Gold & Silver Development Optionality Plays

- A list of gold and silver developers with large resources.

- Estimated valuations for each company on the list.

- Company descriptions from the GSD (GoldStockData) database.

- Optionality plays are one way to identify a good risk-reward opportunity.

- If gold & silver prices rise, then companies that have large resources in the ground become more valuable.

Disclaimer

Gold & silver mining stocks are for speculation only due to the high risk. Some of the information included is out of date and needs to be verified. Do not make the assumption that the data is accurate. Consider this article a starting point for your due diligence.

Introduction

An optionality play is a company that has a large amount of gold/silver in the ground that has never been developed into a mine. Ideally, you want to find large deposits that are highly undervalued compared to a company’s FD (fully diluted) market cap.

To avoid confusion, my list uses AUEQ (gold equivalent). I am using the current spot price and the number of AUEQ ounces a company has in the ground (Note that I have made AUEQ estimates for some companies, and I could be wrong). Then I compare that value to their FD market cap.

I am also estimating the in-situ value. In-situ is another term for how much AUEQ they have in the ground. For in-situ, I am using 10% of the deposit’s AUEQ value. Plus, I am using $100 AUEQ per oz for a second valuation.

There are many factors that skew the valuations of companies, so this is only meant to be a starting point for you to do your own DD. For instance, my AUEQ estimates can be off and will change in the future. The location of the projects and the quality of the management teams impact the value. And there are many other factors that come into play to value a company. One huge one is the ability to finance a project. If a company can’t finance the capex, then its valuation can languish.

I’ve always liked to find good optionality plays, especially for companies that could find more gold/silver through additional exploration. If you can buy AUEQ ounces in the ground for low valuations, then there is a good chance those ounces could be worth more in the future if gold/silver prices rise. Plus, as a company de-risks a project using a PEA, PFS, DFS, and permitting, the value of a company tends to rise.

While I like finding undervalued optionality plays, the risk level is quite high. In fact, you have to treat these as speculation bets and expect to lose money. In fact, I am underwater on quite a few of the stocks on this list. They might do well in the long term if gold/silver prices rise, but I might end up losing money on most of my optionality plays. That said, the potential for big returns is real. If gold/silver prices take off, there are not that many undeveloped projects with large resources. Demand for them should be significant.

Development Optionality Plays

(Sorted by Upside at $100 AUEQ Per oz.) (Click on the image for better detail).

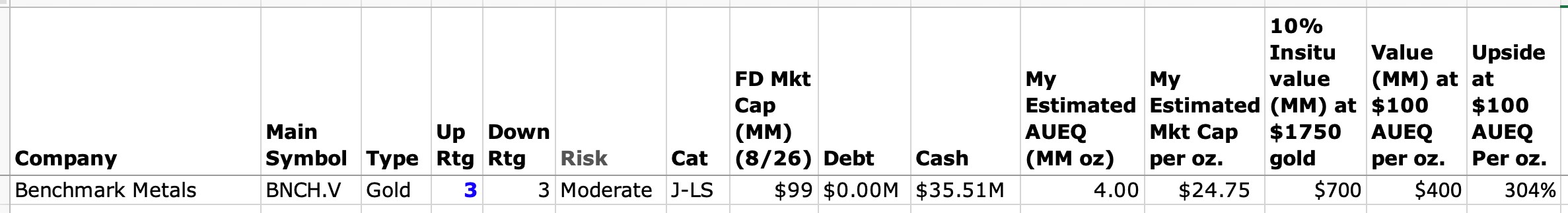

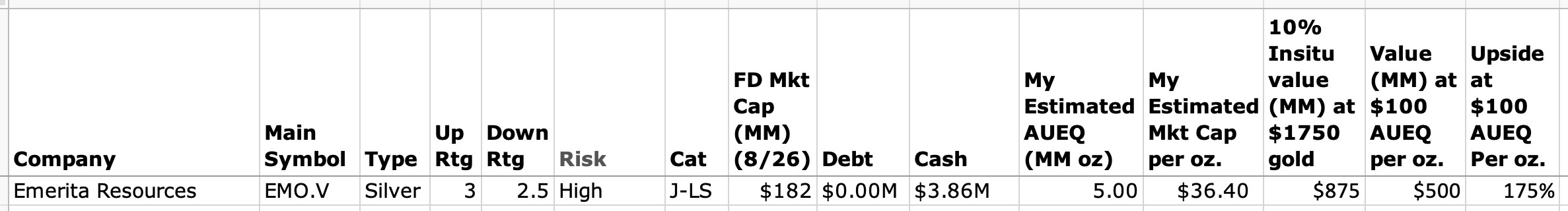

This list includes development companies that trade in North America and Australia. The Main Symbol is the exchange where they are based. V is the Canadian Venture in Toronto. AX is Australia. TO is Toronto. CN is the smaller exchange in Vancouver. Those without a suffix trade in New York.

The Risk column is somewhat of a misnomer. There are no moderate risk mining stocks. Consider High to mean very high and Moderate to be somewhat high.

The Cat column is for the category. J-LS stands for Late Stage Development. JS-NP stands for near-term producer. These are companies that are building their first mine. A near-term producer is within one year of production.

FD Mkt Cap (MM) stands for fully diluted market cap in the millions of dollars.

My Estimated AUEQ (MM oz) is my estimated gold equivalent in millions of ounces.

My Estimated Mkt Cap per oz is a calculation of the current FD market cap divided by the AUEQ ounces.

10% Insitu value (MM) at $1750 gold is a calculated value of the number of AUEQ ounces multiplied by $1750. This column is 10% of that total.

Value (MM) at $100 AUEQ per oz is a calculation using the number of AUEQ ounces and multiplying that by $100.

Upside at 10% Insitu is a calculation that compares the FD market cap to the 10% Insitu value.

Upside at $100 AUEQ Per oz is a calculation that compares the FD market cap to the value in the $100 AUEQ per oz column.

Okay, let me list each stock on the list in the same order as the list above. I will include the company description from the GSD database. Some of these descriptions are not recent, so keep that in mind. This list is only a starting point for you to do your own DD (Due Diligence).

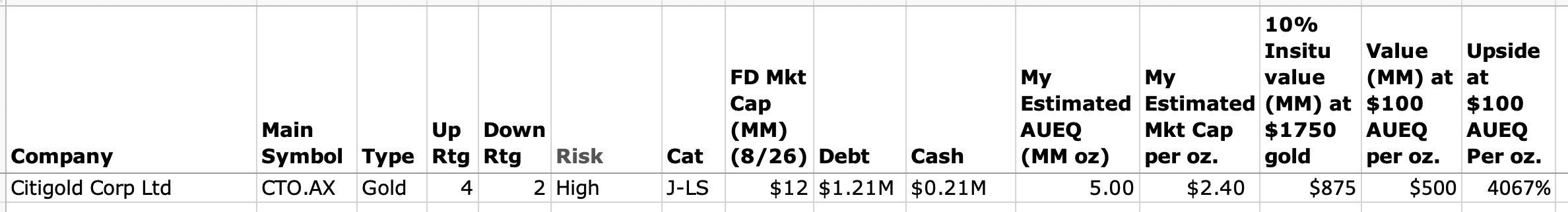

Citigold Corp

Citigold has 50 bagger potential at higher gold prices. They (claim to) have 14 million oz of gold at 14 gpt (nearly all inferred). Plus, they think they can find more ounces on their flagship Charters Towers mine in Australia. It is a past producing mine that requires an investment to lower costs. They have very little cash. This is a very high-risk speculation stock, but worth watching. This stock could be a 5 bagger very quickly if they get financing for the capex. It is permitted and shovel-ready.

Citigold has an FD market cap of $11 million, which is about $5 per oz for their future reserves. That makes it one of the cheapest gold stocks. Investors do not like the uncertainty. If you value this company at $2500 gold, it is extremely cheap. The long-term cash flow could be something like 100,000 oz x $1,000 = $100 million per year. That equates to a potential $1 billion market cap at higher gold prices.

It has several red flags. In 2015 made a deal with KIG to sell 60% of the project for $72 million. That was not exactly shareholder-friendly, although the deal did not close. Also, it has very ugly share dilution: 2.8 billion shares. It's trading at less than a penny. Plus, they are giving no guidance for the capex, production costs, or production oz at startup. This is odd, as it leaves investors in the dark. The only guidance they are giving is the goal to ramp up to 300,000 oz of low-cost production in 5 years.

Even with these red flags, it's worth watching with that much high-grade gold. Big, high-grade mines are very rare, and it could be very profitable. They think cash costs could be under $400 per oz using a mine optimizing investment. What's odd that is there is so little investor interest in this project even though it is big and economic and high grade. It's trading as if there is a legal issue, but I think this issue is management and uncertainty.

In a recent presentation, they said they need funding to begin producing, but they did not say how much. They also say they need to build a ramp, but do not say how long it will take. I think part of the lack of investor interest are the narrow veins, which adds risk. The recovery rates could be much less than anticipated. I've followed this stock for several years and management has not given very much guidance.

Note: Their OTC stock (Pink) in the US has very little volume, which adds risk. It's better to buy it on the ASX exchange.

8/23/2022: Citigold is ready for production (shovel ready). Citigold requires a $120M investment to be in full production. They are seeking either a JV partner to fund the capex, or a bank loan to fund the capex. A bank won't loan the money, so they are likely stuck waiting for a good JV deal.

Batero Gold

Batero Gold has a low-grade open pit project in Colombia. They have a 3 million oz resource (.6 gpt). Surprisingly Batero Gold has a low valuation of $7 million fully diluted. The stock has crashed 99% from $3.80 per share in 2011 to 5 cents today. Their Quinchia project has 3 deposits on 3,500 acres, and 8 drilling targets. They have about $3 million in cash and no debt. Expect share dilution soon.

The company presentation is from 2019, and is only 7 slides, which is not a good sign. The good news is that they updated the resource for the La Cumbre oxide deposit to 730,000 oz (at 1.5 gpt). It should have higher recovery rates and could be a good starter mine. The Dos Quebrada deposit is 950 meters long and growing. La Cumbra is 700 meters long and growing. El Centro is smaller but of significant size.

This could be a 25+ bagger if they develop and operate the property on their own, which is their intent. They released a PEA in 2013 and it was marginally economic, with an after-tax IRR of 21% at $1400 gold. The capex was $110 million. That's a high capex for only 55,000 oz of annual production. However, the PEA was based on only half of the deposit.

It has a tiny market cap versus its value. At $5 per oz for future reserves, that is about as cheap as you can get for 2 million oz of resources. If gold prices rise and they have exploration success, this stock is going to do incredibly well from this tiny valuation. It is being valued as if gold prices will never rise and they will not get financing. One of the best things about this stock is one family owns more than 50% of the shares. Thus, I do not expect them to sell the project.

There are red flags. It has low economics and a high capex for low production. Plus, management has not made much progress. The PEA was back in 2013 and they have not advanced to a PFS. There is still a lot of work to do, and production is at least 3 years away. Until management makes some progress and shows a path to production, this is a high-risk stock. The good news is that it is currently economic at $1800 gold and they can probably finance the project.

Eventually, they will have the motivation to build this mine, and if it gets built, the stock should take off. With their resources, they should be able to reach 75,000 oz of production. Plus, they have exploration potential. The big unknown is the location. Open pit mining is not always easy to permit in Colombia, due to environmental concerns.

There has been very little activity. They released an update in November 2021 and said they were working on the EIS and engineering scoping for an oxide heap-leach mine (those are not easy to permit in Colombia). They plan to update the PEA in 2022.

10/22/2021: NR (News Release)

Finalizing all studies required by the national environmental authority -ANLA- (National Ambiental License Authority) to acquire the environmental license.

SRK CONSULTING - PERU SA completed and delivered, to the Company's satisfaction, the engineering studies for the deposits of low-grade and sulphide stockpile located at Matecaa, as well as stockpile of oxide-transition material, leaching pad, processing plant, agglomeration plant and waste dump located in La Perla area.

Engineering studies for Deposits of organic and inert material, located at north of pit, was performed by R&DC-COLOMBIA, which developed Pit's Geotechnical stability and seismic risk studies as well.

Minnova Corp.

Minnova Corp (formerly Auriga Gold) is a potential producer if they can get financing. They need to raise $30 million to begin production approximately 12 months later. Minnova wants to begin production on their PL property (5,000 acres) in Manitoba, Canada, as soon as possible.

It is only a 600,000 oz (5 gpt) project, but they are going to initially produce 40,000 oz on the open pit (4 gpt), and another 10,000 (6 gpt) from the underground. Cash costs are projected to be about $700 per oz for the open pit (which is small) and $800 to $900 underground. The IRR is about 160% at $1500 gold. The NPV is $96 million at 5%.

They have another early exploration project in Peru (La Esperanza), but they are focused on PL.

Minnova has an FD market cap of only $5 million, and a good share structure of 51 million fully diluted shares. The problem is their balance sheet with is $1.6M in current deficit and $5m in total liabilities. This is a potential 10+ bagger if they can finance the mine, but that won't be easy. The red flag is the high capex versus the NPV, and a short mine life of 5 years.

A few positive notes: The location is excellent. The property is large with exploration potential. They think they can find at least 1 million oz, which will extend the mine life. They do not have much of a website, and I do not know when permitting will be completed.11/4/2021: Phone call with CEO.Potential loan coming in 2022 for $20 to $25 million. No hedging, no streaming required.

The capex is around $30 million. The mill is rated at 1000 tpd. It was only used for 1 year. They plan to begin at 600 tpd, which is around 50,000 oz per year at 6 gpt.

They will begin underground mining and then add open pit mining (probably an additional 10,000 to 20,000 oz per year.

Mineralization is open in 3 directions. Likely a 1 million oz deposit. Excellent grade at both surface and UG.

They still need to permit for open pit mining (they will file an amendment after they begin mining UG, which will only take a few months to achieve).

The CEO owns 10% and does not want to dilute his shares into the ground. But expect significant dilution to pay for the capex. At least 50%. The CEO wants to be patient to finance the capex the best way possible for shareholders.

They likely will do test mining and bulk sampling, which will cost around $5 million in 2022. This will likely be needed to get the larger loan and satisfy the bankers.

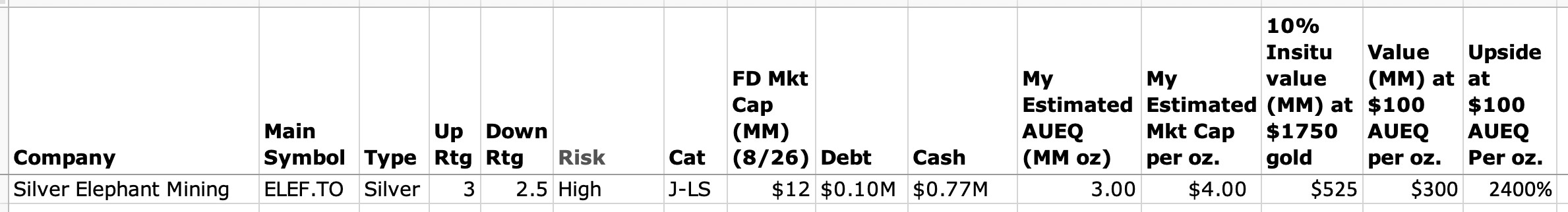

Silver Elephant Mining

Silver Elephant Mining (previously Prophecy Development) is a project generator focused in Bolivia. They have a large silver project called Pulacayo-Paco (8,000 acres). The good news is that it is a large project, the bad news is that it is in Bolivia, where investors could be timid to invest. They are drilling and think it could be a very large mine. In fact, they gave guidance of finding 300 million oz by 2022 (it did not happen), and it is currently only about 120 million oz (70 gpt).

Next to Pulacayo is another potential large discovery (Paca), which has 40 million oz (50 gpt). There are a lot of targets on both Pulacayo and Paco that need to be drilled, and the reason for their high expectations. Note that Pulacayo is a past-producing mine with a mill. It also has a feasibility study from 2012. The CEO thinks it could be permitted in 12 months if they decide to be a producer.

They recently acquired three more properties in Bolivia: Sunawayo (environmental permit is currently suspended) is 15,000 acres and Triunfo is 6,500 acres. Both are early exploration. Surface samples look really good and they plan to drill soon. The CEO is excited about these properties and thinks they could easily add another 100 million oz on top of the expected 300 million from Pulacayo and Paca. That kind of exploration potential makes Silver Elephant an exciting spec stock.

If you don’t mind the political risk of Bolivia and the assumed exploration expectations from their management, then this is a good spec stock. Two things that will help this stock are higher silver prices and good drill results, both of which are likely to happen. Also, large silver projects are rare, so they will get a lot of hype. Additionally, you can consider this an optionality play. Their silver in the ground is currently valued around 50 cents an ounce, plus they will find more.

My only concern is how they monetize their silver. If they do a JV or sell the project, then shareholders won’t get huge returns. I’m hoping the CEO realizes that silver prices are going higher and won’t give it away. He owns about 5% of the company that he paid $3 (CAD) and needs the share price to go higher for a big return. They did a 10 to 1 reverse split in 2022 and now will likely dilute shares to raise money to drill. It's always bad when an exploration stock does a reverse split. This will hurt investor sentiment with the stock. Plus, drill results in 2021 were not good.

3/30/2022: The CEO tweeted that they are working on permitting to begin production in Bolivia. We need to see a PEA.

Paramount Gold Nevada

Paramount Gold Nevada is developing two gold projects with 5 million oz. It was a spinout of Paramount Gold & Silver in 2015, which sold their San Miguel project. That left them with the Sleeper project in Nevada. Sleeper is very large with about 4 million oz, plus 35 million oz of silver (3 gpt). The problem is that it is low grade, and the recovery rates will be low for both. The economics are not great, with a 20% after-tax IRR at $1300 gold. The capex is $175 million to produce 100,000 oz annually, but production could increase. But it gets exciting at $1700 gold or higher. The IRR is 30% at $1500 gold.

Instead of waiting for higher gold prices to build Sleeper, they acquired Grassy Mountain in Oregon (1.1 million oz). They recently released a positive PFS with a 27% IRR, but the market has ignored it. They plan to mine the underground first at 50,000 oz (7 gpt) per year for 7 years. The cash costs are projected to be low at around $550 per oz. They are not giving guidance for when permitting will be completed, so it could require another 1-2 years. Once permitting is completed, they plan to finance and build the mine. I would expect the build to be around 1 year because the capex is only $100 million. I like $100 million projects because they are large enough to create cash flow and not too large to finance.

Their FD market cap is only $37 million, giving them 10+ bagger potential. Their future reserves are valued at about $12 per oz. Once investors realize what they have, it should quickly double in value. Insiders own about 30%, which should be enough to prevent a hostile takeover. Usually stocks this cheap with large resources get taken out. Let's hope that doesn't happen.

Once they get into production, they will begin to focus on advancing Sleeper. I think this stock is being overlooked. Their Grassy Mountain project has exploration potential to expand the mine life, plus Sleeper has exploration potential. Once they get some cash flow and become a producer, they are going to have significant growth potential.

Unigold Inc.

Unigold Inc has a large gold discovery in the Dominican Republic. Their Neita-Candelones property (50,000 acres) is approaching late stage development. They have already found 2.1 million oz (inferred) and have 25 more targets. It is both an open pit (2 million oz at 1.5 gpt) and underground (100,000 oz at 5 gpt).

They need to release a PEA (preliminary economic assessment), but have not given guidance for when it will be completed. Instead, they have decided to do a phase one, small open pit oxide project (120,000 oz). In 2022, the need to complete a feasibility study and permitting. It appears they don't have the cash, so expect more share dilution. The capex is $36 million for a 3-4 year mine life. Once it is up and running, they will focus on their flagship project.

We don’t yet know the capex for phase two, or how long until production. It’s basically the same open pit, so permitting should not be difficult. It’s not a stretch to think it could happen in four years. But first they need to get their oxide project into production.

Eric Sprott owns 12% and management 7%. They don’t want to give it away. If I was Eric Sprott, I would buy it today and take it private. It has an FD market cap of $10 million and a solid flagship project that is likely to grow in size. It makes no sense that this is cheap other than potential permitting issues in the Dominican Republic, which has not been mining friendly of late. Goldquest Mining has been having permit issues.

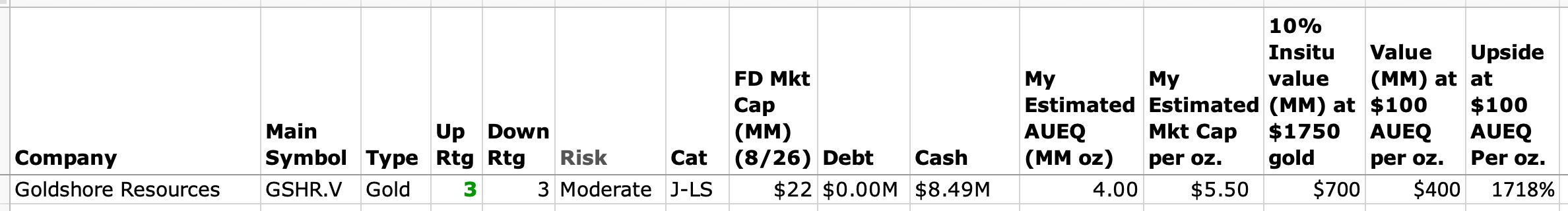

Goldshore Resources

Goldshore Resources is a new company formed in 2021. They acquired the Moss Lake project from Wesdome Mines, who accepted shares of Goldshore, and currently owns 27% of the company. Management owns another 11%, making it tightly held. They are cashed up with about $7 million and plan to drill 100,000 meters over 2021 and 2022. They also plan to update the historical PEA and resource in 2023. This is likely a 3 million oz open pit project. It currently has 1.5 million oz of M&I and 2.5 million oz of inferred at 1 gpt.

They plan to begin the permitting process in 2022, which should take at least 3 years, although it is a past producing mine, which should speed up the permit process. They are giving guidance of doing a PFS in 2023 and possibly a DFS in 2024 if the PFS is economic.

I like the low valuation, excellent location, and high insider ownership. But the length of time until first poor is a red flag. I would not expect production until 2026. However, at this crazy low valuation of $24 million, it will likely be a 10 bagger long before first pour.

Aftermath Silver

Aftermath Silver is a developer with two projects in Chile (Challacollo, Cachinal) and one in Peru (Berenguela). It’s an exciting company that is undervalued. The downside is that it is a long-term investment. They won’t be producing for at least 4 years, and perhaps 5 or 6. Usually, you want to avoid development stocks that are this far away from production, because dilution is inevitable and it will reduce your upside potential. But for Aftermath, you might make an exception because there are so few silver stocks this undervalued. I say it’s exciting because they have three projects with more than 175 million oz at around 100 gpt.

None of their projects have a PEA or 43-101. However, all of them have historic resources that are somewhat reliable. They plan to do a 43-101 for Challacollo and Berenguela in 2021. They are cashed up with about $8 million. So, we can count on those being completed. They plan on producing a pre-feasibility study for Berenguela within 36 months, so by 2024.

Berenguela was acquired from SSR Mining in 2020 for $13 million, plus a 1.5% NSR. They owe $12 million, which is due over 6 years. This will be their new focus. It’s a 125 million oz (90 gpt) open pit project. They will likely mine about 100 million oz, perhaps a bit less. So, that is a 4 million oz a year project. That project alone gives them 10 bagger potential. The low-grade could require $25 silver to get financed/built. But in a few years, I think that is likely.

Plus they have two smaller projects in Chile. Challacollo has 45 million oz at 150 gpt, and will be their second mine. That mine could add 2 million oz per year. Then they have Cachinal, which has another 20 million oz at 100 gpt. For Cachinal, it has a 5% NSR and they only own 80%. But that is their third mine.

Eric Sprott owns 20% of the company and likes their chances (that creates high insider ownership). Plus, they will likely have success with exploration and expand the size of their mines. If that happens, this stock will blast off. This is a legitimate 10+ bagger, although it is a long-term investment for big upside. Their CEO said that water could be a challenge for Berenguela, but they are confident it can be resolved.

Their stock has crashed 80% in the past year. That is a red flag. Perhaps Berenguela is in a bad location in Peru or has a water issue. Stocks usually don't crash that hard without an issue. Plus, the company presentation is 8-months old. That is also not a good sign.

6/11/2022: Sold Cachinal, which was their smallest project with only 20 million oz.

Intl. Tower Hill Mines

Intl. Tower Hill Mines (THM) has a monster project (Livengood) in Alaska with 16 million oz (.6 gpt) with an 80% recovery rate. It has a pre-feasibility study with a $1.8 billion capex to produce 350,000 oz for 23 years (8 million oz). Cash costs are about $900 per oz and all-in costs around $1400 per oz (free cash flow). The IRR is only about 1% at $1500 gold. The project probably needs at least $2000 gold to get financed and built.

THM has begun the permitting process, which will take another 4 to 5 years to complete. They plan to release an updated pre-feasibility study in 2022. I'm expecting the capex and operating costs to be higher than their 2017 pre-feasibility. The NPV is currently $5B at $2500 gold. Hopefully, that won't decrease.

I think this mine will get built, but once gold prices rise, a major will likely buy it. Thus, if you invest today, it will be a major that gets the reward and not the THM shareholders. The good news is that it can't get much cheaper than their current market cap. It's probably a good speculation stock to double or triple in value once gold prices rise.

The stock should begin to move around 2024 if investors are confident it will get permitted. Permitting should be completed around 2025 or 2026. The build is 2.5 years. The ugly part is the capex, and operating costs are likey to increase substantially between now and 2028. We no longer have any cost certainty.

Chesapeake Gold

Chesapeake Gold is developing a huge gold/silver/zinc project in Mexico. Metates has 18 million oz. of gold (.6 gpt), 500 million oz. of silver (15 gpt), and 4 billion lbs. of zinc. With AUEQ production potentially reaching 500,000 oz. per year, this could be one of the most profitable gold mines in the world (using silver and zinc for offsets). They currently have a $116 million market cap, which is only about $10 per oz counting only their gold. If you include their silver, it is much lower.

Metates will be built in phases because of the large size of the project. Phase 1 has a capex of approximately $360 million to produce 150,000 oz of AUEQ with cash costs around $700 per oz. It is economic at $1400 gold, and when they try to finance the capex in 2024, gold prices should be higher.

Here is the schedule:

2021: Heap leach and metallurgy testing (both of these could slip to 2023). Infill drilling.

2022: Complete heap leach testing and metallurgy. PFS.

2023: DFS.

2024: Permitting and financing.

2025: Construction.

2026: Production.

They have about $25 million in cash and no debt. Management and directors own approximately 20%, and long-term core shareholders own about 24%. Those 44% should be able to prevent a hostile takeover for a low premium. They are well-positioned to take it to production in 2026. Why sell today when free cash flow from the project could be more than $300 million per year for 20+ years at higher gold prices?

The red flag is their heap leach testing, which is a new technology that needs to prove itself during testing in 2021/2022. If successful, the stock should begin trending. If I was sure the heap leach will work on the gold sulfides, it would be a top pick.

Metates isn't all they have. Talaposa (Nevada) is a 1.5 million oz open pit project with exploration potential to increase in size (they are looking for offers and want to sell it). They also have 8 drill targets near Metates that are potential discoveries. They could easily have already found a second or third mine near Metates. Plus, they have another project (Tatatila) in Vera Cruz, Mexico that appears to be a discovery.

Revival Gold

Revival Gold is developing an open pit project in Idaho. Their Arnett - Beartrack project has 3 million oz (1 gpt). They are targeting restarting the mine in 2025, with a construction decision in 2023. They recently completed a PEA with a capex of $100 million to produce 72,000 oz annually. A PFS is due in Q4 2022, along with an updated resource.

About 800,000 oz (phase 1) of their 3 million oz have low recovery rate average of 60% (it probably will improve). The remaining oz’s have a high recovery rate at 94%. Cash costs are around $800 to $850 per oz. The economics aren’t great, with an after-tax IRR at 25% at $1550 gold. By 2024, I would expect gold above $1500, so the economics should be fine.

It is a large property (12,000 acres) with exploration potential. Recently that had a drill hole of 45 meters at 2.3 gpt. So, this mine should increase in size.

Management owns 11% and is motivated to build these two projects. I think they will become a 72,000 oz producer with all-in costs around $1350 per oz. That could make them a $500 million company at higher gold prices if they reach 1.5 million oz of reserves and gold prices take off. For this reason, it's not a bad speculation stock.

The red flags are the timeline until production (2025), dilution to finance development and the capex, and low recovery rates for the first 800,000 oz. Also, they will need to pay Yamana Gold about $20 million in 2024 ($6 per resource oz). I expect Yamana to accept shares instead of cash. On a positive note, I think they have a good management team with a good plan, and they have enough insiders to avoid a takeover.

They think this will grow to 4 million oz and 200,000 oz of production. They seem ripe to be taken out by a major. That's my concern. Projects this big and this cheap nearly always get taken out.

Their plan is to be a producer in 2025:

We currently have about 850,000 ounces of the 3 million ounces of resource in the first phase heap leach restart plan. The assumed recovery from this material is currently 60% as discussed below.

The balance of about 2.15 million ounces is mill material with an assumed 94% recovery (see Section 13.2.4.7 of the Beartrack-Arnett TR available here https://revival-gold.com/wp-content/uploads/2020/12/244670-0000-BA00-RPT...).

We are guiding to the completion of a PFS and a restart decision on the first phase heap leach by the end of 2022. At that point we will determine whether to proceed with the first phase heap leach (with its relatively short re-permitting and construction timelines and low capex) or pursue a more ambitious (albeit longer timeline) leach + mill scenario.

In the case where we simply go with the restart of heap leach operations, we would submit NEPA documentation and could be in position to commence construction in 2024. Construction is expected to take about a year. This scenario does not preclude a potential mill phase down the road.

5/16/2022: Updated resource to 4 million oz.

9/5/2022: PFS delayed until H2 2023. Ouch. Construction is not likely until 2024.

NorZinc Ltd

NorZinc Ltd (previously Canadian Zinc) has a zinc/silver/lead project (Prairie Creek) in the Northwest Territories. They are heading towards production, but still need financing ($368 million capex). They have a large zinc/silver deposit (75 million oz at 4 opt). Production will begin at 120 million lbs of zinc ($1.30 lb), 100 million lbs of lead ($1 lb), and 2.5 million oz of silver. So, it will begin as a base metals mine. Once silver reaches $60, the silver revenue would match the zinc revenue (unless zinc prices also increase).

The after-tax IRR is only 15% at $18 silver. I would not expect them to get financing until silver reaches at least $25. They already have zinc off-take agreements and are ready to begin construction. They might need a partner, but are giving guidance they are going it alone.

If they sell, they will crush their shareholders from all of the dilution required to develop the mine. The share price was over $1 in 2011. Today it is at 3 cents. How many shareholders bought above 10 cents? Quite a few. One shareholder holds 44% of the shares and is a fund. They likely need a much higher price to breakeven.

I like their potential to find more silver and increase production because very little drilling has been done on the Praire Creek property (20,000 acres and a 10-mile trend). They have a lot of high-grade zinc (9%) and lead (9%), which could make this a low-cost silver mine if silver prices ever blast off.

I'm projecting all-in costs of $10 per oz, which I think is conservative. Zinc and Lead combined sell for about $1 per lb. 220 million lbs x $1 = $220 million annually. Operating cash costs are projected to be less than $100 million the first 5 years, thus by-product silver cash costs should be very low.

My worry is they will sell the silver in a streaming deal to finance the capex and then focus on zinc production (they are talking to Sandstorm). The capex is high and they will be tempted to sell the silver in advance to finance the mine. That is my biggest concern. If they do a streaming deal, I will probably remove the stock from the database. If they don’t sell the silver, then will need to do a reverse split to dilute shares.

This stock is so cheap that it is better to wait and see how they finance the mine. If they don't do a silver stream to finance the capex, then it should triple in value very quickly once construction begins.

Permitting is completed. A feasibility study is due in 2022. They are planning to begin construction in 2023 (if they can get financing for the capex) with first pour at the end of 2024. Management thinks this is a base metals mine. 50% Zinc. 30% Lead. 20% Silver. They don't even split out the silver revenue. They think zinc/lead will have demand. I still think they will give away the silver in a stream to finance the capex. The CEO seems to be very bullish zinc and lead, and downplays the silver. At current prices, silver is 20% of revenue, but that could change quickly if silver takes off.

Integra Resources

Integra Resources is advancing the DeLamar project in Idaho. It is a 4 million oz resource (including silver), although it is low grade (.7 gpt). The good news is that it is economic, with about a 40% after-tax IRR at $1300 gold. The capex is $160 million to produce 120,000 oz annually (gold equivalent including silver). I would expect that total to rise a bit, perhaps to 200,000 oz. Cash costs will be around $800 per oz for gold equivalent. The mine won't get built until around 2026.

They are cashed up and are working on permitting and the PFS. The bad news is that insiders only own about 20% and can't prevent a takeover. They are even giving guidance that they are a takeover target. My expectation is that a mid-tier producer will take them out after it is permitted and it is de-risked (2023 to 2025). It's a past producing mine, so permitting should not be a problem. The PFS is due in 2022. I would expect permitting to require 2-3 more years. They are giving guidance for permitting to be completed in 2024. That means first pour in 2026. Ouch. That is a long wait.

If it had higher insiders, then I would like it a lot better. But, as a speculation stock, the downside appears to be limited. It could easily double in value as it gets closer to production. They are drilling 4 areas (DeLamar, Florida Mountain, War Eagle, Blacksheep) and could easily add more gold to their resources. I'm surprised it hasn't been taken out yet. This looks like a 5 million oz resource, which means potentially 300,000 oz of production. That's a $2 billion valuation at $2500 gold, when they could be taken out today for $220 million.

This is an excellent project in a good location. The problem is they will likely sell before they get to first pour, which is about 4 years away. So, investing and expecting a 5-bagger is a stretch. The more likely outcome is a 2-3 bagger.

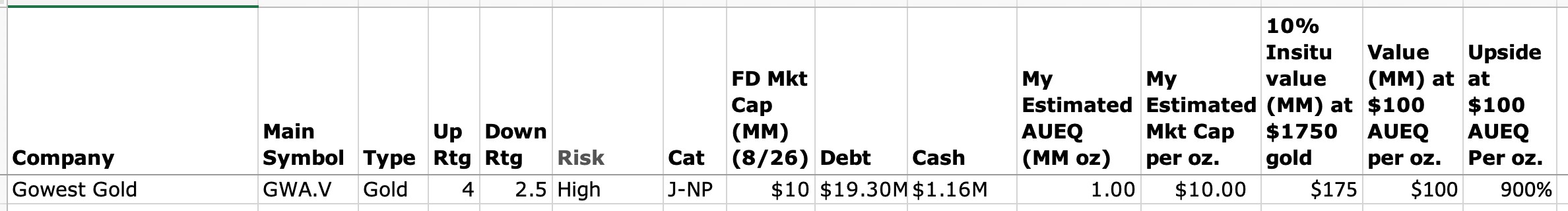

Gowest Gold

Gowest Gold is advancing to production in Canada. They only have one project (North Timmins), but it is large (27,000 acres) and has 15 targets. The Bradshaw deposit is a 1.2 million oz (6 gpt) resource that looks good. It is a high-grade surface and underground mine, where the grades are increasing at depth. The North Timmins property is located in the Timmins gold district in mining friendly Ontario, Canada. The after-tax IRR is 30% at $1300 gold, making it economic.

The PEA (preliminary economic assessment) called for 95,000 oz of annual production with a $60 million capex. They have reduced that to 50,000 oz (40,000 oz after the gold stream) at a $22 million capex. When they expand production to 90,000 oz (phase 2), this stock should do extremely well from their low valuation, although they will need to have exploration success to expand the mine life.

They are currently trying obtain financing for the phase 1 capex. They also need to fund debt on their balance sheet, with about $8 million due out of $16 million in debt. This debt overhang is part of the reason they have not been able to finance the capex. I would expect share dilution this year because of their debt issues which adds risk.

Gowest is very cheap, but management is not stellar. They have been consistently diluting shares (including a 10 to 1 reverse split in 2019). The share price recently crashed to a 5 year low at 11 cents. Today it is at 14 cents. Another red flag is they only have a 75% JV option on about 1/3 of their property (however, management said that this section is not a high priority target). They do have full ownership of the Bradshaw deposit.

If they can get financing and become a producer in Canada, the upside potential is significant. Then, if they can expand production, it could be a high flyer from this level.

8/26/2021: Hired a new CEO. He has operational experience. Hopefully, he will build and operate their mine.

1/24/2022: Raised $19M from a loan and share dilution.

7/4/2022: Looks like they have not paid their bills. They are being sued for $7M by a contractor:

https://ceo.ca/@newsfile/gowest-gold-announces-receipt-of-statement-of-c...

Spanish Mountain Gold

Spanish Mountain Gold has a large open-pit gold project in Canada (British Columbia). In 2021, they released a pre-feasibility, which increased the capex to $460 million, decreased cash costs to $550 (for the first 10 years), and decreased their after-tax IRR to around 15% at $1,300 gold. This project looks attractive at $1,700 or higher gold prices.

A feasibility study should be completed in 2022. Permitting will require 2-3 additional years after the feasibility is completed. So that means no production until 2026 or 2027. It has a high capex for only 150,000 oz. of production, which makes it more difficult to finance. However, at $1,700 gold, the payback can be faster, making financing possible.

They have an FD market cap of only $50 million, with future reserves valued at $12.50 per oz. As long as gold prices remain strong, the only risk to shareholders is if they sell the project for a small premium (losing our upside opportunity).

A takeover is a possibility because shareholders are unlikely to turn down a good offer (they never seem to). I think that a potential takeover is part of the reason the stock is so cheap. Investors are not interested in a small return for a high-risk stock.

This mine will be built in two or three phases, ramping up to full production. They have 4.7 million oz. of M&I resources, plus significant exploration potential. The main pit is still open in all directions and the nearby Phoenix zone has been drilled and appears to have a 3 km strike. Phase one only targets 2 million oz.

This is at least a 5 million oz. mine, and quite possibly larger. That means they will likely be ramping up to 250,000 oz of annual production. The grade will drop, and cash costs will rise as they expand production, but the leverage is huge at higher gold prices.

Management owns 20% of the shares, and I think they have other insiders. Otherwise, someone would have bought the mine already at this cheap price. Usually, highly undervalued projects like this get taken out by larger companies. Especially, once they get de-risked.

One red flag is more dilution for funding the feasibility study and permitting, plus financing the large capex. Dilution should reduce returns significantly. I have my doubts this is still a 10 bagger. The key is how long it will take to permit the project. Once it is permitted, it will rocket higher, as long as gold prices are above $1800.

Falco Resources

Falco Resources has a large gold project in Quebec on 175,000 acres. The Horne mine is a 5 million oz deposit at 1.4 gpt, with significant amounts of copper (260 million lbs) and zinc (1.2 billion lbs) for offsets. Revenue is projected at about 70% gold, 18% zinc, and 12% copper. Cash costs are projected to be under $500 per oz because of offsets. Cash costs are dependent on zinc and copper.

The project will also produce 1.5 million oz of silver annually. They sold their silver for $180 million to Osisko Royalty. They will have to produce the silver at a loss, which will reduce their all-in costs. They will get paid 20% of the silver spot price at a maximum of $6 per oz. When you do the math of how much Osisko will make off this loan if silver prices exceed $50, it becomes a very ugly deal. 25 million oz x $50 is more than $1 billion. What will be the silver price from 2025 to 2040?

The capex is larger than I would like at $850 million. That will be difficult to finance. They have $180 million from the silver stream loan, but the rest won't be easy to obtain. The after-tax IRR is only 15% at $1300 gold because of the high capex. They plan to produce 220,000 oz of gold annually for 15 years. That's not really enough for the capex.

Production at Horne stopped in 1976, but it still has significant infrastructure and should be easy to permit. They expect to complete permitting in 2022 and begin construction in 2023. The CEO is a proven mine builder and operator. What I like about this stock is their potential to find another mine on their 175,000 acres in a gold district that has produced 19 million oz in 14 mines. It's usually the second mine where you make your big returns.

There are a few red flags. First, they are a takeover target. I would expect a major to buy them out before first pour. Second, financing the capex needed to build the mine won't be easy to obtain with the low IRR. Banks might demand hedging and a gold stream. Third, potential share dilution to finance the mine. Fourth, their FD market cap valuation is only $85 million. What don't investors like? Management appears to be capable, although the silver streaming deal is noxious. Perhaps investors don't like the long wait until first pour or the high capex.

It's likely they will get taken out before first pour. These highly undervalued projects are nearly always taken out. However, they have enough insiders to prevent that, although Osisko Development currently owns about 25% of the company fully diluted. Perhaps they have eyes on the project?

1911 Gold

1911 Gold is a new company that was able to consolidate the Rice Lake properties (125,000 acres) in Manitoba. It includes the True North mine (1 million oz at 5.8 gpt) and 1200 tpd permitted mill. This was owned by San Gold, which was valued at over $1 billion in 2012, when it was producing 75,000 oz. Plus, the Ogama-Rockland property has 300,000 oz at 8 gpt.

The new owners have to be excited. They acquired it for a bargain price. They have no debt and only 70 million FD shares with a small FD market cap of $19 million. I'm not sure why investors dislike it so much. The mill alone is worth much more than their FD market cap.

Investors seem to be valuing it as an exploration company. However, I think it is a development company. The CEO was the CEO of Tahoe Resources and knows how to build and operate gold mines. He said that if he finds another 200,000 oz he will restart the mine. However, it will require about $30 million to refurbish the mill (that should be easy to finance at current gold prices). The True North mine is fully permitted.

They are currently cashed up with about $8 million and are drilling 4 target areas at Rice Lake (Tinney, Bidou, Wallace, and Curries Landing).

In addition to True North, they have two properties in Ontario (Tully and Denton-Keefer), both of which are early exploration. And they have significant exploration potential on their large Rice Lake property.

Fury Gold

Fury Gold Mines was created in October 2020 from the merger between Auryn Resources and Eastmain Resources. The combination creates the potential to develop three projects that have over 3.3 million oz (7 gpt), plus exploration opportunities (likely to grow to at least 5 million oz). They are calling themselves an exploration company, but I don’t believe them. It reminds me of First Mining Gold which acquired several advanced projects. Eventually, they picked one to develop because the market would not give them any value.

The red flag is that none of their projects is advanced, and all three need to be permitted. This will take about 4-5 years to become a producer. That is a long wait and will require a lot of share dilution. But, in the long term, the upside is significant. In fact, all three of their projects are worth their current market cap. So, you are basically getting two projects for free.

I expect them to find at least 5 million oz. With an FD market cap of $79 million, their gold in the ground is valued at $16 per oz. That makes them an excelled leverage play, even if they continue as an exploration company. They plan to drill aggressively in 2021 and probably will select which project to develop. Until then we will not have guidance for a timeline to production. All three projects are in good locations in Canada, although Committee Bay is in cold Nunavut.

Committee Bay has 1.2 million oz (7 gpt), Homestake Ridge in British Columbia has 1 million oz (7 gpt), and Eau Claire in Ontario has 1.2 million oz (7 gpt). I would expect them to build Eau Claire first, but that is just a guess. Eau Claire has a PEA to produce 80,000 oz annually with a $140 million capex.

In 2020, they released a PEA for Homestake Ridge. It has an $88 million capex to produce 45,000 oz per year. The IRR isn't great, at around 20% at $1300 gold, but I expect it to get built. The cash costs are low at around $500 to $600 per oz. If they can extend the mind life, then the IRR looks much better.

Committee Bay is in Nunavut, so I would expect that project to come last. If they build all three projects, production should be around 200,000 to 250,000 oz. But that would take at least 8 years, and perhaps longer. It's probably better to value it as a potential 150,000 oz producer within 6 years. This could also be viewed as an exploration/optionality play, because all three projects should grow in size.

They are in a difficult position because their strategy is not clarified. They want to be valued as an exploration company with 3.3 million oz's of high-grade gold in the ground and growing. However, the market won't give them that valuation. They think if they grow their resources to 5 million that their market cap will jump to $1 billion, but it won't. They will come to realize that they need to show a path to production. For this reason, investors aren't excited about this stock. My guess is that they will eventually sell one of their three projects and use the money to develop the other two.

12/6/2021: Sold their Homestake property to Dolly Varden for $50 million CAD, including $5 million in cash and the remainder in Dolly Varden shares.

Goldsource Mines

GoldSource Mines is advancing a gold project in Guyana (South America). They plan to produce around 70,000 oz annually. A PFS will be completed in 2022 or early 2023. Until then, it’s hard to guess their production and cost estimates. My guess is the capex will be around $150 million, with cash costs around $750 per oz.

If the PFS is solid, they will begin permitting in 2023, then do financing and construction in 2024. It’s a long wait until first pour, and the reason it is so cheap.

The Eagle Mountain has around 1.7 million oz (1.1 gpt) and should grow (12,500 acres) with exploration success. I have confidence they can develop Eagle Mountain. Plus, they recently had a new discovery hole of 123 meters at 1.9 gpt. They have been doing a lot of trenching that has returned good grades. There seems to be a lot of surface gold on their property.

Over 90% of their M&I resources is within 50 meters of surface. That will not be expensive to mine. I think this is a 2 million oz property. The key will be if they can make it to first pour without selling it to larger company? Once we get to mid-2023, it is going to look extremely cheap at its current valuation.

Guyana is mining-friendly, and perhaps the best place to mine in South America.

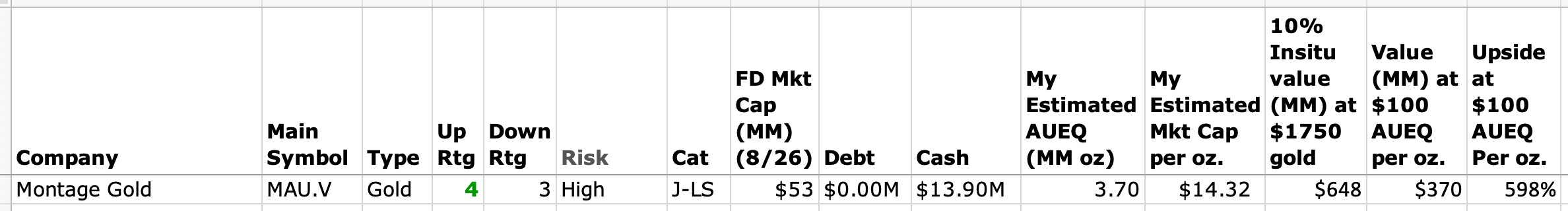

Montage Gold

Montage Gold is advancing a large open-pit project (Kone) in West Africa (Cote d’Ivoire). The project is on 350,000 acres and is already a 4 million oz deposit. It has various grades (.9 gpt to .5 gpt), so they will mine the high-grade portion first, with higher production for the first 3 years.

They released a PEA this year to produce an average of 200,000 oz a year with cash costs at $850 per oz. The Capex is high at $490 million. That might not be easy to finance and is probably the reason it has a low FD market cap of $57 million.

They are cashed up with about $14 million and plan to complete a feasibility study in Q1 2022 and permitting in Q2 2022. They could be ready to begin construction next year, which is amazing considering this is a relatively new company and new discovery.

They have a solid management team that came from Red Back Mining. They know how to build and operate mines. Everything looks pretty solid. They want to build this mine as fast as they can, with first pour around 2023. They also have two other either exploration properties: Korokaha (250,000 acres) and Bobosso (175,000 acres).

There is a lot to like about this company. I really don't see any red flags other than the high capex. Insiders own 45%, including 31% by Orca Gold. It’s not likely they will sell before first pour. A 200,000 oz producer is worth at least $1 billion with a large economic resource.

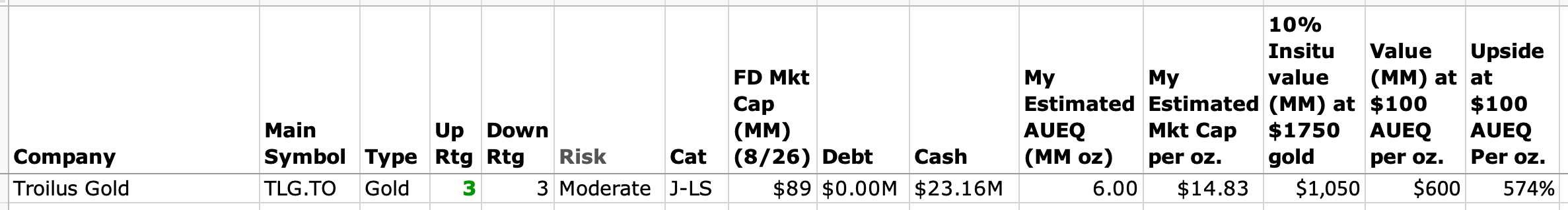

Troilus Gold

Troilus Gold is developing a large open pit mine (Troilus) in Quebec. The deposit is around 7 million oz (.7 gpt). However, about half of the resources are low-grade underground and might not be economic. The open pit is around 3.5 million oz. It relies on copper and silver offsets for its economics. The low grade is the reason for its low valuation, and the timeline until production (2025).

They released a PEA in 2020. The capex is $333 million to produce 250,000 annually for 10+ years (open pit). All-in costs per oz (breakeven) will be about $1300 per oz. The after-tax IRR is low at about 15% at $1300 gold. They probably will need $1600 gold to finance the capex. A pre-feasibility study will be out in 2022 and a feasibility study is also scheduled for 2022. EIS permitting in Quebec takes 12 to 36 months. My guess is that it will be completed by 2024. Hopefully, sometime in 2023, they will be ready to make a construction decision.

The mine is still growing in size and is a large property (250,000 acres). They have been drilling aggressively, and that will continue for several years. I expect production to increase over time. The only red flags are the need for high gold prices to build and operate the mine, the wait for first pour, share dilution, and being a takeout target. With an FD market cap of $172 million, it is cheap versus its upside potential.

Hycroft Mining

Hycroft Mining is the rebirth of Allied Nevada, which went bankrupt several years ago. They have expunged most of their debt, although they still have $146 million in debt. They have one of the largest gold/silver mines in the world. It’s about half gold revenue and half silver. With 15 million oz of gold and 600 million oz of silver. It is low grade for both gold (.35 gpt) and silver (10 gpt). We have no guidance on the expected recovery rates.

The current company presentation does not provide their plans. All we know is they have some gold/silver on their leach pads. What do they plan to do? I think they are working on a PFS, but they don't mention it in the company presentation. The CEO said they have given up on sulphide heap leach technology and will focus on using a mill for their sulphide ore.

The location of the Hycroft mine is in Nevada in a good location. I think one of the majors could make an offer, although insiders own 36%. They are not likely to let it go for a low premium, especially Eric Sprott who owns 12%.

In 2020, they replaced the executive team (CEO, CFO, COO) and hired a new general manager for mining operations. Their weakness is their board, with the chairman from Mudrick Capital, who is not a miner. Plus, the board seems to be overweight finance people. I found it odd that the company presentation is lacking guidance and had too much information on exploration. Who cares about exploration when you have a HUGE resource? It felt like a salesman wrote it.

The stock crashed from $15.82 in August 2020 down to 29 cents in 2022, without any share dilution. That shows that investors are extremely concerned with management. It appeared to be heading to bankruptcy, and then AMC and Eric Sprott both injected money. They have refinanced their debt, with no principal payments due until 2027. The red flags are their debt, expected dilution, management, lack of guidance for production, costs, and capex. There are a lot of unknowns, but higher gold/silver prices solve all of those issues.

7/18/2022: Gave guidance that they plan to drill. They are also working on scoping of a sulphide mill, but have not provided the capex or timeline until completion.

Treasury Metals

Treasury Metals is advancing a gold project (Goliath) in Ontario, Canada. It is both an open pit and an underground project. It has two main deposits (Goliath and Goldlund). Their combined resources are around 3 million oz, and they are likely to find more. I am only valuing them as a 100,000 oz producer, which is conservative. Production will begin at around 88,000 oz in 2025.

The capex is $233 million with $700 cash costs. I would expect the cash costs to increase by first pour, and the capex is likely to also increase. They are hoping to complete the Goliath deposit permits in 2023, with construction to begin shortly after, with production in 2025.

They expect to complete the Goldlund permits in 2024, and production about a year after. So, after the Goliath deposit gets into production, they have a nice pipeline, along with exploration potential.

Goliath is a large property (12,000 acres) with exploration potential and the deposit is open at depth. I would expect them to extend the mine life to at least 15 years. The CEO is confident they will find at least 2 million oz at Goliath and thinks the property could contain 3 or 4 million oz. The management team is optimistic that they will increase production from exploration success.

Goldlund is also large (70,000 acres) with exploration potential. Between the two, I’m sure they are targeting at least 3 million oz of reserves and probably much more. This creates growth opportunity for Treasury in the long term. The problem is first pour is not until 2025. That is a long wait.

Maritime Resources

Maritime Resources has a past producing property (Green Bay) in Newfoundland (2000 to 2004). It is about 1 year away from restarting production with financing. They completed a PFS in 2017, and it is economic with about a 35% after-tax IRR at $1300 gold, with cash costs only $500 to $600 per oz. The capex is only $57 million to produce 60,000 oz annually. A feasibility study and permits are due in 2022. Production is likely in 2023.

It is two deposits: Hammerdown and Orion. They plan to begin production at Hammerdown for the first 5 years and then expand to Orion. The resource is 1 million oz at 6 gpt (500,000 oz M&I). That's a pretty good starter mine. It's on 12,000 acres, so they could extend the mine life with exploration success. Drill results have been excellent at Orion (4 meters at 26 gpt near surface). I don't know why investors hate it, with the FD market cap at only $26 million.

They recently added another larger property next to Green Bay called Whisker Valley (50,000 acres). This gives them significant exploration potential to extend the mine life. I like their chances. Anaconda Mining tried a hostile takeover in 2018 and failed due to high insider ownership (40%). I think this is a good sign of management's commitment to shareholders.

The one red flag is their high share dilution and low share price. To build the mine, you can expect them to dilute about $20 million in shares. That's about 100 million shares if their share price does not rise. Plus, companies tend to want a bit extra cash as a backup, which could be another 50 million shares. That's a lot of potential dilution. The good news is they are finding gold. If they can double their resources, the dilution won't matter.

Moneta Gold

Moneta Gold (previously Moneta Porcupine) in 2021 acquired the Garrison project from O3 Mining, which obtained 25% of Moneta’s shares. It is next to their Golden Hwy project in Ontario. Combined, the projects will have 5.5 million oz (.9 gpt) surface gold and 2.7 million oz (4 gpt) underground.

What is 8 million oz of gold worth in Canada at $2500 gold? A lot. That is why they did the acquisition. They plan to drill 40,000 meters in 2021 and release an updated PEA in H1 2022. Then begin a pre-feasibility study in 2022, followed by a feasibility study in 2023. My guess is construction could begin in 2025. So, it's a long wait for first pour. And, as usual, they will likely sell it before first pour. So, shareholders will pay for development, and then a larger company will get it for a small premium. When does this death cycle for shareholders end?

The CEO is a CPA. The board is two geologists, two CPAs, and a CFA. My expectation is for them to sell or option it. It’s possible they will attempt to build the mine, but that is not usually what happens for projects of this size. It might be a good optionality play, although I think they will accept the first good offer they receive.

If you value the company at $100 per oz (why would they sell it for less?), that is $800 million, which is about what an exploration company can expect. However, as a producer, that much gold could easily be worth $500 per oz at $2500 gold, or $4 billion. The vultures will be circling once we are over $2000 gold and the economics look very strong.

9/7/2022: PEA released. $520M capex to produce 250K oz for 15+ years at $900 cash costs, 31% after-tax IRR at $1600 gold. No guidance for PFS. They plan to drill in 2023. I think the project is too big for them. They are stuck and must sell for a bargain price or wait.

Osino Resources

Osino Resources is developing its first mine (Twin Hills) in Namibia (South Africa). It is on a large property with many drill targets. The deposit is 3 million oz (1 gpt) and growing in size.

They completed a PEA in 2021. The capex is $200M, which is a bit high, but they will likely increase production. Initial production is 125,000 oz for the first 3 years. It is forecast to drop in year 4, but I don’t think it will.

They plan to complete a feasibility study in 2022 and are cashed up with about $8 million. They plan to complete permitting in 2022 and then likely begin construction in either 2022 or 2023. I would expect at least one more financing before funding the capex. Share dilution is low and unlikely to get high before first pour.

It’s a good management team that used to run Auryx Gold before it was acquired by B2Gold. They have 10 properties in Namibia (over 1 million acres) and are likely to find a few more mines. The upside looks good. Insiders own about 32% of the company, including around 15% by Ross Beaty. While Namibia is in South Africa, the population is only 2.5 million and they have a democracy. They do not have any political issues at the moment and appear to be mining-friendly, with 25% of their GDP via mining.

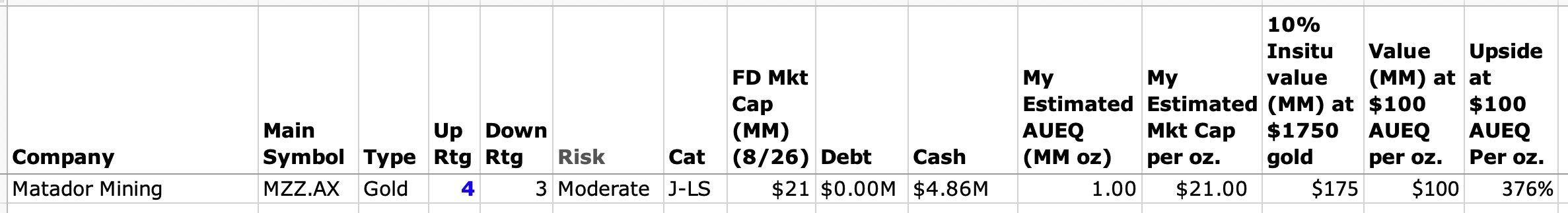

Matador Mining

Matador Mining is advancing a gold project in Canada (Newfoundland). Their Cape Ray project is solid. They have a PEA to begin mining 80,000 annually with cash costs of only $700 per oz. It’s a high-grade open pit at 2 gpt. That’s an excellent grade. Plus, they have a 50-kilometer strike to explore, with 50 identified drill targets. They are likely to grow their resources substantially.

The bad news is the time required to complete permitting. They will submit their EIS in 2022. After that, it will take about 18-24 months to be approved. My guess is that it could be construction-ready in 2024, but might slip to 2025.

Management is very strong. The CEO ran Gold Road and DRDGold successfully. He knows how to build mines and how to explore. I think he will find a lot more gold on Cape Ray and build the mine to hit their cost targets. I expect their resources to increase and production to increase.

I like Newfoundland, which I think provides a premium for investors. I like the low cash costs. But it is always risky investing in development projects with first pour more than 3 years away. But that is why it is so cheap and prints as a 10+ bagger at $2500 gold.

One thing that is strange and seems to be hurting their valuation is the stock does not trade in Canada. It's an Australian company with its main exchange in Australia and it also trades OTC.

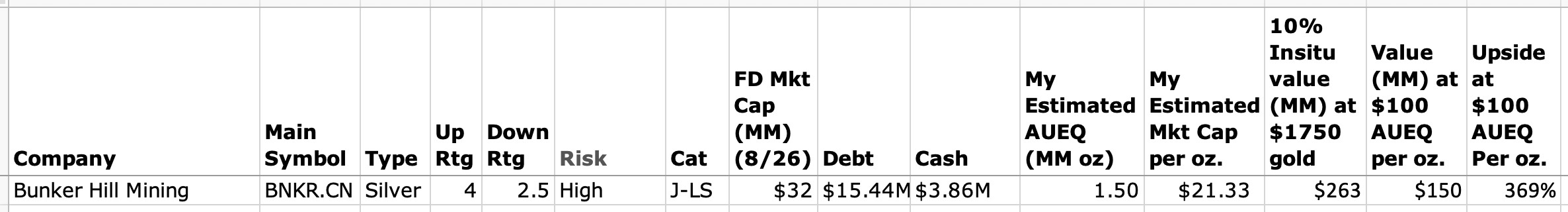

Bunker Hill Mining

Bunker Hill Mining (previously Liberty Silver) began trading in 2017. They have done a good job progressing with their plans to return the Bunker Hill mine in Idaho back to production. They have raised $50 million in debt, and the rebuild is underway. The mine is scheduled to return to production in H2 2023.

Investors are not excited, giving them only a $37 million FD market cap. If they can hit their target of H2 2023 production and not go too far over budget, they could be a highflyer. But the risk is substantial. They need silver prices to rise and They need them to hit their targets. I expect capex overruns and share dilution, but if they only need to raise another $15 million or so, and silver prices rise, they should be fine.

They think they can find 150 million oz (10+ opt) AGEQ, including lead and zinc. If they find half that much, this stock is undervalued. Note that there was a study done in 1991 that identified 59 million oz (11 opt) AGEQ of reserves. The mine has 160 kilometers of tunnels, 28 levels, and 40 known ore bodies. It was last mined in 1981.

They have to pay the EPA $19 million over 7 years. Some of that money will likely come from share dilution unless silver prices rise. The good news is they own 100% of the mine, and I don’t think there is an NSR. Also, the location is ideal, in a large mining district in Idaho. Overall, it looks like a pretty good spec stock at its current $37 million FD market cap. It would be a top pick, but there are a lot of unknowns, and management is a question mark.

First Mining Gold

First Mining Gold was started as a new company in 2014 by Keith Neumeyer the CEO of First Majestic Silver. His goal was to grow the company by creating a mineral bank of properties. However, in 2017, he hired a CEO (Jeff Swinoga) to develop their properties.

They are advancing their flagship project (Springpole) to production in 2025. The capex is $720 million to produce 350,000 oz annually ($650 cash costs). A pre-feasibility is due in 2021. A feasibility is due in 2022. Then permitting is due in 2023. The NPV is $1.6 billion and will increase at higher gold prices.

They recently sold their Goldlund project for shares of Treasury Metals (15%), plus a 1.5% NSR. They also did a JV for their Pickle Crow project and kept 20% and received 15% shares of Auteco. And they did a JV for their Hope Brooke project and kept 20% and received 13% shares of Big Ridge. Plus, they have 20 royalties. None of these push up their valuation, which is entirely based on Springpole. I'm hoping they sell them to finance the capex.

They have $31 million in cash but will need to dilute next year for the feasibility study and permitting. Plus, they will need to dilute to pay for the $720 million capex. So, expect a significant reverse split. Probably 10 to 1. I expect them to also do a silver stream, which will increase their cash costs.

This stock is cheap considering what they own. All of their projects are in good locations in Canada (Ontario, Quebec, and Newfoundland). Plus, they have excellent exploration potential and a good management team. It all adds up to a good risk/reward play.

Their red flags are high share dilution, the high capex of Springpole, the length of time until production (about 3 years), and potential permitting risk at Springpole. Plus, they will be a takeover target for any company looking to grow via acquisition. That would be ugly for shareholders, who need to see first pour for a big payoff.

Bonterra Resources

BonTerra Resources is trying to become a mid-tier producer in Canada. They acquired Metanor Resources in 2018 and now have aggressive plans to become a mid-tier producer in 2024. They have 3 properties with a combined 3 million oz and a mill in Quebec. They have 4 drills turning and expect to expand their resources at Barry (1.4 million oz at 5 gpt) and Gladiator (1.4 million oz at 8 gpt).

Then they plan to develop 3 deposits (and expand the mill from 800 tpd to 2400 tpd): Barry, Moroy, and Gladiator to produce 190,000 oz annually. That seems very aggressive. I'm only valuing them as a 125,000 oz producer because their guidance is not clear. But they have 4 drills turning, and a new resource estimate will be out in 2022-23. It might increase to 3.5 million oz. They will need to spend additional capex to expand production. I'm not sure what production will begin in 2024.

If they can produce 150,000 oz annually at $800 per oz cash costs (that is below their PEA forecast) in Quebec, this is going to be a very valuable company. Of course, they will need to expand their resources to get investors' attention. Plus, we have to wait until 2024 for production.

I like their potential, and think it is highly undervalued. I’m not sure why investors don’t like it, but I do. I like the location, exploration potential, management, and project. I don’t see any red flags, other than the long wait to first pour. If gold goes higher, this should be a 5 bagger. They have strong insiders, including Eric Sprott and Kirkland Lake.

9/7/2022: Made the decision to place the underground infrastructure at the Bachelor-Moroy deposit (only 150,000 oz) on long-term care and maintenance will reduce the annual maintenance costs by at least $3 million/year.

Wallbridge Mining

Wallbridge Mining is advancing a high-grade gold project (Fenelon) in Quebec. They had an FD market cap of $20 million in 2018 and then it exploded to $139 million in 2019 from high-grade drill results. Today, after their acquisition with Balmoral Resources, it is up to $256 million. They are trying to leap from being a small exploration company to becoming a significant mid-tier producer in a few years.

The Balmoral property overlaps Fenelon and increases the size of Fenelon to 200,000 acres (50-mile trend). Fenelon now has 6 discovery areas (Fenelon, Tabasco/Area51, Ripley, Martiniere, Rambo, and Lynx). These combined areas should find around 4 to 5 million oz of high-grade gold. Eric Sprott thought that Wallbridge's original property could find 4 million oz. He owns 20% of the company. Balmoral's management thought their property could also find 4 million oz. So, combined, the potential is very high. 8 million oz seems like a stretch, but perhaps 5 million oz is a good estimate for the long term.

This is a pricey stock based on their current resources, which are about 3 million oz. So, it's really a drill story, and its value is based on exploration success. Unless they can double their resources, investors will probably be disappointed. If they can find 5 million oz and produce 250,000 oz annually, that would make them a valuable company.

They are cashed up and plan to drill 170,000 meters in 2022 (which is what they drilled in 2021). This is a very aggressive company. They plan to begin a PEA in 2023 after they analyze the drill results. Perhaps a PFS in 2024?

Perpetua Resources

Perpetua Resources (formerly Midas Gold) has a very large gold project in Idaho that is heading to production around 2027. Stibnite is a 6.8 million oz resource (1.6 gpt) that is growing in size and has significant exploration potential. They have an FD market cap of $269 million, and the project will produce 400,000 oz of gold at low cash costs (years 2-8). The low cash costs (around $600 per oz) are from offsets in silver and antimony (used in batteries and flame retardants).

Production is forecasted to drop to 300,000 oz in years 9-14, and cash costs will increase, but with exploration success, that production drop likely won’t happen. They already have 4.8 million oz of reserves. This is likely to increase by at least 2 million oz.

It's possible that Midas could maintain production at 400,000 oz for 15 years. Also, they could take that cash flow and buy another mine to grow the company. Thus, the upside potential is significant. However, it is a long time until first pour and they could get taken out. Plus, they have to finance the huge capex, which will create significant dilution.

There are significant red flags: 1) They need to get financing without substantially diluting the stock or hedging profit. 2) They need higher gold prices to finance such a large project. 3) Permits will take at least 2-3 more years. 4) They need to avoid a takeover, which won't be easy, because big profitable mines tend to get taken out for low premiums.

This mine won’t begin construction until at least 2024, so the timeline risk is significant (it's a 3-year build). If they were further along in mine development, with permitting and financing completed, I would like the stock a lot better. That said, it is an economic project at low gold prices and will get built.

They have about 50% insiders, which should prevent a hostile takeover. John Paulson owns 39%, and won't give it away for a low valuation.

Note: Permitting could be an issue. They are being sued by a native tribe over environmental issues impacting local rivers near their proposed mine.

4/13/2022: From their IR: Our current timeline (to production) assumes a construction period of about 3 years following a final Record of Decision late next year. That puts us on track for first production in 2027.

Benchmark Metals

Benchmark Metals is advancing a large gold mine (Lawyer) in the Golden Triangle (British Columbia). The initial resource was released in 2021 at 3 million oz (1.5 gpt). They are targeting 5 million oz and might get there. I am valuing them at 3.5 million oz of future reserves.

The exploration potential looks very good. They have several target areas that are ready to be drilled. If they exceed my target of 3.5 million oz of reserves, then it is still cheap.

Investors like it, giving them a $240 million FD market cap. They plan to release a PEA and feasibility study in 2022. The unknown is how long it will take to complete permitting. My guess is 2023 or 2024. So, that will delay first pour for several years. If it was closer to production, I would like it a lot better.

Eric Sprott owns about 20%. Management also has a large position around 15%. They are cashed up with about $30 million and are financed to take it to a construction-ready phase.

Discovery Silver

Discovery Silver is advancing a large silver project (Cordero) in Mexico. Cordero has about 1.5 billion oz. of AGEQ (60 gpt), with significant offsets of lead, zinc, and gold. They are focusing on higher grades to improve the economics (about 500 million oz. at 90 gpt AGEQ).

They released a PEA in 2021. They plan to mine 25 million oz. (AGEQ) annually at around 100 gpt (AGEQ), with an AISC around $13 (this will increase by the time they get to production). This is their starting pit, and production will likely increase.

The economics are surprisingly good for their low grade. The after-tax IRR is 38% at $22 silver. As long as silver prices are above $25, I think it can get financed. The payback is less than 2 years. Because of their high production, Cordero has huge leverage as silver prices rise. If silver is over $30, the payback period is only 1 year.

They have been finding higher grades and new discoveries on Cordero's large property (85,000 acres). They drilled 50,000 meters in 2021, which has not been added to the PEA. Recent drill results have been excellent.

They plan to do a PFS (pre-feasibility study) in 2022 and an FS (feasibility study) in 2023. They will also be permitting in 2022-23. We could have a construction decision as early as next year.

The management team appears to be competent and ready to build the mine. They have 35% insiders, with management and founders owning 10% of the shares and Eric Sprott with 25%. I don’t think they will sell early and want to take this to production.

If we assume silver reaches $75, they could expand production to mine 1+ billion oz. Annual production could be massive. Let's assume they reach 35 million oz. of AGEQ annual production. That would generate free cash flow of around $1.5 billion per year. Using a 10x multiplier, that values the company at $15 billion. So, you can see how much leverage they have to higher silver prices.

AbraSilver Resources

Abrasilver Resources (previously Abraplata Resources) is advancing a large silver/gold project in Argentina. They obtained the Diablillos project from Silver Standard (now SSR Mining). They paid cash (plus $7 million is still due in 2025), and they gave SSR Mining shares (currently 9% ownership) and a 1% NSR to obtain 100%. Diablillos is an 80 million oz (90 gpt) silver deposit with 750,000 oz (.8 gpt) of gold. That is 140 million oz of silver equivalent. Plus, recent exploration has shown that the resource is going to grow in size.

They released an updated PEA in 2021. The capex is $255 million to produce an average of 8.5 million oz (AGEQ) annually over 16 years. The after-tax IRR is 20% at $20 silver. They will likely need $25 silver to finance it. They plan to release a feasibility study and complete permitting in 2023. Thus, construction could begin in 2023 or 2024. Note that the first 5 years of production will average 12 million oz (AGEQ) at higher grades and lower costs ($11 AISC per oz). They are going to mine the high grade first for a quick payback.

They also have two copper/gold projects in Argentina, and they are seeking JV partners for both. Their focus appears is on Diablillos. Insiders own about 30% (SSR Mining 9%, Eric Sprott 15%, Mgt 3%), so I would not expect them to sell the project for a small premium. Their AGEQ silver in the ground is still cheap. Is this a good optionality play? Perhaps. It's a very valuable mine at higher silver prices.

The red flags are high share dilution and if they decide to sell. However, if they build it themselves, it's still cheap. I expect them to get taken out once silver is above $30. Large silver mines are rare. The one thing that might prevent a takeover is the currency controls in Argentina, which act as a high tax. Companies might want to avoid Argentina.

I listened to a podcast with the CEO and they seem to be thinking about advancing this to production. If that occurs, their upside is much higher. They want to get to a construction decision by the end of 2022 (likely to slip to 2023). They are giving three options: Sell, Option, Develop. The odds favor selling because they are open to that option and I'm sure they will get good offers if silver is over $30. Their future FCF at $100 silver is more than double their current FD market cap.

8/19/2022: Eric Sprott position up to 13%.

8/22/2022: I interviewed the CEO and lead geologist today. After the interview was over, I found out that they only have 6 employees. Plus, the CEO's expertise is M&A. He loves making deals. He has never built a mine. I'm 99% convinced they plan to sell in 2024 after it is fully de-risked with a DFS. I expect the PFS to increase the NAV and annual production, with a much higher capex. That will be another reason this small team won't build this mine.

8/25/2022: Email from Abra: Regarding a construction decision, of course, it is necessary to determine the ultimatum size of the project prior to finalizing permitting and commencing construction. At the moment, we expect a construction decision to be announced sometime in 2024, at which stage we’ll have a much better understanding of the ultimate size potential of Diablillos. At that time, we will determine the optimum way of financing the project in order to maximize value to our shareholders.

Emerita Resources

Emerita Resources has a large historical resource (Aznalcollar) in Spain. It is 70 million tons at 60 gpt, plus high grade zinc and lead. It is likely an economic mine. Eric Sprott recently invested and owns 10% of the shares, plus 14% on a diluted basis. It looks exciting, although not cheap with an FD market cap of $276 million. They call themselves a zinc mining company, but that might change with higher silver prices.

I'm assuming they will get ownership of Aznacollar, but it is currently tied up in a legal battle. They appear to be winning, but these things are never guaranteed.

They also have three other discoveries (Romanera, La Infanta, and Cura) on their IBW project. It has a 35 million ton historical resource. The grade is about 44 gpt, but with high-grade zinc, which makes it significant as an optionality play. These two projects could make Emerita one of the premier silver miners in Europe. However, are they an explorer or developer? I'm not sure, but I think explorer.

They are low on cash, so expect share dilution. This is really a base metals drill story, but their resources could get a lot larger in size. Management thinks there is substantial exploration potential at depth.

6/20/2021: An analyst gave them a $3.30 target. I did some research, and they have big upside potential. They are a developer. Just the Aznalcollar High-Grade Pyritic Complex (43 million tons at $284 revenue per ton) = $12 billion in potential revenue. 3.3% ZN, 1 gpt AU, 67 gpt AG, .44 CU, 1.7% PB. Plus, several other deposits.

7/7/2021: According to the link below, the CEO claim they have 400 million oz of silver. However, all I can find on their website is 100 million tons of historical at under 2 opt.

https://ceo.ca/@Drjimjones/400-million-ozs-of-silveremerita-resources-st...

7/24/2021: I did a youtube video with Doc Jones. Here is the link: https://youtu.be/NlxV9KUBDZc

And here are my comments from the interview: