But “We Owe It To Ourselves”

Have you ever heard someone say this? It falls into the category of, it’s so perverse, so wrong, and so wrong-headed that there has got to be a constituency out there somewhere, to assert this!

First, let’s head off at the pass the objection that the majority of US government debt is held by foreigners. As of March this year, the US Treasury estimates that $6.3 trillion worth of Treasury bills and bonds are owned by foreign holders. This is not even close to the majority of it.

It’s also not the point. The nature of debt is what it is, whether the creditor is the People’s Bank of China or Uncle Ernie who puts 10% of his salary into US Savings Bonds.

The constituency of wrongness is headed by Paul Krugman. He is willing to go beyond the debate of domestic vs. foreign creditors, and defend global collectivism as such. He wrote an article with a headline that is sheer irony. In Nobody Understands Debt he says, “…the world economy as a whole owes money to itself.”

Producing And Consuming

We don’t have much to say to Professor Krugman, other than collectivism is the resort of scoundrels. It is a cynical ploy to distract attention from individual action. When you drill down, you see that some people are productive and others are not. Some people produce more than they consume, saving the difference. Others consume more than they produce.

As an aside, the collectivism is not typically so naked. More often, we are just offered an aggregate statistic without explanation of why it is measured in aggregate. For example, GDP is taken as a given. The idea of “economy as a whole” is implicit in the concept of GDP. But suppose a fat man is eating two steak dinners in a restaurant. A starving man looks through the window longingly. Would you say it’s two men and two steaks, therefore one steak per capita, and therefore all is well?

The problem is doubly severe when it comes to the question of debt. It is of course true that if Erik owes money to Sue, then they add up to zero. His liability is her asset. If you take the aggregate of all debtors and all creditors in the economy, they cancel out. This does not tell you anything useful about economics, except perhaps that every liability of one party is the asset of another.

So declaring “we owe it to ourselves” is either meaningless tautology or breathtaking dishonesty. With Krugman, it’s clearly the latter. Yes, some of us owe others of us. Yes the aggregate sum is zero. But you cannot conclude from this that it’s not a problem. That is the dishonesty. The staggering amount of debt is a problem, and Krugman knows or reasonably ought to know it is.

Let’s look at a simple farm village example, to make this point clearer. Joe has a grain bin full of seed to plant wheat. That is his asset. He has no liabilities. Bill comes to Joe and asks to borrow the seed, and promises to return it in a year, before the next Spring. Joe is a trusting man, so he gives Bill the seed. Now Joe has an equivalent asset. He does not have the seed itself. But he has Bill’s promise to return the seed plus an additional 10% interest. Bill says he will plant it, and repay the principal plus interest from his own harvest. So long as Bill is good for his word, Joe is fine.

Of course, the seed is the edible part of the plant. It is the wheat. What if Bill simply eats it? Bill has a grand old time. He is experiencing the “wealth effect”, he feels rich while the seed holds out but he is not. All too soon, the seed is depleted. Bill will starve, as he has not used the capital asset to produce anything. He has only consumed.

Joe is in trouble, too. Joe thought he could let his field lie fallow, and earn income on his seed in the meantime. When Bill does not repay, Joe will not have seed to plant his field. He could starve too.

In the meantime, Joe does not know this. He doesn’t inspect Bill’s farm, so he thinks everything is going fine during the year. He knew Bill’s father, an upstanding man and pillar of the community, and has no reason to suspect Bill to be a deadbeat. So he borrows gold from Arthur to build a new threshing barn. He anticipates a larger harvest, as Bill is giving him 10% more seed plus his soil will be renewed by growing clover (a legume) that Joe can graze his horses on in the meantime.

Arthur is getting on in years. He is not able to work so long or so hard on his own farm. However, he has saved a lot over 50 years. He doesn’t want to just spend his savings. So he lends it out to younger farmers who work just as hard as he once did, and they pay him interest. He lives on the interest. He has helped Joe finance many improvements.

Inflation Is Counterfeit Credit

Before we go further, let’s take stock of what we have. We have illustrated a general principle. The credit to Bill is counterfeit. Bill has neither the means nor the intent to repay. This is how we define inflation—the counterfeiting of credit. It is a pernicious act, and even in our limited example the damage will not just harm the immediate creditor, Joe. It will spread to Arthur.

If we extend the chain of credit longer and longer, we will see something else. Each party exchanges a physical good for a promise to pay. Each party is happy to give up wheat or gold, and accept paper in return, because the paper pays a yield (and they trust their counterparties).

Incidentally, the solution is not to say no one should trust anyone else. That is a recipe, not for a civilization, but for a small population subsisting off the land. If you want to become a hermit, and live as a hunter-gatherer, go find your side of a mountain somewhere and have at it. But this doesn’t work for most people.

Anyways, back to our growing farm village economy. And yes, it is growing if credit can be increasingly extended. Joe is building a new barn. Jennifer is borrowing to expand cheese production, and finance the time it takes to age the product. Samuel is buying the vats to brew beer, and so on.

Eventually, if this progresses far enough, few people keep a surplus of any goods. They keep just enough to meet immediate needs. The rest is lent to someone else, to be invested in increasing production.

But what if just enough people were like Bill? Perhaps they are smarter than him, and carefully limit their counterfeiting so that it washes with legitimate borrowing and production. What if there was an undercurrent of counterfeiting in these chains, a streak of just enough inflation? Most people in our agrarian society example have enough goods to meet immediate needs, and the rest of their wealth is in the form of paper promises to pay in real goods. At the same time, most of them are borrowing as well. In other words, each has a balance sheet, with assets and also liabilities.

And, as we said, some of the assets are counterfeit. Enough of them to undermine the system. Joe faces the problem of being unable to repay Arthur, if (when) Bill does not repay Joe. Everyone gets into that position. And just as Bill is counterfeiting, so too are others.

“We Owe It To Ourselves.”

In this example, this claim is true as stated. And it’s useless. It does not give any hint of the pain that will soon enough be inflicted on everyone from Arthur to Joe to Jennifer (and even Bill). As we said above, Joe lent wheat to Bill and at the same time borrowed gold from Arthur. He plans to have the means to repay the loan. When Joe would have gotten the wheat back with interest from Bill, he would have threshed it in the new barn. He planned save so much labor that he could repay Arthur.

Except, Bill won’t repay. So Joe won’t plant wheat the next year. So he won’t have a harvest. So he won’t use his new barn, won’t generate any income, and won’t have the gold to repay Arthur.

Deflation Is Credit Contraction

Deflation is coming to the farm village. We define deflation as the forcible contraction of credit. It is the inevitable consequence of inflation.

Joe is a good exemplar of our main point. Suppose the end result of the deflation is that Joe loses his asset and his liability. Bill’s promise to pay wheat is gone, and he defaults on his promise to pay Arthur. Is Joe even? Is his position the same as it was before?

No Way.

Joe does not have seeds to plant his field. Instead, he has a useless barn. We can see that inflation, while enabling the consumption of capital assets, has another consequence. It causes people to give up productive capital assets in exchange for unproductive.

To recap, Bill gets something for nothing. Arthur gets nothing for something. And Joe in the middle trades seed he needs for a barn that he now doesn’t.

The next time someone tells you “we owe it to ourselves” thresh him in Joe’s barn!

There is an interesting postscript to this. Inflation causes malinvestment. That’s our term for when Joe builds a barn he cannot use. But does it cause prices to rise? The mainstream view regards inflation as either the increase in the quantity of money, or the presumed direct effect caused by increase in quantity, namely increase in prices.

Note that so long as each borrower is using someone else’s capital to increase his own production, that prices are not rising. We would expect Jennifer’s expansion of her cheese production to reduce the price of cheese, all else being equal.

When someone engages in fraud (and that’s really what Bill did), then it gets more complicated. In our example, the total wheat supply is reduced as Joe does not plant wheat. So that would argue for higher prices as a result (though not due to “greater money supply chasing smaller wheat supply”). However, it’s not so simple.

As people are impoverished, they may buy less wheat. Arthur may tighten his belt, as do the workers who don’t earn wages planting and harvesting for Joe. Bill, also, will eat less.

On the other hand, demand for food is pretty inelastic. People will find a way to get their daily bread, even if the price goes up a little. So the price of wheat will have to go up a lot. It has to rise enough to make them tighten their belts despite their intentions. In this case, the people may be forced to do without other goods, such as clothing. Having spent more of their income on food, this leaves less for shirts. The supply of shirts was not impacted in our example. So with the same supply, but falling demand, the price of shirts could fall (though not due to “less money supply chasing…”)

Supply And Demand Fundamentals

Yesterday May 28, markets were closed so this Report is coming out a day later than normal.

The price of gold rose nine bucks, and the price of silver 4 pennies.

With little action here, we thought we would write 1,000 words’ worth about oil. Here is a picture showing the price and open interest of crude oil futures.

We don’t track the oil basis (perhaps we should). However, as we have discussed in the past, open interest rises in response to rising basis. That is, when speculators bid up the price of futures relative to the price of spot, it becomes more profitable to carry. Unlike gold, oil has a significant cost to carry (it has to be stored, it is flammable and toxic, it can spoil with too much sun or oxygen, etc.) However, the same thing is true for oil as for gold. A positive and rising basis attracts the marginal warehouseman (tanksman?) to buy spot and sell futures against it. To profit from the basis.

Open interest was around 1.6 million contracts when oil was making its price low. Since then, the price has nearly tripled (not counting the price drop this week). And at the same time, the open interest has increased by nearly two thirds. We would wager an ounce of fine gold against a torn dollar bill that there has been a commensurate rise in basis.

A price that has risen due to and along with a rise in basis is not going to remain high. All that quantity of the good has gone into the warehouses (tanks). When the marginal demand of warehousing (tanking) turns off, and becomes instead the marginal supply, watch out.

We have no idea if this is the week for it, but it fits with the dramatic drop in interest rates. From May 18 to May 25, the 10-year Treasury yield fell from 3.11% to 2.93%. That may not sound like a lot, but in percentage terms the move is 5.8%.

We have no idea if this is the decisive turn down interest rates, or if there’s more upside action before that turn occurs. But we do know two things.

One, the long-term trend is still falling interest rates.

Two, commodity prices correlate (and are caused by) interest rates. Rising rates causes rising prices, and falling rates causes falling prices for reasons Keith spells out in his Theory of Interest and Prices.

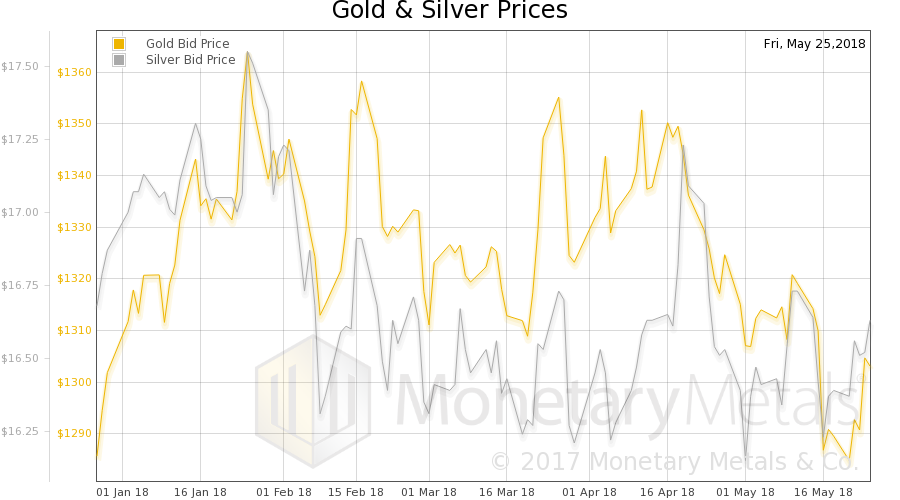

We will take a look at the fundamentals, not of oil, but of gold and silver. But first, here is the chart of the prices of gold and silver.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It rose a skosh this week.

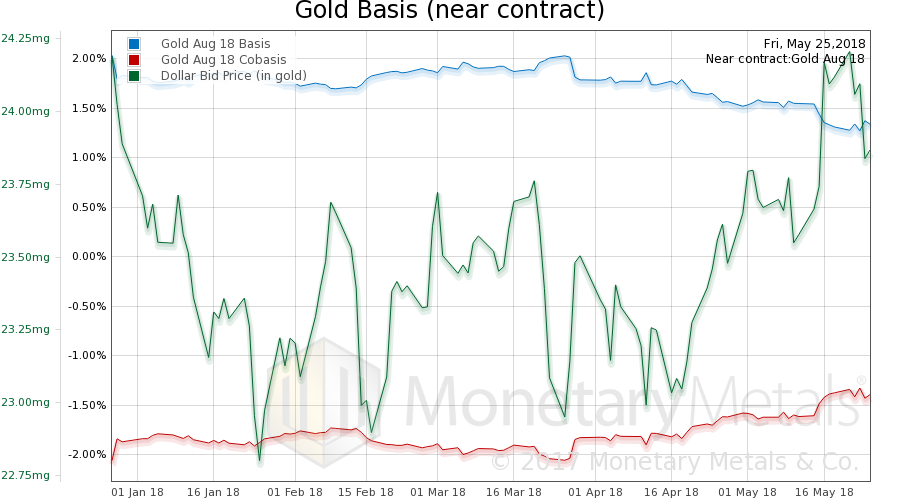

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The price of gold rose this week, but its scarcity fell.

The Monetary Metals Gold Fundamental Price fell $24 this week to $1,398.

Now let’s look at silver.

The same thing happened in silver, except the drop in scarcity was larger than gold. And the price fell.

The Monetary Metals Silver Fundamental Price fell 49 cents to $17.43.

© 2018 Monetary Metals

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the