Gold’s Path After Breaking to New All-Time High

Earlier this year, Gold broke out of its cup-and-handle pattern and made its biggest breakout in 50 years.

It has steadily climbed higher but could be experiencing its first notable post-breakout correction.

There were three other instances in the last half century when Gold broke to a new all-time high.

The first chart shows Gold in the 1970s, including the two breakouts to new all-time highs.

Gold eclipsed its 1968 peak at the start of 1972 and shot higher until the summer. Then it corrected 14%, which ended with a test of its 200-day moving average. There was no retest of the breakout.

Later that decade, Gold recovered from its nasty bear market and eclipsed its 1974 peak at the end of 1978. Then, Gold quickly corrected 21%, retested the breakout, and bottomed at its 200-day moving average.

In the autumn of 2009, Gold broke $1000/oz. It surpassed $1200/oz before correcting 14%, down to its 150-day moving average.

At present, Gold has climbed roughly 73% from its 2022 low.

It closed the week at $2695. The 200-day moving average is $2395, and the 150-day moving average is $2486. Both are rising sharply.

In each of the past three breakouts to new all-time highs, Gold tested its 150-day or 200-day moving average not long after its breakout. The 200-day moving average should reach $2500 by January.

Note how Gold performed after the tests of the 200-day moving average at the end of 1972 and the end of 1978. In both cases, Gold exploded higher over the next 14 months.

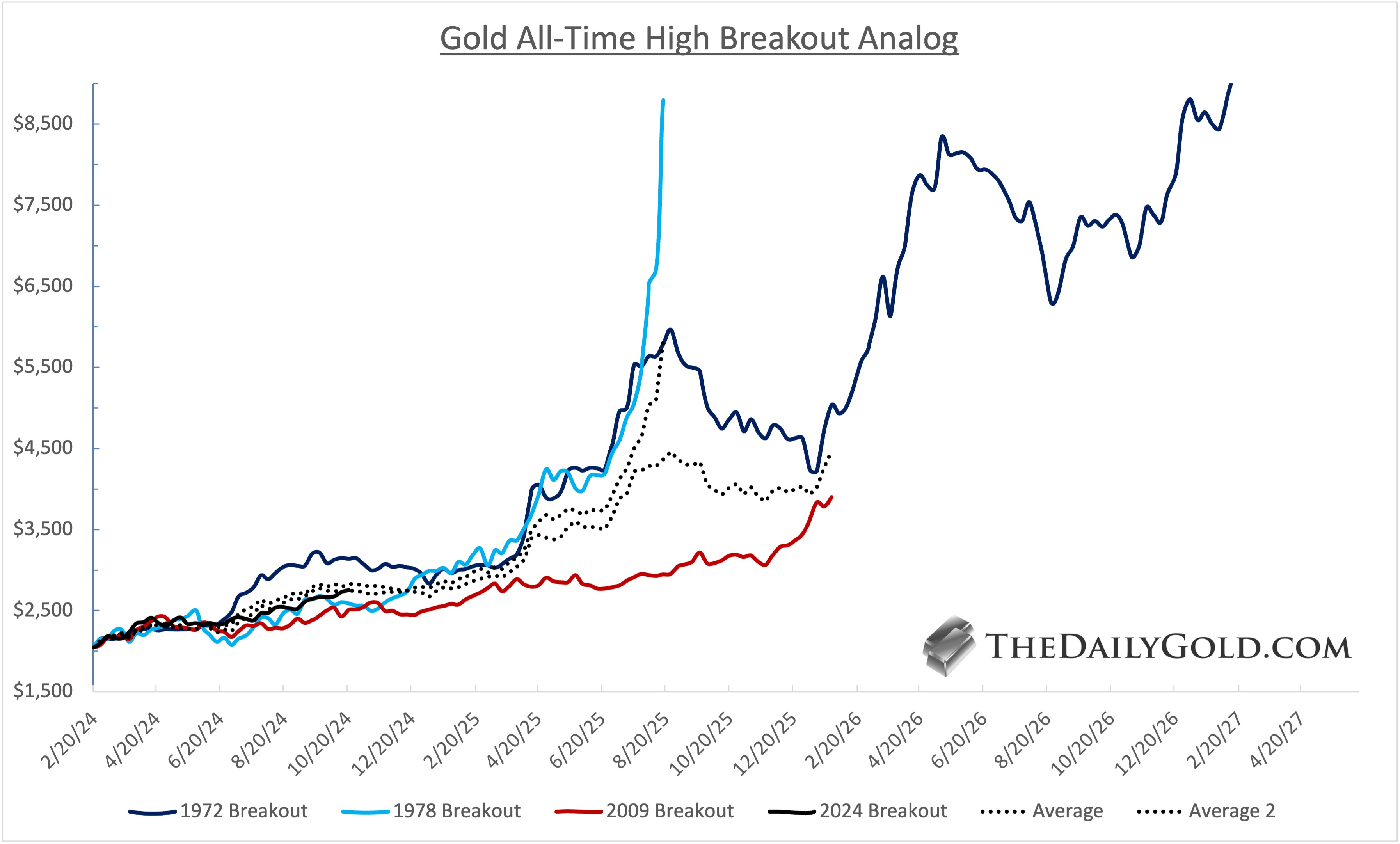

The chart below plots the performance of the three breakouts to new all-time highs on the scale of the current breakout.

Both averages (one for all three and the other for the weaker two of the three) show that after a correction, Gold could recover early next year and then gain momentum in the spring.

Gold could reach $3000/oz or even higher before a correction begins.

The other scenario is that the real correction has begun, and Gold could test $2500/oz and its 200-day moving average.

In any case, let’s examine Gold’s performance following the first correction after breaking to new all-time highs.

In the early 1970s, it surged 200% over the next 15 months. At the end of the 1970s, it exploded by 400% in only 14 months. After the test of the 150-day moving average in early 2010, it advanced 51% in 15 months.

Following the weakest of the three would take Gold to nearly $3800/oz by the end of Q1 2026.

The current weakness is a gift. Use it to identify and focus on juniors with quality assets and value.

You will want to position before Gold explodes higher against the 60/40 portfolio and breaks out of its 45-year base against inflation.

********