Rocket Time For Gold

With a technical double bottom pattern as a launchpad, gold continues to move solidly higher while global stock markets get smashed. What comes next for these key markets and what are the main factors at play?

This is the daily gold chart.

What began innocently as a bullish non-confirmation between gold-USD and yuan-USD is now a powerful rally fuelled by positive action in the love trade, the inflation trade, and the fear trade… all at the same same!

Institutional money managers are becoming concerned that the US government’s obscene debt growth is violently accelerating as the Fed’s quantitative easing and rate normalization programs are already putting intense pressure on bond market yields.

In turn, that puts intense pressure on the stock market… a market that is already at a very point late in the business cycle. Corporate earnings growth has peaked and inflationary pressures are rising.

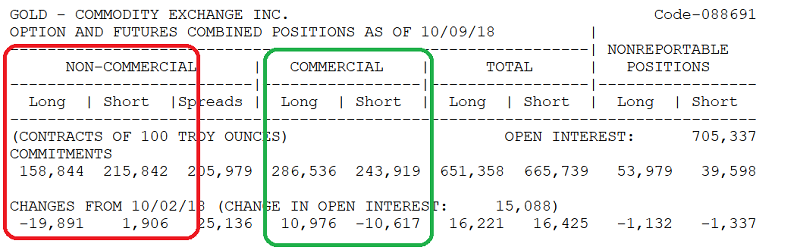

Hedge funds are feeling pressure to liquidate their short positions on the COMEX and the “smart money” commercial traders went heavily net long gold just before the US stock market got smashed.

Like most governments around the world, the US government has almost always had a maniacal obsession with spending money that it doesn’t have. That money is either borrowed or extorted via “income taxation” from over burdened citizens. It’s quickly spent on supposedly grand “people helper” programs.

This disgusting obsession is now putting enormous pressure on yields in the bond market.

This rancid “cake” is being iced by disturbing events taking place in Saudi Arabia. Institutional investors are becoming nervous that Trump may try to have key members of the House of Saud arrested for murder in the Khashoggi incident, and the House of Saud would respond by cutting oil production.

The US head of the treasury brags that he doesn’t care if the Chinese government sells US government bonds. He doesn’t care because the treasury doesn’t buy those bonds as an investor.

It issues them to keep government spending wheels greased.

The long-term bond bull market is dying, and a long consolidation for gold is ending. Gold’s mighty bull run is ready to resume… and it is likely to continue for decades.

Gold is performing exactly as I projected it would. An annoying decline from $1320 to $1180 was required to give ultimate symmetry to the massive inverse head and shoulders bull continuation pattern shown here.

That decline has taken place and, as projected, gold has begun a fundamentally-fuelled ascent towards the neckline zone of the pattern in the $1400 area.

My short-term trading service at www.guswinger.com is flashing buy signals for the US stock market this morning. It has captured the bulk of this “barn burner” gold stocks rally, via the leveraged NUGT ETF and call options on key gold stocks. While the gold and related positions look fabulous, this could be just a dead cat bounce for the stock market. Here’s why:

Institutional money managers have projected strong fourth quarter GDP and corporate earnings growth, but they are becoming horrified by the pressure that government debt growth and quantitative easing is putting on yields.

That spike in yields is ruining their stock market buybacks “free money stock market ride”. For the past nine years, stock buyback programs funded with low interest loans have been the main engine of US stock price appreciation. The party is over!

Legendary investors like Carl Icahn know the long and painful role that import taxes have played in major stock market crashes, but some amateur investors don’t believe these taxes are negative for markets.

It doesn’t matter what these amateur investors believe. What matters are the beliefs of institutional investors, and they are clearly very uncomfortable with the import tariffs situation. The bottom line: China’s stock market has already crashed and now America’s is on the rocks.

There’s also a new reason for institutional investors to be horrified about global bond yields and stock markets; Italy’s “populist” government is wasting little time in ramping up its spending programs to unprecedented and dangerous levels.

It is clearly following in the American government’s interesting footsteps… towards a global bond market inferno and a major bull run for gold!

Gold is surrounded by green lights and tails winds. I predicted gold would stay soft until Indian dealers ramped up their buying in late September/early October. That’s exactly what transpired. Next comes China! Chinese dealer buying for New Year celebrations will soon begin, and with Chinese stock markets and currency smashed by government tariff taxes, the citizens are focused on gold.

With outrageously positive COT reports for gold, enormous love trade buying, global stock and bond markets mayhem, and governments pushing the spend-more-money button maniacally, is it any wonder that GDX looks as fabulous as it does right now on this chart?

I’ve outlined the entire $23-$18 zone as a spectacular buy zone for all investors. I’ll boldly predict that as time passes it may come to be recognized as the greatest buy zone in the history of markets.

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Ten Baggers!” report today! I highlight a key group of gold stocks that seem destined to become ten baggers in a very short time frame. I include key buy and sell points for each stock!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: