Gold Forecast: Making the Most of Declining Junior Miners

Not all ways of profiting of declining mining stocks are made equal – let’s explore that.

Preparation for Next Move

It’s quiet on the market… That’s normal – periods of high volatility are often followed by relatively stable periods during which markets prepare for another move. In our case, it’s important to note that after gold’s invalidation of the move above its 61.8% Fibonacci retracement (and the 50%, too), it didn’t move back up. Therefore, the sell signal provided by the invalidation remains fully intact.

Even though almost nothing is happening, this “almost” does provide us with a small clue as to what’s next.

The thing is that at the same time:

- Gold is slightly down

- Silver is slightly up

- Miners are slightly down

- Stocks are slightly up.

This means two things:

- Silver is outperforming gold on a very short-term basis

- Miners are underperforming gold despite getting support from the stock market.

Both are bearish short-term indications for the precious metals market.

USD Index Holds Strong

Additionally, while the price of gold invalidated its breakouts, the USD Index – quite surprisingly – didn’t.

Yes, while I have been writing about the USD Index’s likely strength and bullish outlook overall, this kind of resilience is surprising even to me. I thought that we’ll see a bigger correction now – after all, the USDX soared by 8 index points without a bigger decline.

We don’t see it now, which could mean that it will still happen in the following days, or that the momentum for the USD is so remarkably strong that it will just consolidate and trade sideways here instead of really correcting.

Either way, after this week, the USDX could be back in the rally mode due to the monthly turning point (vertical, dashed line). My yesterday’s comments on it remain up-to-date:

Will we see a correction shortly? That’s quite possible. After all, no market moves up or down in a straight line without periodic corrections.

Will the correction in the USDX trigger a rally in gold and miners? I wouldn’t say that’s necessary. The most recent boost that both markets got was based on geopolitical turmoil (a new type of rocked used by Russia), and those tend to have only temporary impact on prices. Today’s move lower in gold and USDX confirms this. So, it is quite possible that we would see a decline in gold and the USD Index at the same time.

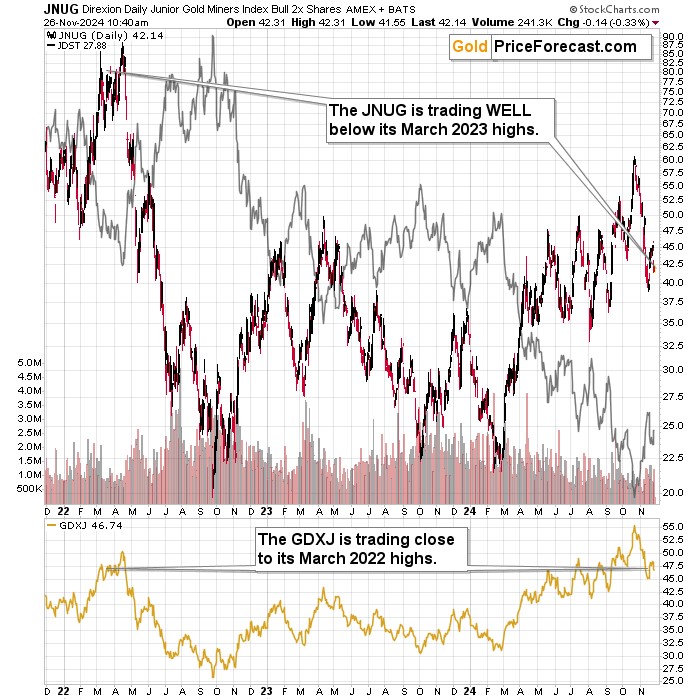

The profit-take levels that I provided for the GDXJ as well as the targets for gold, silver, JDST and JNUG remain up-to-date. And speaking of JDST and JNUG, I’d like to show you something. I’d like to show you why my preferred strategy for taking advantage of the decline in the junior mining stocks is shorting JNUG – a leveraged ETF based on the GDXJ, and not shorting GDXJ itself. Of course, using leveraged instruments may not be applicable for everyone, especially beginning investors, so please keep in mind that this not an individual investment advice aimed at you, specifically.

Both: JNUG and JDST are ETFs that provide 2x leverage over the GDXJ price movements and they multiply DAILY price moves on each day (or at least that’s the goal). The JNUG is the direct ETF and the JDST is the inverse ETF. So, for every daily gain of 1% in the GDXJ, JNUG should gain about 2% and JDST should decline by about 2%. And with a 1% decline in the GDXJ, the JNUG should decline by about 2% and the JDST should gain about 2%.

The critical detail here is that the leverage is provided for daily price moves and not for the entire price move that you might want to take into account. Why is this important? Because if price declines by 20% and then gains 20%, it doesn’t get back to the original price level.

(1 – 20%) x (1 + 20%) = 96% and not 100%

The more repetitions we have and the bigger the deviations from 0, the stronger this effect becomes. This means that as the time goes by and prices move in both directions, both leveraged ETFs will lose value over time. Here’s how it looks like in practice.

The GDXJ is trading more or less at its March 2022 highs right now. However, the JNUG is almost 50% lower! The JDST is also below its March 2022 price levels – both due to the same price-volatility-based decay.

By holding any of those ETFs for a particularly long period (in terms of years, for example), it’s getting increasingly more difficult to come out ahead.

So… Why not take advantage of this tendency instead of being hurt buy it? Yes, you can short JNUG and profit from the decline in its value over time (if you have margin account, of course). This is something that my subscribers have known for a long time.

If one’s brokerage account doesn’t allow to short JNUG, then this option is not available, and one might use other means to benefit from declining junior mining stock prices, but in case of the JDST, please keep in mind that it should be held too long. Still, this particular short trade might be over within a month (or slightly longer), so using JDST should be ok in my opinion (if one wants to use a leveraged instrument at all). Also, JDST is up by almost 7% so far this week and its only Tuesday.

All in all, while there remain some opportunities to gain something extra on gold investments in the long run, the outlook for the precious metals market remains bearish for the following weeks.

Przemyslaw Radomski,

Przemyslaw Radomski,