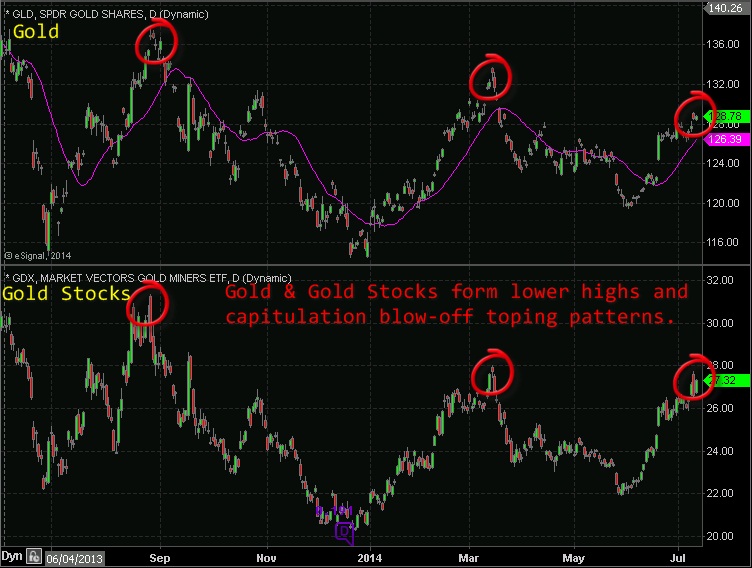

Gold Forecast and Gold Stocks Bottoming Analysis

Gold and gold stocks are starting to firm up within their basing patterns. Back on April 16, 2014 I wrote an article with my gold forecast. Today I've provided the weekly chart from that article and have added an arrow to show you where I feel the gold market is trading within this pattern. While gold and gold stocks remain in their stage 1 basing pattern, I feel they are a little overextended to the upside and ready for a minor correction.

One thing investors and traders must understand is that the stage I basing pattern can last months if not years at times. Trading during this stage I basing pattern can be very frustrating and volatility of the investment will remain high. This is a time when the investment is being accumulated and distributed by large institutions. This is what causes large percentage price swings within this stage.

While gold, gold stocks, silver and silver stocks have shown strong on balance volume and relative strength, this market remains in a fragile state until key resistance levels are broken with both physical metals and mining stocks. The first sign of a trend reversal is signaled by a higher high within an investment. Gold, silver, precious metals stocks have yet to make a higher high on the daily or weekly charts.

Below is a chart with both the price of gold and gold. You’ll see from the chart the price action has formed what appears to be a blow off top. This type of pattern happens during key turning points within investment. As investors and traders Chase prices higher in fear of missing out they created one final rally or pop in price that signaled the end of a short term trend. I like to call these a pop-and-drop reversal pattern.

The chart in my analysis clearly shows where I feel prices are likely to head next. While I am bullish on the gold market long-term I feel as though we are ready for a multi week correction in the precious metals.

Looking at the broad market using the SP500 index. It looks as though stocks are ready to continue running higher for another week or two. If this takes place than money will flow back into large-cap stocks as the safe haven play and money will likely rotate out of the overbought precious metals sector for the next two weeks.

Get My ETF Trades & Analysis Every Day! Join www.GoldAndOilGuy.com

Chris Vermeulen