As Gold Breaks Out Why Is Platinum Watching From the Sidelines?

Gold has broken above $3,000 and appears poised to push even higher. So far, platinum has not followed gold’s lead but seems to be watching from the sidelines.

What is causing this divergence?

Over the last two years, platinum has shown a moderate correlation with gold (+0.47), however, the yellow metal has recently left its cousin in the dust.

In early 2023, platinum was trading around $1,080, while gold was in the $1,820s. Since then, gold has surged by 65 percent, while platinum has remained rangebound between $843 and $1,153. As of today, platinum is trading at around $985.

To put the platinum price into perspective, the metal hit an all-time high of $2,213 an ounce in March 2008. This was higher than the record price gold hit in 2011.

One of the factors driving that 2008 record was a severe supply shortage due to a power crisis and labor strikes in South Africa, the world’s leading platinum producer.

Before 2011, platinum was generally more expensive than gold. In 2015, this historical trend reversed, with the spread between gold and platinum growing wider.

What Drives Gold and Platinum?

Gold and platinum have decoupled because the dynamics driving them are as different as the metals themselves.

Industrial demand accounts for the majority of platinum offtake.

Its primary industrial application is in catalytic converters for vehicles. Platinum is also crucial in the chemical industry for producing fertilizers, in petroleum refining, and in various electronic components due to its excellent conductivity and resistance to corrosion. The metal is also increasingly being used in green technologies such as hydrogen fuel cells.

While industrial demand dominates, platinum is also popular in jewelry and as an investment metal.

Meanwhile, gold primarily trades as a financial asset. As Metals Focus explains, the yellow metal has benefited from “a very different set of tailwinds.”

“Strong central bank demand for gold has provided price support and instilled confidence among investors. Separately, heightened geopolitical risks and growing concerns over sovereign debt have boosted gold’s appeal as a safe-haven asset. These divergent drivers have propelled gold to repeated record highs, even as platinum has trailed.”

Platinum’s Fundamentals Are Far From Weak

While it has yet to drive the price higher, there is a significant platinum shortage developing. The market posted a 749,000-ounce deficit in 2023, followed by a 527,000-ounce shortfall last year. Another 470,000-plus ounce deficit is expected this year.

According to Metals Focus, “These deficits reflect constrained primary supply, disrupted autocatalyst scrap flows, and a rebound in autocatalyst demand after the semiconductor shortage.”

So, why haven’t these market dynamics supported the platinum price?

Because a significant above-ground platinum stock remains after seven years of surpluses running between 2016 and 2022. The combined 2023-2025 deficit will total around 1.7 million ounces. This will leave around half of that seven-year surplus available.

However, there are still issues on the supply side. According to Metals Focus, the concentration of above-ground stocks is “inaccessible to key end-users.” This is exacerbating perceived supply tightness.

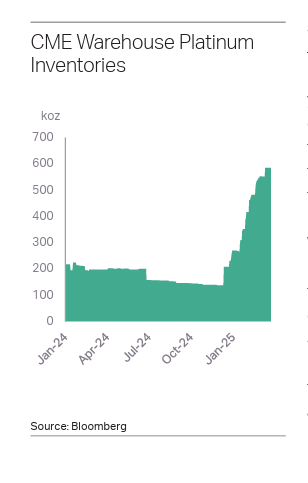

“Since Trump’s election victory in November 2024, tariff concerns have driven CME warehouse holdings higher, climbing by 445koz to 585koz. This has triggered a backwardated platinum market in 2025, where spot prices exceed future prices, reflecting a premium for immediate delivery. Similarly, heavy flows to China in 2021–2022 absorbed surplus stocks, keeping the market tight and platinum in backwardation through much of that period.”

Investment demand for platinum has also created some market tightness.

Platinum ETFs currently hold around 3.3 million ounces of metal, effectively removing it from industrial use. According to Metals Focus analysts, “While they signal investor confidence and support prices by reducing available supply, they also pose a risk; in the event of a breakout, profit taking could quickly release metal back into the market, capping gains.”

China: The Key to the Platinum Market

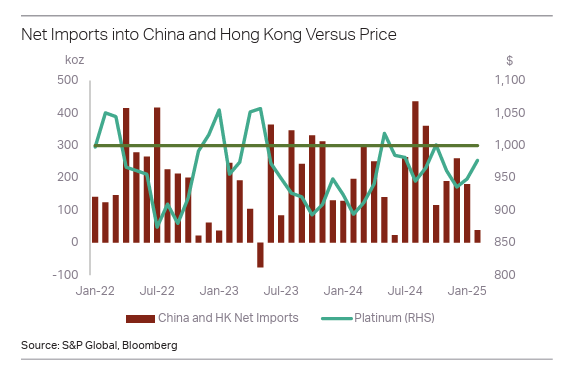

It appears that China holds the keys to the platinum market. Imports of metal into the country plunge when the price rises above $1,000 an ounce. However, imports spike whenever the price drops into the low $900s.

According to Metals Focus, this pattern has reinforced platinum’s narrow trading band.

“On recent research trips, industrial buyers frequently highlighted the low $900s as an attractive entry point. CFTC data shows that on the CME, platinum’s managed money positioning – typically fast-moving speculative funds – has frequently swung between net long and net short over the past two years. This pattern reflects traders capitalizing on short-term price moves within a well-defined range.”

While this pattern seems likely to continue in the near term, there are opportunities for investors who work within the current dynamics. In the longer term, continued supply shortages could open the door for a breakout.

********

Mike Maharrey is a journalist and market analyst for

Mike Maharrey is a journalist and market analyst for