Gold SWOT: Would a Trump Win Be “Bullion Positive”?

Strengths

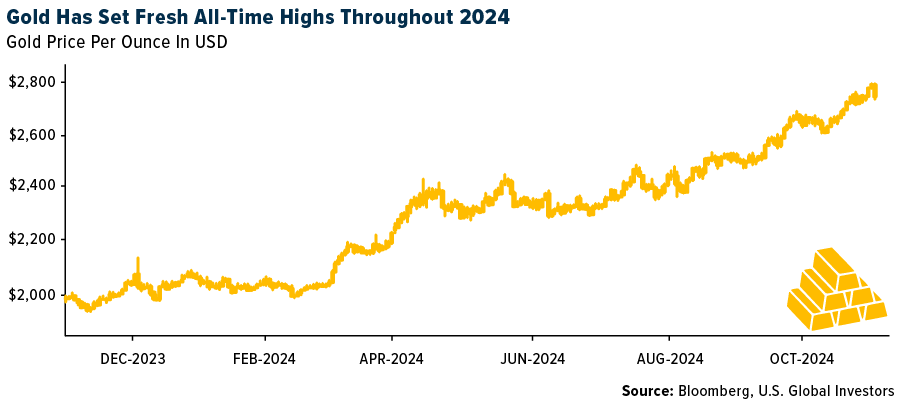

- The best performing precious metal for the week was gold, but still down 0.38%. According to Bloomberg, bullion retains a clear upward bias. With wider markets bracing for the potential prospect of Trump 2.0, a poll showed most investors reckoned such an outcome would be bullion positive. A second Trump presidency could bring greater policy disruption, trade tariffs and enhanced geopolitical risks. The Federal Reserve, meanwhile, will likely deliver another rate cut next week, which also aids gold’s cause.

- Global gold demand swelled about 5% in the third quarter, setting a record for the period and lifting consumption above $100 billion for the first time, according to the World Gold Council. The increase — which saw volumes climb to 1,313 tons — was underpinned by stronger investment flows from the West, including more high-net-worth individuals, that helped offset waning appetite from Asia, the industry-funded group said in a report on Wednesday.

- Agnico Eagle Mines reported adjusted earnings per share for the third quarter that beat the average analyst estimate, according to Bloomberg. Adjusted EPS was $1.14 versus $1.01 consensus. Revenue from mining operations $2.16 billion (estimate $2.11 billion).

Weaknesses

- The worst-performing precious metal for the week was palladium, down 7.87%, following last week’s surge on Western proposals to stop buying certain Russian-sourced metals. Gold demand in China — the world’s biggest consumer — plunged by more than a fifth in the third quarter as record prices and a sluggish economy dented consumption, especially for jewelry. Total demand fell by 22% to 218 tons in the three months to September, according to Bloomberg calculations based on data from the China Gold Council on Monday.

- Gold retreated as some investors booked profit after the metal’s rally to a fresh record. Bullion fell by as much as 2% after earlier reaching a fresh record of $2,790.10. The drop followed the release of strong economic data, which boosts the chance of a cautious approach to interest-rate cuts in the months ahead. Lower borrowing costs tend to benefit the precious metal, as it does not pay interest, according to Bloomberg.

- Eldorado Gold Corp. reported on Friday that its share price dropped as much as 6% after the company adjusted its production guidance for the year. The revised guidance places production at the lower end of previous estimates, while cash costs are expected to be at the higher end.

Opportunities

- According to Canaccord, gold valuations remain attractive with the senior producers trading at 0.69x NAV, up from a recent low of 0.57x but below the historical average of 0.81x and at the lower end of the 0.65-1.0x range.

- According to RBC, junior gold valuations have started to move higher along with metal prices but remain depressed versus historical levels and prior peaks. They continue to see significant value in the group at spot metal prices and strong potential for re-rating versus producers on increased appetite for new projects with better economics at higher prices. Costs have capped upside as well as a weak M&A market.

- According to Bank of America, silver net non-commercial long positions on the CME have risen but are still below all-time highs. Investor interest has also been inconsistent across other segments, with a gap emerging between silver prices and risk reversals. Inflows into physically backed ETFs remain relatively low. However, with strong demand for silver from the EV sector and the potential for accelerated industrial production in the coming quarters, there is room for silver prices to rally further.

Threats

- According to RBC, Gold Road Resources' Q3 gold production fell 9% below estimates, while all-in-sustaining costs (AISC) rose by 17%, increasing the risk of meeting the revised guidance for calendar year 2024. The guidance remains unchanged at 290-305K ounces, but a strong Q4 performance will be essential to achieve this target.

- According to RBC, Ramelius Resources had a weak Q1, with gold production down 15%, all-in-sustaining costs (AISC) up 11%, and tax-adjusted cash flow down by A$32 million—all below estimates. The production shortfall was primarily driven by the Mt Magnet site, raising concerns that these issues may persist throughout the year.

- After Newmont reported disappointing earnings on October 23, its stock price has fallen lower in price each day for the past eight days, posting its longest losing streak in five years. Generalist investors who may have played Newmont as their liquid gold stock exposure was negatively rewarded for stepping back into gold.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of