Gold’s Backwardation Profit Taking

The big news this week is that Donald Trump was elected to be the next President of the United States. Whether due to his comments about restructuring the government debt, tariffs on imported goods, or other economic concerns, many expected news of his election to push up the price of gold.

They were wrong.

Every day since last Friday (November 4) has seen the price of gold falling. From a peak of over $1308, the price fell to $1227 on Friday.

There was a rally from $1269 to $1337 on the evening of election day, from 8pm to midnight in New York. This is roughly the time when election results began to trickle in and show that Trump was going to win. At the same time, the stock market tanked. S&P futures fell from 2150 to 2028, or -5.7%. Volume was off-the-charts high for US evening time.

But then what passes for normal took hold once again. The price of gold resumed its slide. The stock market recovered.

One thing is for sure. The price of gold does not go up for the reasons supposed by most gold bugs. Any more than it goes down for the reasons given by the propaganda of the paper bugs.

There is something else going on that could drive the gold price up. I refer to the new Indian policy of demonetizing larger-denomination cash (500- and 1000-rupee notes, worth $7.40 and $14.80—i.e. not so large). So many Indians rushed out to buy gold that credible sources report a temporary 20% spike in the rupee-price of gold.

We doubt that Prime Minister Modi can force many Indian cash holders to increase their bank balances. However, he could push the marginal cash holder to increase his holdings of gold. If that proves to be durable, that could drive the price of gold up substantially. This situation with cash and gold in India needs to be watched.

The price of silver took a big dive on Friday, ending down a buck twenty. Yes a buck twenty, as in -6.4% (the low of the day was 15 cents lower).

The question is: what did the election do to the fundamentals? Are people now stacking silver bars and gold coins, who had not been doing it before the election? Or is this price move just more noise that will be lost in a month, much less over the long term?

We will give a teaser. Something changed in the market this week.

We will update the pictures of the gold and silver fundamentals below, and show our first-ever intraday basis charts. But first, here’s the graph of the metals’ prices.

The Prices of Gold and Silver

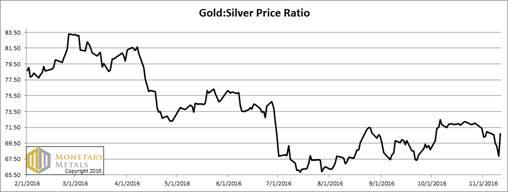

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose this week, how could it not with the big price move in silver?

The Ratio of the Gold Price to the Silver Price

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

And now we see or old friend, who has been absent for a while. Backwardation. The cobasis is over +0.3% (30 bps).

We admit that we have a conundrum. We are not quite sure how to handle Friday. In the US, Friday was a bank holiday Veteran’s Day. The Treasury bond market was closed, as were the banks. However, the stock market was open as was the gold futures market. And there was high volume (the third highest day of the year, after Thursday and June 27).

We are including Friday.

Friday had a big price move in gold, with the dollar up almost 2/3 of a milligram gold (muggles will see this as gold going down -$32).

Last week, we said:

“Are we predicting a crash, much less on Monday morning (as we write this, the price of gold is down in Asian trading by $11)? No, but we are saying gold is not looking like a good value here. If you don’t have any, then there is never a bad time to buy. But if you’re trading a position, we could think of better times to buy than now. Maybe now (especially at Friday’s price over $1,300) might be a good time to consider selling a covered call.”

That was then and there (a week and 76 bucks ago).

And something else changed. The fundamentals got stronger. Unless this turns out to be an anomaly due to the bank holiday and the absence of some market makers, the fundamentals are stronger now than they have been in quite some time.

We calculate a fundamental price of over $1310.

We will take a look at intraday basis charts for gold and silver, below.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The same thing happened in silver. And unlike last week, it occurred across all contracts. Falling basis (abundance) and rising cobasis (scarcity). ‘Course, in silver, the price drop was epic, much bigger than in gold.

We calculate a fundamental price of just over $17. So, like with gold, we had buying of physical metal and selling of futures.

Many times over the years, we have seen reports of a big paper flush amidst strong physical demand. We have debunked several of them, and dismissed the rest.

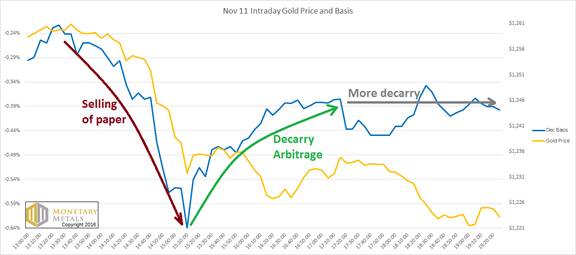

What happened on Friday was different than those other events. Here are intraday graphs showing basis and price (the cobasis moved pretty much inverse to basis so not included to keep the graph as readable as possible).

Intraday Gold Basis and Price

From just before 13:30 (London time, or 90 minutes before the PM gold fix), the basis begins falling. The basis is the spread of futures – spot. So futures begin selling off before even the price begins to decline. Shortly after 2pm, the price of gold is still holding at $1259, but the basis is already dropping. And boy does it drop, to a trough of -64bps. From there on, the basis recovers somewhat.

We have annotated the graph to highlight three distinct phases. In the first phase, it is simply selling, driven by selling of futures. How do we know? First, the basis begins to fall before the price. Of course, the fact that the price begins to fall while the basis continues to fall proves it. It is simple enough, lots of traders sold gold futures and the price fell around $30 initially.

The second phase is more interesting from a market theory point of view. Here we see the basis rising, and it’s a pretty big move up from a low of -64bps to -38bps—just about a 2/3 retracement of the original drop. However, the price is sideways to positive. The basis is changing but the price is not. In other words, the spread between futures and spot is compressing (basis is negative here, so rising value means tighter).

What this means is simple. For an hour and a half, the panicky herd of speculators stampeded at will. After that, the market makers were able to reassert some control. No, not over price but of spread! The market makers did not manipulate the price of gold up or keep it from falling. They began to decarry gold, that is sell spot and buy futures. This pushes down the bid price on spot, and pushes up the offer price on the futures contract.

Why would they decarry? To take profits, of course! In recent months, the profit on offer to carry gold has been very high. This has tempted many arbitrageurs to exploit the opportunity: by buying a bar of metal and simultaneously selling a futures contract. They are long metal and short a future.

When the basis drops, that provides an opportunity to close the position and make more than one would have made by holding to maturity. For example, suppose you put on this trade on June 27. You locked in a profit of 1.45% on your investment (in dollars, of course). Ever since then, the basis has been declining. Now the basis hit a low of -0.64b%. At that moment, the cobasis was +0.44%. So you could close your trade a month and a half early, and add 44 bps to your profit.

And after this, in the third phase, the basis goes sideways while the price falls another $13. In this phase, the arbitrageurs are still decarrying. What’s our evidence for this? The price is moving down, which means lots of selling again. But in this phase, the arbitrageurs are keeping up. They are decarrying as fast as speculators are selling.

As we have described in many past Reports, while basis is rising the marginal demand for metal is to go into the warehouse. It feeds the gold carry trade. We emphasize that when this builds up, it’s dangerous because the marginal demand can abruptly turn off and a new marginal supply come online. A high basis cannot predict the timing, but it can tell you that the market is ripe for a drop the way a supersaturated solution is ripe for a precipitation. They have seen their opportunity to profit, and are reluctant to keep holding their positions and risk the basis continuing to rise.

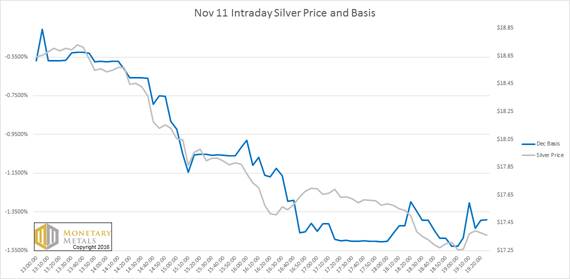

Intraday Silver Basis and Price

We did not mark up the silver chart. It is interesting that the basis correlates more highly with the price. Or, in other words, while the selling pressure in gold largely abated, it continued in silver. The total drop in the Dec silver basis was nearly 100bps.

If you had carried silver on August 10, you could have locked in a profit of 156bps. If you decarried it on Friday, you could have added another 95bps.

If gold was in a supersaturated solution, then silver was in a super-duper saturated solution.

It will be interesting to see this week, if the arbitrageurs can catch up in silver and we see a rising basis. And if the elevated silver fundamental price of $17.08 holds.

It is also possible that some market makers were off on holiday on this Veteran’s Day.

© 2016 Monetary Metals

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the