Gettin’ High On Bubbles

Back in the drug-soaked, if not halcyon, days known at the sexual and drug revolution—the 1960’s—many people were on a quest for the “perfect trip”, and the “perfect hit of acid” (the drug lysergic acid diethylamide, LSD). We will no doubt generate some hate mail for saying this, but we don’t believe that anyone ever attained that goal. The perfect drug-induced high does not exist. Even if it seems fun while it lasts, the problem is that the consequences spill over into the real world.

Today, drunk on falling interest rates, people look for the perfect speculation. Good speculations generally begin with a story. For example dollar-collapse. And then an asset gets bid up to infinity and beyond (to quote Buzz Lightyear, who is not so close a friend as our buddy Aragorn). It happened in silver in 2010-2011. It happened more recently in bitcoin.

Most speculators don’t care about the economic causes and effects of bubbles. They just want to buy an asset as the bubble begins inflating, and sell just before it pops. But bitcoin and many gold proponents are different. They promise that their favorite asset will cure many social ills, fix many intractable problems, and increase liberty. Oh yeah and get-rich-quick.

We been pounding the table for going on a decade, sometimes even bellowing from the rooftops, that gold does not go up. Even the gold bugs claim that the dollar is collapsing. Our point—which has so far gone unanswered—is that you cannot use something which is collapsing to measure other things. Especially not the economic constant (gold). Either the dollar is collapsing, in which case if gold is going up then the dollar could not be used to measure this. Or else it’s not collapsing, in which case maybe it could measure gold—but then remind us why these folks are buying gold.

In response, some argue “well yeah, we don’t necessarily want a higher price of gold for its own sake—we want to grow our purchasing power.” Gold, they say, will increase in purchasing power when the masses dump their dollars and buy gold. Maybe.

As an aside, we are not sure how they square this with their oft-stated assertion that purchasing power in gold has been constant since Rome. We have heard this a million times. A fine toga back then supposedly cost one ounce of gold, as does a fine suit today. We don’t know where they shop, but we have bought pretty nice-looking suits for a lot less than $1,350 and we have also paid multiples of that for a handcrafted Italian sartorial masterpiece. There is no reason why prices should be constant, but we suppose this myth is necessary to bolster the belief that the value of money is 1/P (P being prices).

Anyways, suppose it were true that prices will fall in gold terms (while they hyperinflate in dollar terms). So? Is that a good thing?

Bear with us, as we get to the answer to that question.

Waving the Magic Wand

Mainstream speculators—fueled by the rubbish economics that passes for theory in our modern monetary era—believe that the Fed can create wealth. You see, if the economy gets into a bit of trouble, the Fed can just, you know, wave its magic wand and abracadabra prestochango aggregatedemand and we’re growing and getting richer again. Like after 2008. It’s the perfect monetary hit, with no consequences.

But the gold and bitcoin proponents know this is not so. A key reason for their love of the metal and the … umm … bit … is that neither the Fed nor anyone else can increase their quantity arbitrarily. They know that if the Fed gives a billion bucks to a bank, then maybe the bank is enriched but everyone else is impoverished. That this is a transfer of some kind.

People are trained to think—recall those rubbish theories—that if the quantity of money increases, there is a dilution of all monetary units. Those who get the money first may be enriched, but everyone else is impoverished—the Cantillon Effect. Diluted. Like pouring more water into a giant pot of soup. The same amount of food is still there, but there is more water which means each spoonful contains less nutrition.

So if this is so, then we have no worries about the rush to gold. Sure purchasing power will increase for those who already own the metal, but there is no increase in quantity of gold. There is no central bank. There is no dilution. And no Cantillon. Therefore it’s all good, all part of the path to the gold standard, wherein the right (i.e. very high) gold price brings about the gold standard. Oh yeah, and the massive enrichment of current gold owners.

What is Wealth?

Maybe. But this leads to a question. What is wealth? What does it mean to be wealthy?

We love to use the parable of the Prodigal Son for many reasons. Today, we will use it because it does not carry any connotations of money supply, money printing, dilution, Cantillon, inflation, etc. It is a simple example of a man who consumes his capital. He is on the perfect trip—until the capital runs out.

Does being wealthy mean consuming lots of capital—your own or someone else’s?

There is a vital reason why we go to such lengths to make the distinction between operating a farm to grow food vs. selling off pieces to buy groceries, as Keith does in his Yield Purchasing Power series. And in our discussion of investing vs. speculating. In the former case, you are producing what you consume (or more than you consume). The latter case is different, because you are consuming without producing, which means consuming something previously produced.

Consuming capital.

Framed in this light, the answer to this question about wealth is now obvious. No, to be wealthy does not mean to consume capital. Just as to be happy does not mean to be high on an acid trip.

Now we have established the context to go back to our question at the top: is it good if the purchasing power of gold skyrockets? Even though it does not involve central banks, money printing, increased quantity of money, or Cantillon. It is not good.

It is just one more way for people to consume the capital that supports our civilization. Capital is the leverage on human effort. We do not work harder today than they worked during the stone age (probably a lot less hard). Yet we are so much more productive. Forget the countless tools that they could not have imagined (such as the one you are using to read these words). Today, poor people are often fat. It was taken as an axiom of natural law, that food shortages kept the human population in check. Now even the poorest can be obese.

And, in the Fed’s mad falling-interest world full of perverse incentives but with scant opportunity to earn yield (especially for the plebes whom regulators seek to protect), we are trained to dismiss yield. We are trained to seek the perfect speculation. Operating the farm to grow food is old school. Much cooler to dismantle it, and sell off the pieces. After all, operating it produces few crops but selling it off pays for years of groceries.

We submit for your consideration that wealth is not purchasing power, if purchasing power is merely the power to liquidate capital to buy consumer goods. Wealth means generating the income by producing. The wealthy man is the one who earns 100 ounces of gold a year, spending only 90. Whereas, the man who sells off his gold hoard, to go on a great trip like the Prodigal Son, is not wealthy. He only deceives himself to think he is wealthy, and the trip must end when the wealth is all consumed.

We emphasize, as always, that we do not blame the speculators. The Fed, “engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” These are the words of John Maynard Keynes, citing Vladimir Lenin on how to destroy the capitalist system.

We are all caught up in the Fed’s game, as it engages those hidden forces (i.e. incentives). Our moral condemnation goes to the Fed, not to the people.

There may be a grand opportunity for gold owners to consume mass quantities of capital, in the final desperate days of the collapse of the dollar. We predict in Keith’s permanent gold backwardation thesis that prices, in gold terms, will be collapsing even while they are going to infinity and beyond in dollar terms. However, we think conditions will deteriorate so badly that most will think twice about partying. As we suspect that not many people are partying in Venezuela right now.

In any case, we regard capital consumption as a cost not a benefit. What the world needs most badly is a stable monetary unit. Not another gyration and another generation of Prodigal Sons. The path to this stability is not paved by a skyrocketing gold price or skyrocketing gold purchasing power, but with the return of the gold interest rate.

Keith will give a talk in Las Vegas in early May. Please contact us if you would like to attend.

Supply and Demand Fundamentals

Picture, if you will, a brick slowly falling off a cliff. The brick is printed with green ink, and engraved on it are the words “Federal Reserve Note” (FRN). A camera is mounted to the brick.

The camera shows lots of things moving up. The cliff face is whizzing upwards at a blur. A black painted brick labelled “oil” is going up pretty fast, but not so fast as the cliff face. It is up 26% in a year.

A special brick, a government data brick of sorts, labelled “CPI-U” had been going up ever so slowly. But as of March, it is actually falling. At least according to the camera on the FRN brick.

In this surreal vertical landscape-in-motion, the lighthouse across the water, labelled gold, went up $13 this week. Amazing, these GoPro cameras, able to capture such a thing while falling off a cliff attached to a brick… The silver streamer tied to the gold lighthouse went up 24 cents.

If the CPI-U is to be believed, the purchasing power of the dollar went up slightly. So that means the purchasing power of your gold went up slightly more than slightly and the purchasing power of your silver went up slightly more than that. If this continues, it promises to be a great trip…

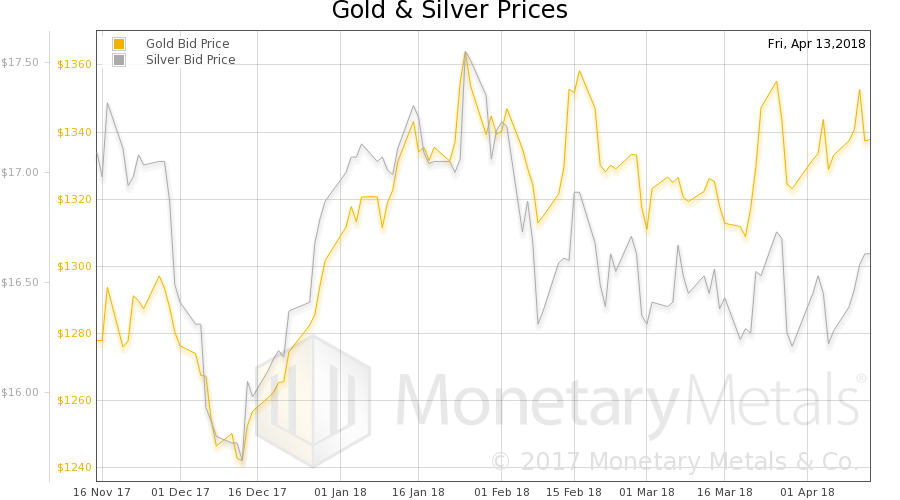

…But will it? We will look at that. But first, here is the chart of the prices of gold and silver.

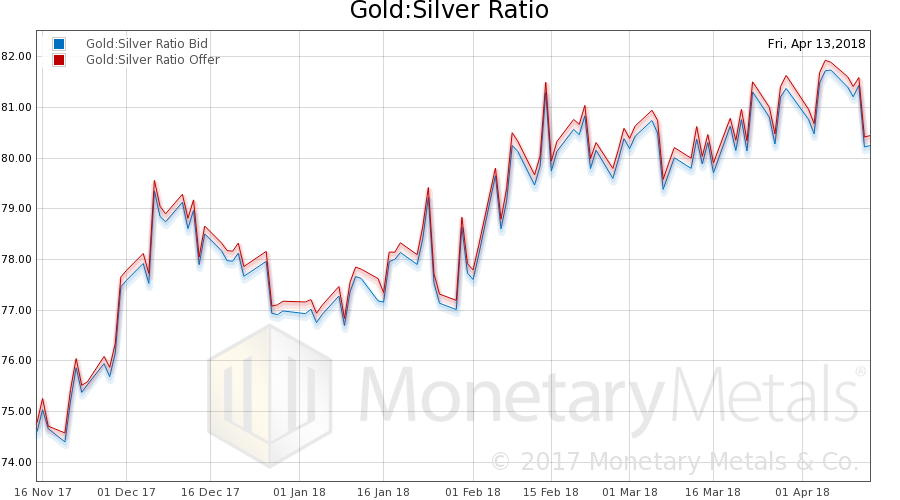

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell slightly this week, i.e. silver went up objectively, i.e. in gold terms.

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

We see a non-speculative, i.e. fundamental, move occurring here, particularly since around March 20. The FRN brick has been as seen from the gold lighthouse (ok ok, this is the inverse of the rising price of gold measured in dollars). Yet gold’s scarcity to the market has been rising in the face of this. The typical pattern when speculators are driving the market, is that gold scarcity moves with the dollar price. As the dollar rises (i.e. price of gold falls) gold becomes more scarce. As the dollar falls, gold becomes more abundant. Not at the moment.

So it should not be a surprise that the Monetary Metals Gold Fundamental Price rose a further $16 this week (now over $1,500).

Now let’s look at silver.

It’s a bit different in silver. The scarcity of this metal fell a bit.

However, the Monetary Metals Silver Fundamental Price rose 36 cents to $17.46. The fundamental is now back where it had been in the third week of March. Unlike in gold, there is no rising trend for the silver fundamental. It’s been sideways action since September last year, and arguably a downtrend of lower highs since February 2017.

© 2018 Monetary Metals

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the