very well come when and if the ban is ever rescinded.

Palladium and Platinum

Prices of the platinum group metals (PGMs) hit three-year highs following the double whammy of a five-month-long miner strike in South Africa and trade sanctions against Russia, the world’s leading producer of palladium. Fear of a shortage in PGMs, which are essential to the production of catalytic converters in automobiles, drove prices skyrocketing.

This comes at a time when U.S. auto sales have surged to 16.9 million in June alone, an increase of 9.2 percent over the same time last year. Auto manufacturing is expected to grow 10.3 percent in the third quarter, according to International Strategy & Investment (ISS).

Although the labor strike ended last month, PGM production cannot reasonably resume within the next three to five months. And with a separate strike underway, this one led by the National Metalworkers of South Africa, country leaders fear yet another economic setback that has already threatened a third of South Africa’s manufacturing output.

Gold

Our Gold and Precious Metals Fund (USERX), rated four stars by Morningstar,* continues to excel because we intimately understand the dynamics of both the Love and Fear Trade in the global gold market. We also know how to read and act on China’s positive purchasing managers index (PMI), which has recently hit a six-month high of 51. Any number over 50, of course, indicates strong growth in the manufacturing sector. China is already the world’s largest producer and consumer of gold, and because its middle class is swelling in rank—the country is expected to have over 670 million middle class citizens early next decade—gold sales should remain robust.

Our Gold and Precious Metals Fund (USERX), rated four stars by Morningstar,* continues to excel because we intimately understand the dynamics of both the Love and Fear Trade in the global gold market. We also know how to read and act on China’s positive purchasing managers index (PMI), which has recently hit a six-month high of 51. Any number over 50, of course, indicates strong growth in the manufacturing sector. China is already the world’s largest producer and consumer of gold, and because its middle class is swelling in rank—the country is expected to have over 670 million middle class citizens early next decade—gold sales should remain robust.

Besides China, other global drivers of gold consumption at this time include India and the Middle East. Diwali—otherwise known as the Indian Festival of Lights—Christmas and other international celebrations encourage generous giving of gifts, of which gold jewelry is one of the most traditional and popular. Ramadan, scheduled to end on July 28, involves a type of alms-giving called zakāt, which is one of the Five Pillars of Islam. Zakāt is obligatory for all observant Muslims, who handsomely give precious metals such as gold to those in economic hardship.

As I told Catherine Murray on BNN’s Business Day PM back in May:

So we’re coming to that trough on a seasonal pattern, and that seasonal pattern is predominated by what I call the Love Trade, where you have jewelry demand, et cetera, coming out of Asia, Middle East and India... And this is the first time that we had what they call the Flash HSBC PMI. And this is very important for job creation and GDP per capita rising, and that’s highly correlated with consumption of gold for the jewelry trade. So the second half [of 2014] looks great, and I think it’s also very important for all exports of any resources.

Crude Oil

Although not one of the top leaders in the first half, crude oil deserves a shout-out. Its 7.06 percent annual return is closing in on the 7.19 percent return in 2013, when oil was the second-best performer. Because of unrest in Iraq, North Sea Brent crude has set a record for trading between $107 and $112 a barrel for 12 consecutive months, handily beating the 170 consecutive days in 2008 when it traded over $100 a barrel.

In its monthly energy report, the U.S. Energy Information Administration (EIA) forecasts that 2015 will represent the highest level of West Texas Intermediate (WTI) crude production since 1972. Global consumption of oil, driven largely by China once again, is expected to reach 94 million barrels a day (bbl/d) by the end of next year.

Global Resources Fund (PSPFX) portfolio manager Brian Hicks reiterates these points on why we are bullish in light of the current domestic oil production boom:

Within our portfolio, we are investing heavily in the shales through upstream oil and gas companies, oil services companies and equipment companies. Shale is transformational; it is really changing the energy landscape. Almost overnight, companies are developing resources that are long-lived and repeatable. Remember, only five years ago we were talking about peak oil. Now, we're producing roughly 8.4 million bbl/d. That's the highest we've seen since the mid-'80s. It is a trend that is going to continue.

Always Remaining Vigilant

Even though the commodities market has so far exceeded everyone’s expectations this year, especially following a lackluster 2013, a correction could occur with little warning. That’s why the portfolio managers of PSPFX, USERX and our World Precious Minerals Fund (UNWPX) are constantly looking out for opportunities and threats as well as ensuring that the fund is optimally diversified to protect against changes in the market.

For now, however, it appears as if resources could continue their strong performance for at least the near-term and hopefully much longer.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

*Morningstar Overall Rating™ among 71 Equity Precious Metals funds as of 6/30/2014 based on risk-adjusted return.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

The Reuters/Jefferies CRB Index is an unweighted geometric average of commodity price levels relative to the base year average price. The HSBC Flash China Manufacturing PMI is published a week ahead of the final HSBC China PMI every month. It analyzes 85-90 percent of the responses to the Final PMI from purchasing executives in more than 400 small, medium and large manufacturers, both state-owned and private enterprises.

Morningstar Ratings are based on risk-adjusted return. The Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Ratingä based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

Diversification does not protect an investor from market risks and does not assure a profit.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of