Gold Miners Lost Their Power: Bearish Scenario Confirmed

The market was up, but mining stocks chose to reverse. Meanwhile, gold sent a clear signal to investors. So, when everyone buys, what happens?

The gold mining stocks and silver mining stocks have reversed, even though gold didn’t. The top for the former is likely in.

Most developments regarding the precious metals and their immediate surroundings were a continuation of what we had seen in the previous days, but one thing was different. That one thing is particularly informative. It has trading implications, too.

Without further ado, let’s jump into mining stocks.

Gold miners fell. Even though they declined by just $0.06, it was profound. The miners were following gold higher during the early part of yesterday’s (Feb. 9) session, but they lost strength close to the middle thereof and were back down before the closing bell.

If the gold price reversed and then declined during the day, that would have been normal. However, gold stayed up.

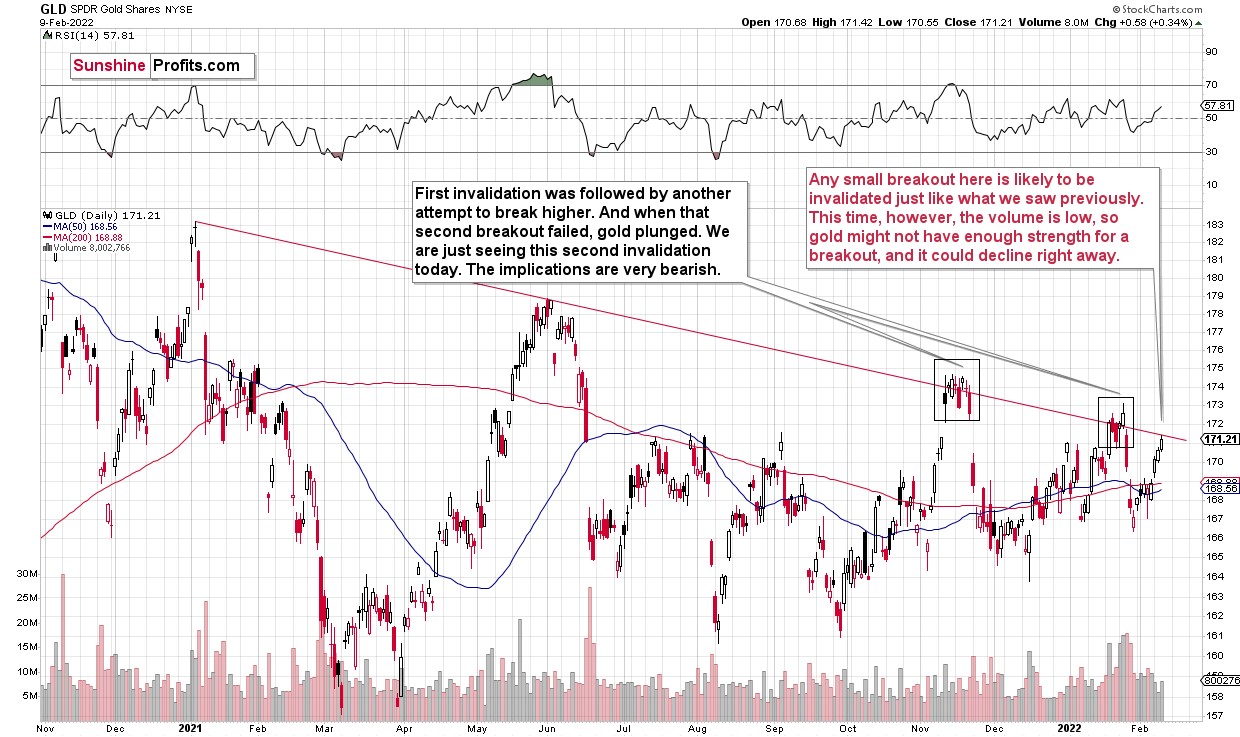

It’s fairer to compare GDX to GLD than to compare GDX to gold continuous futures contracts, as the former have the same closing hours, so let’s take a look at what GLD did yesterday.

There was no reversal. GLD simply stopped at its declining medium-term resistance line. Also, the general stock market was up yesterday. Consequently, gold mining stocks had no good reason to decline. In fact, they “should have” rallied. They didn’t – they reversed instead.

This tells us that the buying power has either dried up or is drying up.

When everyone who wanted to get into the market is already in it, the price can do only one thing (regardless of bullish factors) – fall. Those who are already in can then sell. Monitoring the markets for this kind of cross-sector performance is one of the more important gold trading tips.

Look, I’m not saying that declines now are “guaranteed”. There are no guarantees in the markets. There might be buyers that haven’t considered mining stocks that would now enter the market, but history tells us that this is unlikely. Instead, declines are very likely to follow.

Let’s focus on the GLD ETF chart one more time.

As I wrote earlier, it approached its declining medium-term resistance line. Any small breakout here is likely to be invalidated just like what we saw previously in November 2021 and January 2022. This time, however, the volume is low, so gold might not have enough strength for a breakout, and it could decline right away.

Junior mining stocks provide us with a perfect confirmation of the bearish narrative.

I emphasized before that juniors hadn’t moved above their 50-day moving average, and that they stayed below their rising blue resistance line. Consequently – I wrote – the downtrend in them remained clearly intact.

Yesterday’s reversal served as a perfect confirmation of the above. The previous breakdowns were verified in one of the most classic ways. The silver price has been quite strong recently, which is also something that we see close to the local tops.

The reversals in mining stocks, the situation in gold, AND the situation in the USD Index together paint a very bearish picture for the precious metals market in the short and medium term.

By “the situation in the USD Index”, I’m referring to the fact that it’s after its early-month reversal and right above its rising medium-term support line that was not successfully broken.

Since the USD Index remains above its rising medium-term support line, the trend remains up. Therefore, higher – not lower – USD Index values are to be expected.

All in all, it seems that gold, silver, and mining stocks are going to decline in the coming weeks (quite possibly days) and that we won’t have to wait too long for the next big decline to start.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*********

Przemyslaw Radomski,

Przemyslaw Radomski,