Gold SWOT: Silver Inventories at Comex (New York) Have Risen to a Record High Strengths

Strengths

- The best-performing precious metal this past week was gold, despite experiencing its first weekly loss due to tariff threats against Canada and Mexico, set to take effect on March 4. These threats led to a stronger U.S. dollar, which put pressure on gold. However, a sharp decline in Bitcoin, which lost 27% of its all-time high, triggered billions in redemptions from various Bitcoin ETFs. As a result, gold bullion ETFs benefited from this asset rotation.

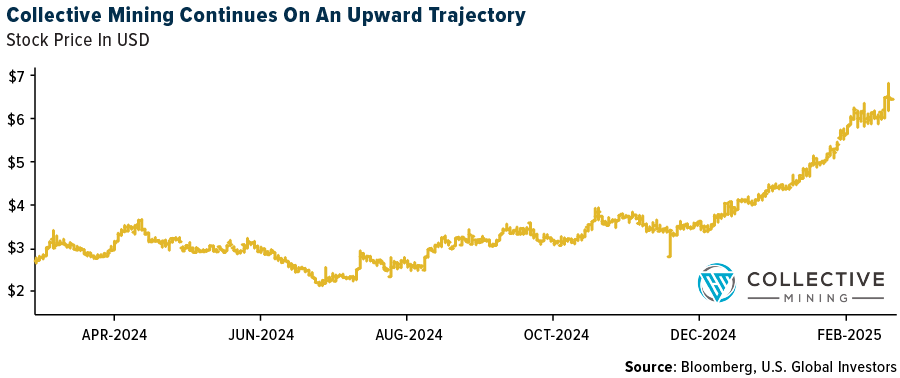

- Collective Mining Ltd. reported its best drill intersection at the Apollo system this week, with drill hole APC104-D5 intersecting 106.35 meters at 9.06 g/t gold equivalent (AuEq) within 497.35 meters at 3.01 g/t AuEq, highlighting the potential for high-grade sub-zones that could enhance the project’s overall grade and size. This breakthrough underscores Collective’s ability to unlock significant value at Guayabales, reinforcing its position in the gold exploration sector.

- Silver inventories at Comex (New York) have risen to a record high as the metal pushes prices month-over-month. The CME Group warehouse has reported 403.2 million ounces as of February 27 – a record high amount of silver stored, reports Bloomberg.

Weaknesses

- Gold jewelry demand in China slumped 11% in 2024, with high bullion prices above $2,800 per ounce further denting consumption this week, per a World Gold Council update. This persistent weakness threatens a key physical demand driver, exposing the market to reliance on investment flows amid a property crisis and equity underperformance.

- Franco-Nevada Corporation disclosed a $100 million write-down on February 26, 2025, tied to ongoing delays in restarting Cobre Panama (130-150k oz potential), as noted in its latest SEDAR filing and a Mining.com article. This setback, impacting its 112M oz AuEq portfolio, weakens near-term GEO growth and pressures its premium 1.05-1.15x P/NAV valuation.

Opportunities

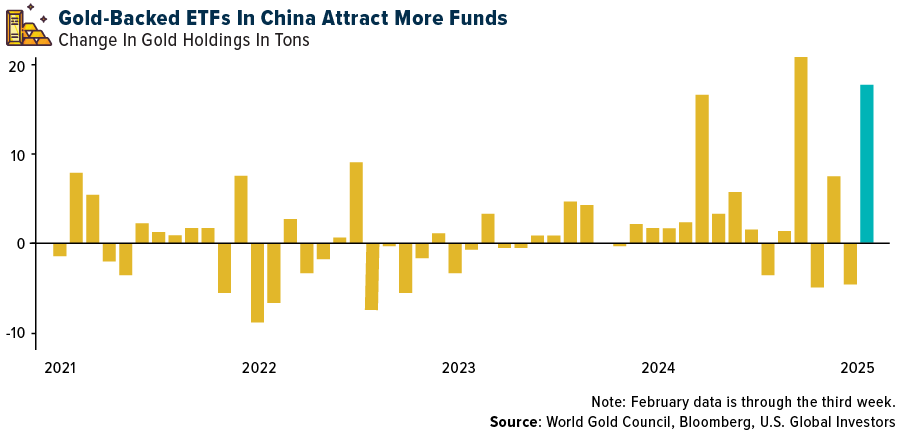

- Gold-backed ETFs in China swelled with 17.7 tons of inflows in the first three weeks of February, nearing a record 20.9 tons, driven by a pilot program allowing insurers to buy gold for the first time, as reported by Bloomberg this week. With banks like Goldman Sachs forecasting prices to $3,100-$3,300 per ounce by year-end, this surge reflects gold’s rising role as a hedge against currency depreciation and a diversification tool.

- Gold prices stand to gain as investors pulled a record $3 billion from U.S.-listed spot bitcoin ETFs this week, with $750 million exiting on February 26 alone, per Etf.com, while pouring $4 billion into gold ETFs amid crypto’s slump and a $1.5 billion Bybit hack reported last week. This shift, driving the SPDR Gold Trust (GLD) up 8.6% year-to-date against bitcoin’s decline, offers a prime opportunity for gold to climb toward $3,000 per ounce as risk-off sentiment and distrust in digital assets bolster its safe-haven appeal.

- Allied Gold launched a $500 million joint venture with UAE investment fund Ambrosia Investment Holding, targeting untapped high-grade deposits in Allied’s Mali operations, as announced on their website. With a combined 2.7M oz Au resource potential and gold prices staying above $2,800 per ounce, this partnership could boost production and re-rate Allied Gold’s valuations.

Threats

- Fortuna Silver Mines Inc. flagged a $20 million budget cut to its 2025 exploration plans on February 26, per its SEDAR filing and Mining.com, due to gold price volatility risks below $2,660/oz impacting its 83% gold-heavy revenue. This reduction threatens its 400-450k oz AuEq output and 0.83x P/NAV if Diamba Sud and Kingfisher development falters.

- Trump’s tariff threats intensified this week, Bloomberg reported, noting plans for Canada and Mexico tariffs next week, driving gold’s rally to pause near $2,865 per ounce after hitting $2,956.19. This volatility, coupled with a rising dollar, poses a near-term risk to gold’s momentum, potentially triggering profit-taking in precious metals markets.

- Silver’s long-term underperformance versus gold was highlighted this week by Bloomberg, despite a 0.95 correlation, silver’s cyclical volatility has left investors who bought at 1980’s $50/oz peak with losses, unlike gold’s 2.45% inflation-adjusted return since 1950. This disparity, detailed in Bloomberg’s Markets Live blog, threatens silver’s appeal as a gold proxy, potentially dragging sentiment in the broader precious metals market if gold’s rally falters.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of