Where Will Gold Price Go Following Presidential Election?

Strengths

- The best performing precious metal for the week was silver, up 3.69 percent. Weakness in the U.S. dollar began to materialize this week, benefiting the precious metals sector.

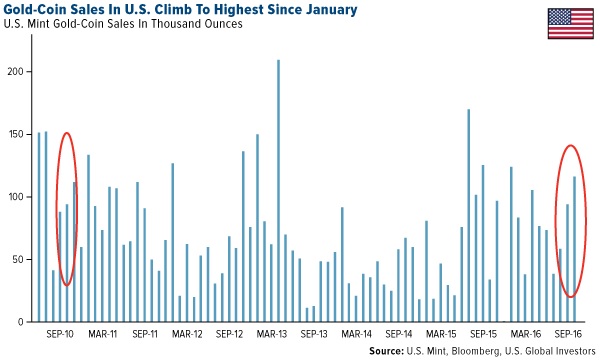

- With polls increasingly tight ahead of the U.S. elections on November 8, gold’s upside will persist, according to a note from UBS this week. In fact, as seen in the chart below, the U.S. Mint has already seen gold-coin sales in the U.S. climb to the highest since January. Additional positive news for the yellow metal comes from HSBC who reports that physical gold demand from China remains steady with the SGE premium trading between $4 and $6 per ounce.

- Gold is heading for its longest run of weekly gains this week since the U.K.’s Brexit vote shook financial markets, reports Bloomberg, primarily on rising concern that presidential candidate Donald Trump may prevail over Hillary Clinton in next week’s election. The precious metal held near a one-month high as investors weighed the need for a haven against expectations of higher U.S. interest rates, Bloomberg continues.

Weaknesses

- The worst performing precious metal for the week was palladium, rising just 0.93 percent. A story from Equities.com this week on asteroid mining, noted that if humans were ever able to get their hands on just one asteroid, it would be a game-changer. Even if a small metalliferous asteroid could be harvested, it would contain more platinum group metals than what has been mined here on earth.

- Non-farm payrolls came in on Friday up 161,000, slightly missing expectations of 170,000. Earlier in the week the Institute for Supply Management said its Purchasing Managers’ Index pushed further into expansion territory in October, reports Kitco News, rising to a reading of 51.9. For now, gold is holding near its one-month gains.

- The trade gap in Turkey widened in September by the most this year, reports Bloomberg. The balance of gold shipments went from a surplus to a deficit. To be specific, the precious metals’ trade went from $520 million to $160 million. Russia is in a similar situation according to its Finance Ministry. The eight-month output for silver in the country fell 11 percent year-over-year and the output for gold fell 1.3 percent year-over-year, reports Bloomberg.

Opportunities

- HSBC says that the policy proposals from the two U.S. presidential candidates have “significantly different implications for gold and other assets.” If Clinton wins, the research group sees gold at $1,400 an ounce by year-end and around $1,440 an ounce in 2017. A Trump win, however, would be “decidedly gold-bullish,” the group writes. HSBC believes Trump could send gold prices to $1,500 relatively quick. Echoing these thoughts is a forecast from Citigroup which states that gold may rally to $1,400 an ounce if Trump wins the election.

- Hillary Clinton’s odds of winning the U.S. presidential election dropped from 82 percent to 71 percent on October 27 (the day prior to the FBI reigniting the email controversy), according to poll aggregator FiveThirtyEight. A Trump win or a sweep by the Democrats could send investors running, reports Bloomberg, much like the aftermath of the Brexit vote in June. So what does the election mean for commodities? According to Bloomberg, a Clinton win will put pressure on coal and oil because of her environmental policies, particularly in regards to combating climate change. If Trump wins, natural gas prices could suffer because coal is a beneficiary under Trump.

- Newmont Mining completed a $1.3 billion sale of its Indonesian copper and gold assets to a local consortium, reports Bloomberg. This deal reduces Newmont’s dependence on copper and narrows its geographic focus to the Americas, Africa and Australia, the article continues. The company has lowered its debt by 56 percent since 2013 and has generated $2.8 billion in asset sales.

Threats

- Bullion’s run in 2016 has slowed a bit in the second half of the year as the market gears up for higher U.S. borrowing costs. Although the FOMC made no moves during its meeting this week, the probability that it will hike rates in December has climbed to 71 percent from 59 percent, reports Bloomberg. “If policy makers signal stronger support for future rate hikes during the meeting, bullion prices could adjust very quickly,” Xu Wenyu, analyst at Huatai Futures Co. said.

- The CME Group will start London gold and silver spot contracts in January, reports Bloomberg. Scrutiny from regulators has shaken up the city’s over-the-counter trading, sending exchanges fighting for a share of London’s gold market, the article continues. “There is a risk that liquidity is split too thin,” David Govett, head of precious metals trading at Marex Spectron Group said. “With three exchanges, that will just be multiplied."

- The London Metal Exchange (LME) has laid out plans to expand in China, according to its top executives. Charles Li, who oversees Hong Kong Exchanges & Clearing Ltd., LME’s parent company, says that China is the bigger prize for the world’s top metals exchange, reports Bloomberg. “We want a lot of the small- and medium-sized players, who can trust that system we are building in China, to trickle into the international system,” Li said at a seminar in London this week. With the recent scrutiny of gold price fixing in London, hopefully new regulations will improve price transparency but not reduce liquidity.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of