Gold: Back to the Past

As the world transitions from a bi-polar to a multi-polar one, Europe is experiencing a brutal crossborder conflict, the financial markets are in disarray, and the two superpowers are engaged in a new cold war. Fracturing the world’s alliances and echoing the beggar-thy-neighbour protectionist past of the Great Depression, countries have become insular led by the United States with trade barriers, guardrails and nationalistic policies dividing the world. Globalization which once allowed easier access to food, energy and decades of prosperity has been replaced by a new reality of deglobalization, reinforcing the inflationary problems of today which is far from transitory. The largest bond and stock boom in history was then fueled by fifteen years of free money, but this was followed by a hangover of entrenched inflation, rising interest rates, and bank collapses on both sides of the Atlantic. Today, the focus is on the capital wars of a financially strapped United States after fighting two fruitless wars, a pandemic, Russia, and a Green Revolution. America's debt is its Achilles heel, with a debt to GDP ratio of 130 percent. Yet America’s challenges are only beginning.

The gravity of the problem is that amidst the turmoil in its financial markets, the US is locked in a great power competition with an ascendant China and unstable Russia, with its defense industry dependent on chips and critical minerals mined by others and debt held by foreign powers. To close the gap, the US has gone on a reckless spending spree in an attempt to bring back industries and technology in a realpolitik world.

Too Big to Fail

The “March madness” failures of three banking institutions and a fourth, First Republic Bank sparked new jitters in Washington. A bank run of just $0.04 trillion in a single day brought down Silicon Valley Bank (SVB) and the Federal Deposit Insurance Corporation's (FDIC) $250,000 insurance cap, exposing the structural vulnerability of the US financial system at a time when approximately half of US deposits, or about $2.6 trillion, are uninsured. The FDIC made Silicon Valley Bank's venture capitalists' accounts whole in an effort to prevent the deposit outflow from spreading, which caused the Fed's balance sheet to expand by $300 billion in just one week.

The deposit insurance law was part of a raft of new laws, that included thousands of pages of new regulations and the Dodd-Frank reforms which were designed to stop costly future taxpayer-funded bailouts, following the crash of 2008. Further, to save taxpayers’money, bail-ins were enacted to shift the risk to unsecured creditors and depositors. Ironically, then Fed Chair Janet Yellen was one of the architects of the series of reforms to protect the system. However ten years later, the Trump era rollbacks of Dodd-Frank allowed SVB to escape the more onerous stress tests and liquidity requirements and this time, the former Fed Chair and now Treasury secretary, Janet Yellen guaranteed SVB’s billionaire clients’ deposits, scrapping the “bail-in” provisions. And, worrisome is that the FDIC has less than $100 billion left after taking a $15.8 billion haircut on Silicon Valley Bank and handing over $50 billion to America’s saviour of choice, JP Morgan for taking over First Republic, raising questions about the safety of the more than $5 trillion of savings which have subsequently moved into money market funds, ironically without FDIC guarantees. Fearful of the threat to the financial sector’s plumbing, Treasury secretary Yellen warned of “structural vulnerabilities”. Are mattresses any better?

The contagion reached Switzerland where 167-year-old Credit Suisse was the next domino to fall, forcing the Swiss government to provide $120 billion of state backed guarantees to orchestrate a shotgun wedding with archrival UBS, creating the world’s fourth largest megabank along the lines of Goldman Sachs. Despite a half-trillion-dollar balance sheet, Credit Suisse was the first collapse of 30 global financial institutions designated as “too big to fail” by the International Financial Stability Board. But by declaring some subordinated $17 billion CoCo notes worthless, the Swiss government wiped out bondholders rather than shareholders and arbitrarily modified the law, upending a longstanding hierarchy that places debt ahead of equity. Contingent convertibles, or CoCos, were designated as Tier I capital to assist in financing the banks following the 2008 crash, with the payment of higher coupon rates to offset the underlying risk. That action alone put the $260 billion derivative market in jeopardy. Again, regulations such as the aforementioned bail-in provisions were scrapped, shifting the liabilities to shareholders and bondholders, leaving depositors intact. Memories are short. In 2008, UBS required a bailout, financed then with taxpayers’ money. Plus ça change ……

Let The Bailouts Begin

Much has been written that it is different this time. Two years ago, Silicon Valley Bank made an unhedged investment in long-term securities during the Fed's low-rate environment. When the bank needed cash to pay depositors during the Fed's cycle of rising rates, the bank was forced to sell, which resulted in a run on the bank. Similarly in 2008 because of a liability mismatch, a $17 billion run on bankrupt Washington Mutual forced the takeover by America’s largest bank JP Morgan for $1.9 billion setting off the sub-prime meltdown that triggered the failures of Lehman Brothers and Bear Stearns.

Financial markets, accustomed to decades of easy money that fueled an “everything bubble”, perversely celebrated on high hopes that the Fed would slowdown rate increases. However as before, similar to the overuse of fiscal policy during and after the pandemic, the bailouts and the dismantling of reforms created more uncertainty and confusion, with taxpayers again on the hook. In the past year, the Fed has raised rates 500 basis points, a process which destabilized SVB and First Republic, sowing the seeds for this current crisis in a scramble for safety and yield. That scramble, and now the banking implosion has raised hopes for a short-term reprieve, but inflation continues to roar ahead. Moreover, the failure of four US banks lights the fuse on a new round of higher inflation because to help the troubled banks, the Fed’s emergency injection of liquidity again uses the nation’s balance sheet to bailout the risk takers, just as they did in 2008, when no banker was held to account. President Biden’s response? “That’s how capitalism works”. The taxpayers are less fortunate.

And as the swamp drains, the ugly frogs have surfaced. One of the first was the US banking system which underpins the US economy and dollar. The banking system is in turmoil, but it is just the tip of the iceberg. Behind the immediate crisis there are more serious structural problems as the government can’t guarantee every deposit in the banking system. Of concern is that Silicon Valley Bank problems are not isolated and that many more failures lie ahead particularly since of the 4,800 or so, regional banks’ and savings institutions’ securities portfolio are an estimated $1.75 trillion underwater or 80% of their capital. Furthermore, it is the banks that are the backbone of the US financial system providing the majority of loans to the all important $6 trillion commercial real estate market where a $1.5 trillion wall of debt needs to be refinanced over the next few years and, at sharply higher rates. Commercial real estate in our opinion is the next shoe to drop. That looming crisis is part of the consequential retreat from lending, together with the mass exodus of bank deposits are the ingredients of a classic credit crunch, requiring additional federal help to bailout the “walking dead”.

Money For Nothing

And not just banks are having problems. Much larger losses are also in store as the bigger frogs in the swamp, their overseers, the Fed and other central banks also purchased trillions of bonds as part of the “prolonged” series of quantitative easing (QE) stimulus programmes. Last year the Swiss National Bank reported a loss of $143 billion or almost 18% of Swiss GDP. Even before the bailouts, the Fed, which has capital of $42 billion, has lost nearly $36 billion since mid-September.The accountants reclassified those central bank losses as “deferred assets”, yet with negative capital and massive losses to come, how will the central banks pay their bills? From past history, central banks could always print more. In 2008, before the housing crisis, the Fed’s balance sheet was only $900 billion. Today after the pandemic and Biden’s spending blowout, the Fed’s balance sheet is at $8.6 trillion. Printing more money won't do anything but increase inflation, which will perpetuate the never-ending boom-and-bust cycle.

While this dynamic is not new, velocity (VIX) is. Recent events are happening much quicker, deeper and the safety net is frayed. We believe that the billions of bailouts and trillions spent on the pandemic on top of the trillions borrowed earlier will only trigger a broader economic crisis, requiring yet another series of market bailouts. And the consequential changing of rules, moving the goal posts, or abrogating laws undermines market discipline, leading to a crisis of confidence in the market. With the world much more interconnected and the banking sector now so big, should we face a synchronized downturn, the rules of the game could change quickly as Credit Suisse and Silicon Valley Bank discovered – they are the canaries in the coal mine.

“Guns and Butter” Era Has Returned

Amid the fallout from the banking turmoil and concerns of a financial meltdown there are antigovernment strikes in the UK, Germany, Israel and France with President Macron even postponing a visit by King Charles because of escalating demonstrations. Is the world aflame? To counter the Russian invasion, the world is rearming with the best armed nation increasing military expenditures to almost $900 billion as the military-industrial complex doubles down on the disasters in Afghanistan and Iraq. Today US-led NATO is larger than it was at the start of the war. Such is the breadth of consensus that even Canada has raised military expenditures but far short of the promised two percent target, after spending only 1.2 percent of GDP leaving an armed force consisting of less than 30,000 reserve troops, 40,000 regular troops and four submarines in dry dock.

Meantime, Mr. Biden wants trillions more to reshape America’s industrial strategy to a green society even though its scientists and businesses have expressed doubts about the growth and efficiency of his industrial policy. We believe the weaponization of trade, the impossible task of self-sufficiency and domestic subsidisation is a negative sum game sure to lead to America’s declining global influence as well as an unprecedented surge in fiscal spending, and inflation.

The population appears to be moving in a different way as housing, inflation, healthcare, and jobs are front of mind for voters at the same time as President Biden is waging a cold war with China, and as a result, this president's popularity is at a low point. In the 1960s, when it came to choosing between "guns and butter," President Johnson's administration chose to pursue both his "Great Society" and a war in Vietnam, which grew spending deficits that resulted in double-digit inflation. To pay for Biden's spending bonanza, America must borrow more, evoking the 1960s. We have thus far reached the 5% inflation rate of the late 1960s thanks to Mr. Biden's pursuit of the same several aims, and soon, inflation will surpass the 1970s' 10% rate. But this time, Mr. Volcker is not around.

Sino-US Cold War

President Biden is a man of integrity, but Robert Gates, the former defence secretary under President Obama and a former CIA employee for three decades, said in his memoirs that Biden has been "wrong on nearly every major foreign policy and national security issue over the past four decades." Gates emphasised Biden's opposition to "every one of Ronald Reagan's military programmes to contest the Soviet Union", the Iraqi disaster, the Gulf Wars, the unaccounted-for WMDs, and the hurried pullout from Afghanistan. Since then, Biden's support for Ukraine and the rebuilding of European allies may prove to be an exception, but the continuation of Trump's trade war and treatment of China as an enemy rather than a competitor has reshaped the global economy, with potentially dangerous consequences as geopolitical risk spills into international finance.

To be sure, politics on both sides endangers world peace but a US-China uncoupling is much more dangerous than a few broken supply chains. As America remains divided within its borders, its global leadership is being challenged and as they attempt to rewrite the rules of globalization, deeper problems lie ahead. In this realpolitik situation, the US risksshooting itself in the foot with the reversal of a half century policy of globalization which benefited both economies such that they have a codependent relationship. However isolating China has become the bi-partisan axis of US politics. China’s fears are not unfounded. The IMF even warned about carving the global economy into competitive geopolitical blocs and, estimates that the long-term cost of US-China rivalry could be around 7% of global GDP.

The ratcheting of tensions is so tenuous that it was easily blown off course by a balloon and recently the wildly popular social media platform TikTok (partially owned by America companies) pits 150 million users against Washington lawmakers. Maybe Washington’s concern over TikTok was not ownership but the fact that intelligence leaks (the third in 13 years) disseminated on social media online sites weeks without US government knowledge. Maybe America should have used balloons.

To offset the tariffs, blacklisting, and protectionist-style actions that are a part of the tech war, China's anti-trust regulatory authority has strengthened its assessment processes, including those for US tech businesses. China has tightened export regulations on vital minerals used in the US automotive, green energy, and electronics industries. In retaliation for the export restrictions, China is looking into US chipmaker Micron and imposed sanctions on US weapon companies. A new House Committee on China runs the possibility of worsening relations as everything Chinese is demonized, evoking analogies to the McCarthy anti-Communist trope despite recent efforts by Treasury secretary Yellen to defuse tensions. Meanwhile the US shipped more arms to Taiwan, added four more military bases in the Philippines, sent the nuclear armed US Navy to patrol the South China sea and deepened military ties with Australia by selling them nuclear subs under the AUKUS framework. All this saber rattling will increase the risk of war and boost China’s determination to become more self-sufficient, reducing their reliance on Western technology. China has just one military base outside China, in Djibouti on the East African coast.

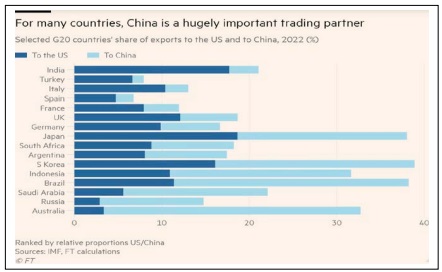

Global implications are already being felt as a result of the West's blindness to China's power as the world's largest exporter and market. The amount of Chinese investment in the US has decreased, as expected. However ironically despite Washington’s efforts to decouple, business has deep economic ties with China as the global supply hub with trade between the two countries posted record highs for the sixth month in a row. According to Qianzhan of Shenzhen, the world's top manufacturer and exporter has invested around $40 billion on coastal infrastructure, which could not be readily replaced or replicated by America. Around 80% of that trade is transported by water. Due to their reliance on China, which is home to the world's second-largest economy, the United States lost the last trade war with President Trump. Products like Tesla cars, iPhones, and toothbrushes are all produced there. China has surpassed Germany and Japan to take the top spot for volume automobile exports. Then there are America’s tech giants and big multinationals which have major investments in China who are caught in the middle of the escalating tensions, highlighting the reality that both superpowers can ill afford a decoupling since they remain economically co-dependent.

What Are Friends For?

As the global order fragments, the strategic rivalry has both superpowers courting allies in nearly every corner of the globe. America dominated the world for the majority of the last fifty years, but as a result of the cold war, China is now establishing an alternative system. "We are witnessing a fragmentation of the global economy into competing blocs, with each bloc trying to pull as much of the rest of the world closer to its respective strategic interests and values," said Christine Lagarde, President of the ECB. As new coalitions are being established with 30% of the world suffering western sanctions, there are perhaps 100 or so nations in Europe that do not completely enforce Western sanctions, despite the fact that the US-led North America Trade Organisation (NATO) is staunchly backing Ukraine. The war itself has forced Russia into the arms of a former rival China which offered Russia an economic lifeline despite much ink mischaracterizing the relationship, which to date is largely transactional. And not all nations have demonized China. Both the EU and France have asked China to use its leverage over Putin to help end the war, a move also supported by both India and South Africa. President Macron was among the latest succession of world leaders to go to China attempting to reboot trade, although his support of China’s nascent peace process was heavily criticized in Washington. Unnoticed too was Ursula von der Leyen, the European Commission president who joined Macron, arguing that Europe should “de-risk” rather “decouple” its Chinese ties. She is right.

On energy, China has made progress in the oil sector by extending its ties with the Persian Gulf players and becoming their largest trading partner, taking a page from American transactional diplomacy. A number of the world's top oil exporters, led by Saudi Arabia, a longtime ally of the United States, startled the oil markets by lowering more than a million barrels of oil per day, contradicting President Joe Biden's demand to increase output to control inflation. As part of a coordinated effort to raise oil prices, Russia will also extend a decrease of 500,000 barrels per day. With US involvement declining, the Saudis are realigning their allegiances as other players like Russia and China gain power. Prior to that, President Xi made history by travelling to Saudi Arabia for the first time and using soft power, he helped normalize relations between Saudi Arabia and Iran plus set up a future meeting between Iran and the six Gulf Cooperation Council members in Beijing. Significantly China also created the petroyuan, invoicing oil in local currencies in a move with important economic and financial implications, at the expense of the dollar. Rumours are circulating that Saudis are re-cycling those petroyuans into purchases of gold on the Shanghai Gold Exchange.

The biggest consequence of the war forced Russia from the West to find China and by America’s crossing of redlines on Taiwan, they lost China despite Washington’s acceptance of the long standing norm “one China” policy accepted by the international community. And rather than having China and Russia working at cross purposes cultivated earlier by Nixon and Reagan, the US position has them growing closer. Little noticed, while the media made much of Tsai Ing-wen’s visit to Washington, less was said that Tsai is no longer the leader of her party (DPP), and that her predecessor, Kuomintang’s (KMT) Ma Ying-jeou visited mainland China for a 12-day visit to smooth cross-strait relations and to keep Taiwan, neither fully independent nor fully united with the mainland. Two different parties, two different visions and two sides of the same coin.

Falling Into the Thucydides

Trap As the world’s largest banker, China’s leadership role and its $1 trillion Belt and Road Infrastructure project extends its influence among developing countries, including Ukraine. However inevitably the world’s largest creditor had to rescue some participants resulting in China restructuring their debt but locking in some sovereign borrowers for years to come. And while the renminbi’s share doubled last year to 3%, China’s central bank is pushing to internationalize the renminbi further using it in settlements of cross border commodities. Additionally, India and a growing group of developing nations have avoided Western sanctions and the SWIFT system, which is backed by the dollar in the West, as a growing number of players use the alternate China's Cross-Border Interbank Payment System (CIPS). Dollar usage is declining. Further the BRICS group (Brazil, Russia, India, China and South Africa) are negotiating a common trade agreement and forming a new global currency backed by gold at the upcoming summit this summer which will further reduce dependence on the US dollar. Additionally, some 19 countries have applied to join the alliance, a move which would make the bloc larger than the G7 nations in GDP (PPP) terms, according to South Africa’s ambassador. Brazil, which has the biggest economy and population in Latin America, has already agreed to a trade agreement worth $150 billion annually with China replacing the dollar with local currency.

All this points to a very fragile period in world history. Professor Graham T. Allison of Harvard University, an American political scientist, cautioned against falling into the Thucydides Trap since, 12 out of 16 occasions when a growing power challenged the incumbent in power, war was the outcome. Today this cold war might not shed blood but might prove to be a different type of war, a capital war with America’s dollar-based banking system its casualty. China with $3.2 trillion of reserves is better prepared than America, the world’s biggest debtor. To be sure a capital war would hurt both countries, but a debt-heavy America is much more levered and financially fragile. The US dollar's position as the world's reserve currency would suffer the most. Who will then finance the US in light of Washington's ill-timed desire to decouple from China?

Everything, Everywhere

Overseas, rising rates almost caused the collapse of the British pension fund industry when a similar yield mismatch triggered selling in the bond market and a government bailout. One of India's largest corporate groupings appears to be disintegrating. The unravelling, a result of decades of unrestrained spending, has accelerated and the losses on a worldwide scale are not "one offs" but rather a continuous string of mini crises. Governments are at the center of this which guarantees the next crisis. The tide is going out.

None of these is a good option. Mr. Biden's aggressive green industrial policy, supported by generous new subsidies, has led to a fundamental change in US policy that has sparked a new gold rush and heaped billions of incentives on American players to develop new technologies as part of the green boondoggle, despite growing twin deficits and a deterioration of the country's balance sheet. His “buy America” policies have taken aim at both friend and foe. Mr. Biden's Chips Act and Inflation Reduction Act (IRA) package drives a wedge between Europe and the United States' climate law by excluding European carmakers from $400 billion in clean energy subsidies, semiconductor credits, and tax credits, while American businesses receive billions of subsidies to accelerate the development of chips, solar, and wind technologies. The Chips Act also harms South Korea, a significant ally in the chip industry.

Moreover, the US strategy to incent the greening of business is inflationary in direct costs in a net zero sum equation. The German Regulatory Control Council recently estimated that compliance costs alone will cost Germany over half a trillion dollars. The problem is that America’s green transition, the reshoring of critical supply chains, and now the last round of financial bailouts will push underlying inflation and rates even higher. The cost? Trillions. And, the Biden administration feels they can spend freely on both guns and butter and on everything, everywhere, but can’t all at once.

Too Big to Save?

The return of calm in the financial markets following the overnight rescue of Credit Suisse may signal the worst is over. But as we learned, borrowers still face a squeeze. Bank runs can surface overnight the moment confidence is tested. Governments were unprepared for the change in the global interest rate environment. Spending particularly in Canada remains a priority, despite widening deficits. In Washington, the administration does not seem to be overly concerned about the cost of the federal bailouts nor to stop the next one. Permanent bailouts, guarantees and subsidies are part of its playbook, including guaranteeing every deposit in America. It is estimated that the banking crisis alone resulted in another $2 trillion addition in global liquidity which not surprisingly boosted stock prices again. Yet the underlying problems are plain to see.

Stock market history is littered with crashes and on average 20% or more pullbacks happen every seven years. In decades past, the implosions of Long Term Capital, Enron, Madoff, 2008 global meltdown and lately FTX crypto, the Fed flooded the economy with liquidity, worrying about the consequences later. Money matters. Print too much and history shows that inflation always follows. However unlike in 2008 when inflation was a non-event, debt levels today are much higher and the trifecta of soaring inflation, record debt levels and another banking crisis leaves government little room to spend their way out of trouble. The Fed is now caught between rising inflation and a banking crisis caused in part by the Fed’s run-up in rates. Inflation is embedded. Services output (excluding energy) is up 7.3%. Labour remains tight. Shelter is up, car prices returned to highs. Consumers are 9 spending some of that pandemic largesse. Simply today’s inflation is a product of yesteryears’ policies in response to the last crisis in 2008. At that time, the federal debt was $9.5 trillion, or 67% of GDP. It is now $31.4 trillion, or 130% of GDP, and it is constantly rising. Nearly 10% of federal revenues are used to pay interest on the debt. For the second year in running, the non-partisan Congressional Budget Office (CBO) predicted that the government deficit would be $1.4 trillion, or 6% of GDP, which would be unsustainable for other nations.

Debt Default?

And yet, the Fed increases its influence after every crisis, while the government continues to fuel inflation. Deficit spending, we are told is necessary. All carry a price tag. The US ended the 1990s with a national debt of $5.7 trillion. Little is mentioned that today the US government breached the $31.4 trillion borrowing limit, and particularly worrisome is that the Republicans are threatening to push America into default, unless there are spending cuts. A political deadlock on debt rescheduling would have disastrous consequences given the high level of US debt relative to GDP and the fact that 25% of the country's debt is owed to foreign creditors. Still, investors and the Federal Reserve remain complacent in the belief that another short-term fix is in the cards. However, America’s spiraling debt is not going away and next year in an echo of 2016, markets will face round two of Biden versus Trump.

Worrisome is that like its dysfunctional banking system, America is too big to fail and, who will save America? The Fed’s reverse repo facility at $2.2 trillion is just another stealth QE III, with banks borrowing $500 billion in a week. As the Fed finances the banks, money market participants, and now the market with the aftershocks and contagion, a greater issue, the plumbing is blocked. As long as the government keeps using taxpayers’ funds to save its banking buddies, trust is absent. The US economy is no longer exceptional.

More broadly, what happens when cautious international investors, fearful of this new era of bananatype financial chaos, decide to dump dollars which would spark a run on the dollar, particularly when the risk of default looms over the debt ceiling stalemate. One thing is clear. Inflation is here for the long haul and the self-inflicted wound of a sovereign default would topple the dollar with catastrophic consequences. In a few months the US might not be able to pay its own bills, let alone bailout its banking sector. Who then will bailout Uncle Sam?

US Dollar Collapse

America’s reliance on credit – consumer, corporate and federal, like its banking system has a breaking point. The world’s financial system was established at Bretton Woods in 1945 and subsequently from the end of World War II through the early 70s, currencies were fixed against the dollar, making it the de facto global currency. But the system fell apart when soaring debts caused by Lyndon Johnson’s “guns and butter” era helped fuel the inflation of the 1970s, forcing President Nixon to devalue the dollar and abandon its gold backing at $35/oz. The problem is that since severing the gold standard in 1971, there was a massive increase in the supply of fiat money, credit and derivatives which has debased the dollar, made worse since the US Treasury was forced to mint more and more dollars to pay for an ever-expanding deficit, the pandemic and now the war in Ukraine. Unsurprisingly global debt to GDP also soared to all-time highs aided by Wall Street’s derivatives or the weapons of mass destruction which are many times the world’s GDP. President Biden is spending $2 trillion on restructuring the economy, but he has been silent on the price of becoming green or, similarly, the price of aiding Ukraine. Less is spoken about having to pick between "guns and butter" as spending keeps rising and the dollar's foundation is undermined. Mr. Biden has the worst fiscal record of any president in modern times. No one else is even close, not even Mr. Trump.

The issue is not brand-new. The trust people had in the dollar was the foundation of America's reputation and banking systems. It serves as the cornerstone of our global monetary system. The dominant currency in the world, however, is structurally weak as a result of political polarisation and poor economic management. Like its banks, the nation has piled up debt with the printing presses working overtime. The strain in the financial system caused by the return of inflation and consequential higher rates has led to banking turmoil, the bursting of a series of bubbles and a breakdown in trust. The pandemic too led to a welfare state and the rescue of households, and the cult of the bailout saw central banks forced to rescue their financial sector. All of this cost money, and the CBO estimated that US federal expenditure will account for 24% of GDP. This vast misallocation of capital damages trust, particularly in the wake of bailouts and the violation of investors', shareholders', and bondholders' rights. America itself is a bubble.

America Is in Denial

The world is flooded with dollars from the decades of easy money and the accumulation of debt on an horrendous scale. For a decade the US Dollar Index (DXY), which measures the currency against a basket of six currencies, was strong as investors flocked to safety. Lately the dollar however has lost some of its lustre, falling more than 10% from its peak late September. We believe the dollar’s reign is coming to an end, particularly since America risks isolation as the world moves to multi blocs with non-Western countries conducting trade lately in other currencies to counterbalance a reliance on the dollar after Washington weaponized the currency.

Confidence in currency matters too. Lose it and trust disappears. Without confidence in the dollar, there is no reserve currency. America is in denial. In the midst of the deadlock over raising the US debt ceiling, America's divided democracy is currently dealing with a crisis of confidence in their banks, regulators, and an erosion of faith in the dollar. With trillion-dollar deficits stretching as far as the eye can see and coupled with the explosion in monetary growth, the burden of debt grows in a world where the Fed’s main policy tool is to let inflation help pay America’s debt.

Worst of all, America’s confrontational stance with China raises questions as to who will fund its savings deficit, particularly since the government, banks, corporate and household balance sheets have deteriorated. The dollar is the world’s most popular currency for trade. However, China is the world’s largest trading nation and as Chinese trade expands, the usage of the renminbi increases. Today four of the five largest economies in terms of purchasing power are Asian. More and more trade is being conducted without usage of the dollar and which has fallen to 58.4%, the lowest since 1994. Finance depends on confidence, trust and the maintenance of a nation’s laws which has lately been corrupted. The dollar is not forever.

Gold, the End of Cheap Money

All this and the de-dollarization trend have led to growing geopolitical tensions as central banks seek alternatives to the dollar. More and more nations are requesting that trade be conducted in currencies other than the US dollar. China recently inked deals with Saudi Arabia, purchasing oil in exchange for renminbi. The Saudis once sold oil for dollars but as the US became a leading competitor and exporter of oil, usage of petrodollars declined and as trade with China expands, renminbi usage will increase too. The globe needs fewer dollars today. All of this indicates that the world's reserve currency is being put to the test amid the capital conflicts. Gold is an alternative to the dollar.

Gold’s store of value caused inflows into the gold ETFs for the first time in 10 months. In the past gold acted as a currency hedge and last year although gold went up 13% in pounds, and 15% in yen, the performance in dollars was flat. Today the US has accumulated the world’s largest international debt because its politicians won’t stop spending and new borrowings are necessary to pay bills. As a result, the dollar has declined, notably as a result of the sanctions and the drive towards dedollarization. China at the same time has been building up the world’s largest monetary reserves including gold at the expense of the dollar. China in fact has reduced its Treasury holdings for six months in a row and only a quarter of their $3.2 trillion of foreign exchange reserves are in dollars. France too has been selling. The problem is that other currencies, including gold, are replacing the dollar, taking a larger share of the market, and as America’s burden of debt grows, foreign investors will be reluctant to put all their eggs in the dollar basket.

In the past, interest rate increases were accompanied by gold corrections, momentarily bolstering the dollar. Although the dollar has fallen since the autumn, recent strong talk from Fed Chair Powell has strengthened the greenback. However as shown, Fed’s pronouncements only temporarily impact gold before gold reaches new highs. We believe that gold’s performance is telling us that all is not well with the dollar.

Then there is demand for gold, underpinned last year by central banks who bought 1,136 tonnes of gold, the most on record as the bankers diversified their holdings. In the first quarter they added 228 tonnes or 176% more than a year ago. Singapore added 69 tonnes. India added 3.5 tonnes holding 794.6 tonnes in its reserves. Overall annual gold demand jumped 18% to 4,741 tonnes, the largest since 2011. Supplies are limited. A growing number of developed countries also joined the crowd although cash strapped. Turkey was an exception, selling 15 tonnes in March. Moreover, the growing usage of sanctions made enforcement difficult for some central banks with some purchasing gold at the expense of dollars to circumvent the sanctions. Coincidentally Russia’s reserves increased by 31 tonnes to 2,330 tonnes. China bought more than 120 tonnes, for the sixth month in a row holding 2,076 tonnes, the sixth largest after Russia. The United States holds the largest stockpile of gold at 8,100 tonnes.

Since the start of the year, gold has risen 11%, reaching a 12-month peak at $2,053/oz in April, close to its all-time record on central bank demand and fears over the health of US banks. Gold is an alternative to the dollar. This time amid the banking wipeout, gold spiked $180/oz overnight, surging past $2,000/oz while the dollar weakened. We believe gold is a hedge against the chance that confidence in dollar is not forever. Gold’s bull market has only just begun, and we continue to believe gold will top $2,200/oz this year.

Recommendations

Gold stocks have performed well as investors bet on a shrinking pool of players which have benefited from higher bullion prices in the latest quarter. Nonetheless gold stocks remain under-owned presenting an opportunity. Recent takeover activity is driven by the gold miners’ dilemma of declining reserves and the need to boost reserves. Yamana is another one that bit the dust. Developers like McEwen Mining have done well and B2Gold consummated its deal to buy Sabina Gold & Silver. Osisko sold half of high-grade Windfall for $600 million to South African Gold Fields to set up a 50/50 joint venture. Another point is that reserves in the ground are valued at less than $500 an ounce which makes gold mining profitable with gold at $2,000 an ounce. With fewer players, dealmaking and the game of musical chairs will continue. We continue to like Agnico Eagle, Barrick which boosted reserves and developers B2Gold and McEwen Mining for growth. While million-ounce players appear to be the sweet spot needed for ETF attention, we believe that the mid-sized miners will likely prove to be tidbits in the M&A activity. Lundin Gold, Centamin and Eldorado are future tidbits.

Agnico Eagle Mines Ltd.

Agnico Eagle’s acquisition of the balance of Canadian Malartic gives the miner ownership over 60% of Canada’s major gold mines. We believe the consolidation is a positive move since it allows the exploration of nearby deposits like underground Odyssey and East Gouldie. We liked Agnico Eagle after the merger with Kirkland Lake and believe the consolidation of Canadian Malartic mine will open a new mining district to join Kittila in Finland, Fosterville in Australia and La Ronde in Quebec. Agnico is set to grow organically producing 2.7 million ounces annually. Plans are in place for Detour to become a million-ounce producer and Agnico has a large exploration program with over 310,000 meters of drilling. Agnico has a strong balance sheet and a long history of consistently increasing its dividend. Buy.

B2Gold Corp.

B2Gold produced 267,000 ounces in the first quarter with AISC at $1,000/oz reflecting major contributions from flagship Fekola, lower costs and production from Otjikoto which will produce 200,000 ounces annually for the next eight years. B2Gold’s task is to construct the recently acquired high-grade Sabina’s Back River project in Nunavut which boosted B2Gold’s reserves by 60% and will produce 223,000 ounces a year over 15 years. An ice road allowed shipment of supplies and equipment to be worked on this summer and production could begin as early as next year. At Fekola there are plans to build a second mill to accommodate nearby satellite discoveries. With a strong balance sheet, B2Gold will produce one million ounces this year at AISC of $1,200/oz, among the lowest in the industry. Buy.

Centamin PLC

Centamin PLC had a strong quarter from its flagship Sukari gold mine in Egypt. After reaching a milestone of producing 5 million ounces to date, the Sukari deposit has more than 6 million ounces in reserves. The miner produced 438,000 ounces last year and has a strong balance sheet of $157 million cash and an undrawn $150 million credit line. Centamin produced 14 percent more gold in the first quarter and increased resources by 13%. Cash costs are about $900 and AISC about $1400/oz. Centamin will spend $225 million this year on the paste-filled plant and underground. The miner recently commissioned a 36MW solar plant. The company also completed Egypt's first airborne geophysical survey and there are numerous targets across the company’s 160 km2 concession. Elsewhere, Centamin will produce a pre-feasibility study for its Doropo project in Côte d’Ivoire this summer. We like the shares here.

IAMGOLD Corp.

Mid-tier producer IAMGOLD has a new president Renaud Adams who faces a challenging job in bringing the over-budget and problem prone Côté Lake into production. The Côté project requires another half billion dollars of construction costs which will be shared with joint venture partner Sumitomo. IAMGOLD’s Essakane mine in Burkina Faso performed well producing 420,000 ounces on an attributable basis last year. However with AISC of $1,700/oz, finances are tight even with the sale of Rosebel and promising Boto. At Westwood in Québec, gold production was disappointing, producing only 18,000 ounces in the quarter with cash cost above $2,000/oz. Although Westwood should produce about 80,000 ounces this year, the higher costs mean that IAMGOLD will lose money on every ounce they produce. IAMGOLD has about $400 million in cash and cash equivalents which is sufficient to complete Côté but nonetheless, we are skeptical of Côté and believe that it will be a long time before they can generate a decent return on the mine. Sell.

Kinross Gold Corp.

Kinross continues to pour good money into the Great Bear acquisition while producing 466,000 (GEO) at AISC of $1,300/oz. Tasiast’s throughput is averaging 21,000 tpd with better grades. The first quarter was to be the weaker quarter, yet Kinross expects to produce 2 million (GEO) this year. Kinross must spend almost billion dollars to put Great Bear into production, although reserves to date are only 2.3 million ounces and that is after drilling more than 500,000 m. We fear continuity will plague this deposit and Great Bear won’t be producing until 2029. Consequently, with only mature mines, a flat production outlook and spending millions with little return for the next while, the shares should be sold.

Lundin Gold Inc.

Lundin Gold’s Fruta del Norte mine (FDN) in Ecuador is one of the richest deposits in the world producing almost 480,000 ounces last year at AISC of $800/oz at 10 g/t. The low-cost mine has been in production only two years but is performing better than expected due to higher recoveries and tonnage increasing from a designed 3,500 tpd to 4500 tpd in the latest quarter. The South Ventilation Raise was completed enabling mining at all levels. The company even paid down about $200 million of debt and began an active exploration program looking for nearby look-alike epithermals (Bonza Sur and Castillo). Lundin has a large acreage position, and a 43-101 update is expected. Lundin is a cash machine with $360 million in cash and, we like the shares here.

McEwen Mining Inc.

McEwen Mining turned the corner with improvements at the Fox Complex and Gold Bar in Nevada. McEwen shares was one of the best performers in the quarter. In addition, a contribution is expected from EL Gallo’s Fenix using 3,000 tpd equipment. Los Azules in Argentina was the big story with McEwen Mining retaining 52 percent after the $80 million successful offering of McEwen Copper which saw strategic partners Stellantis and Rio Tinto owning half of the project at a $500 million valuation. Today an investor would get McEwen Mining’s mines for free at that valuation. McEwen has spent $41 million on the Los Azules copper project, which is one of the world’s largest undeveloped copper deposits. We like the shares here because the parts are worth more than the whole valuation.

New Gold Inc.

New Gold produced about 105,000 ounces despite lower tonnage. At Rainy River, production was 13 percent ahead of a year ago, but costs remain a problem. New Gold's production report is in gold equivalent ounces and thus the copper by-product credits helped out. New Afton’s better grades also assisted results. Development continues at Intrepid underground. Nonetheless total debt stands at a whopping $395 million and cash of only $195 million. New Gold is still bleeding cash and sold the balance of Artemis to pick up $31 million. With high debt and underperforming mines, the shares should be sold.

Newmont Corp.

The world's largest gold miner raised its offer for Australian Newcrest to $19.5 billion, increasing an earlier all-share bid of $17 billion which was rejected earlier. Newcrest consists largely of mature mines except for Pretium which they overpaid and are still trying to turnaround. While Newcrest is losing its president, the new bid according to Newmont is final. Although 16 percent higher than the previous bid, Newcrest would be just another fill-in candidate and work in progress as Goldcorp is, and thus, Newmont is just treading water. While Newmont is a great cash machine, we believe the shares are dead money with too many turnaround assets. Newmont took a $500 million impairment charge at Cripple Creek in Colorado. During the first quarter, Newmont produced 1.3 million ounces and 288,000 gold equivalent ounces (copper, silver, lead). Newmont has $6.5 billion in liquidity. Nonetheless, we prefer Barrick here.

John R. Ing Jing@maisonplacements.com

Please refer to the Legal Section of our website (maisonplacements.com) for our Research Disclosures for an explanation of our rating structure at https://maisonplacements.com/researchreports/

********