Protect Your Wealth Against The Law Of Unintended Consequences

The United States is the strongest, most prosperous country on the planet. This has been made possible only by free markets and the rule of law. But even the U.S. is not immune to the unintended consequences of well-intentioned policies. I believe gold is a rational investment to help protect your wealth against said policies.

Gold has little to no correlation with stocks, making it an exceptional, time-tested diversifier when there’s market uncertainty. A 10 percent allocation, split between physical gold and gold mining stocks, is a rational way to hedge against multiple headwinds right now, many of them sparked by poor government policies.

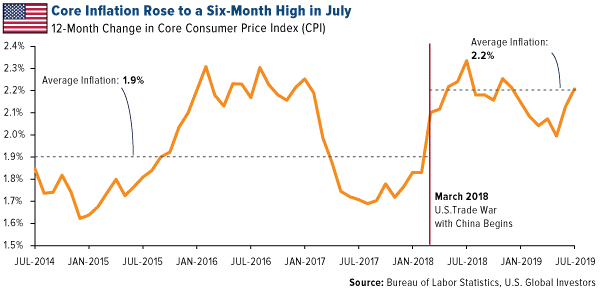

And yes, that includes trade tariffs. More than a year after the start of the U.S.-China trade war, we’re starting to see consumer prices increase. Tariffs are like taxes. Core inflation, which excludes food and energy, rose to a six-month high of 2.2 percent year-over-year in July. In the chart below, you can see that average inflation since the trade war started in March 2018 is higher than it was in the months prior.

This data becomes more tangible when you look at changes in price at specific stores. According to Gordon Haskett Research Advisers, a trip to Walmart or Target in June was nearly 5 percent more expensive than it was a year ago. That might not sound like much, but because of Walmart’s reputation of having low prices, even a slight bump up could be enough to prompt some shoppers to turn to deep-discount retailers like Dollar General, Gordon Haskett analysts say.

Pool of Negative-Yielding Debt Hits $16 Trillion

As I’ve pointed out before, inflation has been very constructive for the price of gold. With yields around the world falling deeper and deeper into negative territory, the yellow metal has hit new all-time highs in a number of currencies.

That includes the Canadian dollar, which is incredible news for the country’s massive metals and mining industry. Canada is the number five gold producer in the world behind the U.S., and nearly 60 percent of all global mining financings are done on either the Toronto Stock Exchange (TSX) or TSV Venture Exchange. In 2017, about 56 billion mining shares were traded in Canada, for a total value of C$206 billion. Last month, I highlighted several junior, mostly-Canadian miners that have made some monster moves lately thanks to higher metal prices in the local currency.

So will gold hit an all-time high in U.S. dollars? Already some analysts are making forecasts for $2,000 an ounce gold.

Speaking to CNBC last week, Daniel Ghali, a TD Securities commodities trader, said that as the pool of negative-yielding debt expands, “I could see a case for gold at $2,000.”

I could see this happening as well, especially if nominal Treasury yields turned negative. That’s no longer an absurd notion, says PIMCO’s global economic advisor, Joachim Fels. Last week former Federal Reserve Chairman Alan Greenspan echoed that sentiment, telling Bloomberg that there’s “no barrier for U.S. Treasury yields going below zero. Zero has no meaning, besides being a certain level.”

Municipal Bond Investors Won Big in Last Downturn

Besides gold, municipal bonds are highly sought by investors right now due to their history of steady performance in good as well as bad times. Look at the chart below. State and local debt was up in most years going back to 1981, when during recessional years. Over the past 38 years, munis have delivered an impressive average annual return of 6.8 percent.

It’s no surprise, then, that inflows into muni bond mutual funds have done so well this year.

Investments were up 58 percent in the week ended August 7, for the 31st straight week of positive flows, according to the Investment Company Institute (ICI). Year-to-date, investors have added a whopping $58.3 billion to funds that invest in munis. Remember to follow the money!

Curious to know what’s next for gold? Check out my latest video by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The S&P TSX Gold Index consists of 68 precious metal mining companies traded on the Toronto Stock Exchange (TSX). The S&P Municipal Bond State General Obligation Index includes bonds from the state-secured general obligation sector in the S&P Municipal Bond Index, a broad, market value-weighted index that seeks to measure the performance of the U.S. municipal bond market. The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. A bond’s credit quality is determined by private independent rating agencies such as Standard & Poor’s, Moody’s and Fitch. Credit quality designations range from high (AAA to AA) to medium (A to BBB) to low (BB, B, CCC, CC to C).

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 06/30/2019.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of