Gold, A Month End Report

"We bought gold at 640 today."

A subscriber questioned my sell signal in gold, and promptly sent me the buy order above, recommended from another analyst. It makes no sense to me why some folks keep trying to pick a bottom of this gold correction, why not just let it run its course, and buy it when the selling has dried up. As always, we have no opinions or predictions, we simply follow price action and go with the flow. Following is our month end review on gold.

Our signals

GLD - our sell signal on 5/17 ended our buy signal of 3/24, which gave us a 24% profit. We also added to our shorts today (5/31), and we shall exit on a violation of resistance, which places our current risk at 2%.

Our analysis

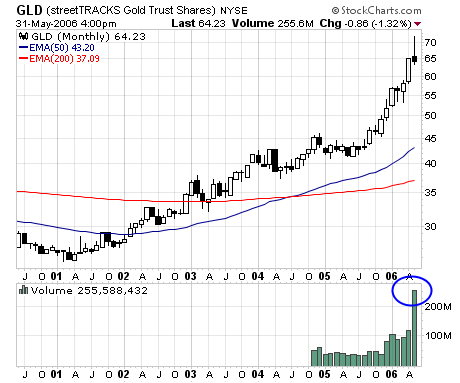

GLD is at a critical point, a break of support at $64 and we will see a downside price target of $56, which is also the 200ema support where we may get a chance at a buy signal.

The price action in May is the first time we see a "grenade" since this bull market began. A grenade or hammer as others call it often indicates a trend reversal when it appears after a parabolic rise. Of course, bulls do not accept the parabolic nature of the recent upside explosion, to them, the perpendicular rise could last indefinitely. There is no doubt that gold is in a long term bull market, as the bull cross on a monthly chart has very bullish implications. However, prices often correct to the 50 or 200ema at some time after a bull cross, where it will provide a great entry for the next bull leg up.

Back to GLD, and lets look at the monthly volume. For every buyer there must be a seller. May's unprecedented volume indicates a tremendous amount of transactions took place. Using pure common sense, given a choice, would you rather be the seller, or the buyer?

Summary

Trading is all about risk and reward. Our current short entry has a risk of 2% for a potential profit of 12% which is a 1 to 6 risk/reward set up. For the record, we have been mostly buyers of this gold bull market, but the current set up provides a great opportunity on the sell side, and as much as a gold bull I am for the long term, it is my obligation and financial interests to provide these trading opportunities for our subscribers, whether they are long or short. As always, we trade the signals and set ups, not the analysis.

Jack Chan at www.traderscorporation.com

2 June 2006